Title loan success stories humanize these loans, showing how real individuals use them as short-term financial aids during emergencies, regaining stability without long-term debt. By sharing their experiences, borrowers challenge stereotypes, emphasizing responsible borrowing and clear terms, contributing to financial literacy and dispelling negative perceptions.

Title loans often come under fire, shrouded in misconceptions. However, real-life success stories can illuminate the positive impact these financial tools can have. This article explores the reality of title loan experiences through three key sections: “Unveiling Truths” highlights authentic cases, “Debunking Myths” showcases borrower victories, and “Empowering Choices” demonstrates how these successes challenge stereotypes. By sharing these stories, we aim to dispel myths and empower individuals considering legitimate financial solutions.

- Unveiling Truths: Real-Life Experiences with Title Loans

- Debunking Myths: Success Stories from Borrowers

- Empowering Choices: How Successes Fight Stereotypes

Unveiling Truths: Real-Life Experiences with Title Loans

In a world where financial struggles are all too common, many individuals seek out various solutions to improve their monetary situations. Among the options available, title loans have garnered both interest and controversy. However, it is through examining title loan success stories that we can uncover the truth behind this financial tool and dispel misconceptions. These real-life experiences offer a compelling narrative of how title loans have served as a reliable financial solution for countless people across diverse backgrounds.

For instance, consider Sarah from San Antonio Loans, who found herself in an emergency situation with unexpected medical bills piling up. She explored her options and decided on a title loan as a short-term financial bridge. Thanks to the straightforward title loan process, she received funding quickly and was able to cover her expenses without adding long-term debt. Stories like Sarah’s illustrate that title loans can provide a much-needed boost during challenging times, helping individuals regain financial stability with minimal hassle.

Debunking Myths: Success Stories from Borrowers

Many people hold misconceptions about title loans, often due to a lack of understanding or negative portrayals in media. To counter these myths, real-life title loan success stories provide powerful narratives that highlight the positive impact these financial tools can have on individuals and families. These stories showcase borrowers who have successfully navigated challenging financial situations through responsible car title loan usage.

By sharing their experiences, these borrowers debunk common myths surrounding the title loan process. They demonstrate that a title loan isn’t a trap but a manageable solution when used as a short-term bridge for unexpected expenses or to cover urgent needs. These success stories emphasize the importance of understanding the clear loan terms and committing to timely repayments, thereby fostering financial literacy and responsible borrowing practices.

Empowering Choices: How Successes Fight Stereotypes

Title loan success stories offer a powerful tool to dispel myths and stereotypes associated with these financial services. These narratives showcase real individuals who have made informed choices and achieved positive outcomes, empowering others to do the same. By sharing their experiences, borrowers challenge the notion that title loans are solely for those in desperate situations or unable to access traditional banking.

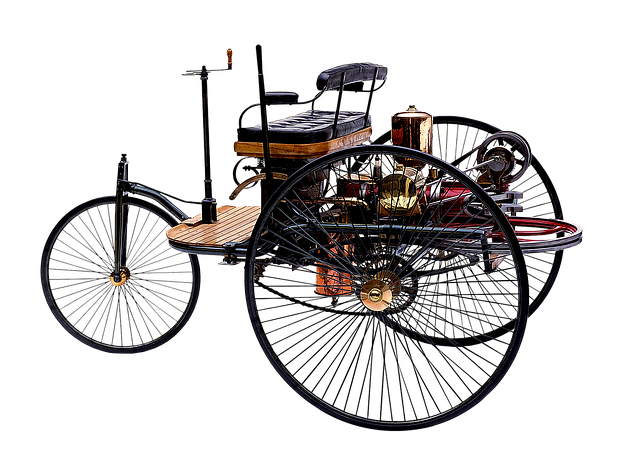

Success stories highlight how a well-understood and transparent process, such as a vehicle valuation, can provide a safety net for owners of assets like cars who need quick cash. It demonstrates that responsible borrowing through a title pawn can be a viable option for gaining financial flexibility, preserving vehicle ownership, and making ends meet during unexpected financial strains. These stories are a testament to the fact that, with education and guidance, individuals can make informed decisions about their vehicle ownership and financial well-being.

Title loan success stories offer a powerful counterpoint to common misconceptions. By showcasing real-life experiences and debunking myths, these narratives empower individuals to make informed choices. The positive outcomes shared by borrowers highlight the benefits of responsible borrowing, challenging stereotypes and promoting access to much-needed financial resources. Embracing these success stories is a step towards a more nuanced understanding of title loans and their role in supporting individuals during financial challenges.