Adhering to legal requirements is paramount for both lenders and borrowers in a Title Loan Spanish Application context, with each jurisdiction having specific regulations on loan terms, interest rates, and disclosure obligations. Lenders must communicate interest rates and fees clearly, while the application process should be designed for quick approval using straightforward forms and efficient verification methods. Key to compliance are detailed income documents, transparent term disclosures, and adherence to local laws. Skipping credit checks or language barriers can lead to non-compliance and defaults; best practices include clear information in English and Spanish, robust financial assistance programs, offering options like Motorcycle Title Loans, thorough credit verification, and accurate risk assessment.

In the dynamic landscape of short-term lending, ensuring legal compliance is paramount, especially for Title Loan Spanish applications. This article navigates the intricate requirements, offering a comprehensive guide to help lenders and applicants alike avoid pitfalls. From understanding key legal elements to implementing best practices, we delve into the essential steps for a legally compliant Title Loan Spanish application process. By adhering to these principles, lenders can foster trust and maintain regulatory integrity in this robust financial sector.

- Understanding Legal Requirements for Title Loan Spanish Applications

- Key Elements to Ensure Compliance: A Step-by-Step Guide

- Common Pitfalls and Best Practices in Title Loan Application Regulation

Understanding Legal Requirements for Title Loan Spanish Applications

When it comes to Title Loan Spanish Applications, understanding the legal requirements is paramount. Each jurisdiction has its own set of regulations that lenders must adhere to, ensuring fair and transparent practices in the lending industry. These rules cover various aspects, including loan terms, interest rates, and disclosure obligations. For instance, lenders must clearly communicate the Interest Rates and fees associated with the title loan, allowing borrowers to make informed decisions.

Moreover, the application process should facilitate quick approval for those in need of emergency funds. Legally compliant applications streamline this process by employing straightforward forms and efficient verification methods. This not only protects consumers but also ensures that lenders operate within a regulatory framework, maintaining integrity in their business practices.

Key Elements to Ensure Compliance: A Step-by-Step Guide

To ensure your Title Loan Spanish application is legally compliant, it’s crucial to understand and incorporate key elements that meet regulatory standards. The first step involves clearly outlining the borrower’s financial situation and repayment capability through detailed income documentation. This includes providing proof of employment, bank statements, or other financial records to assess their ability to repay the loan. Additionally, disclosing all terms, conditions, and fees associated with the title loan in a transparent manner is essential.

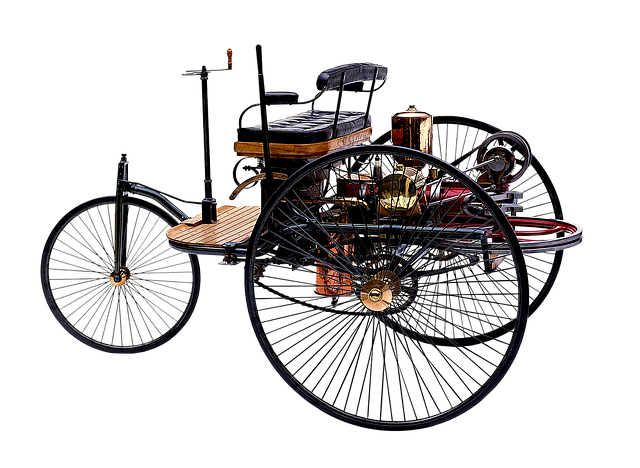

Next, the application must include a comprehensive breakdown of payment plans, highlighting interest rates, repayment schedules, and any potential penalties for late payments. Given locations like San Antonio Loans offer same-day funding, it’s critical to ensure the application process complies with local laws and regulations, ensuring borrowers receive clear information and are not subjected to unfair practices.

Common Pitfalls and Best Practices in Title Loan Application Regulation

When navigating the process of a Title Loan Spanish Application, one must be aware of potential pitfalls that can lead to legal non-compliance. A common trap is the lack of thoroughness in verifying the applicant’s financial situation and credit history. Lenders often skip essential steps like conducting proper credit checks, which can result in inaccurate assessments of an individual’s repayment capacity, leading to defaults and legal issues. Additionally, language barriers can create confusion, especially when dealing with non-English speakers, potentially leading to misinformed consent or incomplete documentation.

To ensure a legally compliant Title Loan Spanish Application process, lenders should adopt best practices such as providing clear, accessible information in both English and Spanish. Implementing robust financial assistance programs that cater to various borrower needs is another crucial step. This includes offering options for those with less-than-perfect credit, like Motorcycle Title Loans, which can serve as a bridge for individuals seeking urgent financial support. Thorough credit checks and documentation verification are vital to assess risk accurately and mitigate potential legal complications stemming from inaccurate representations.

When it comes to a Title Loan Spanish Application, adhering to legal compliance is paramount. By understanding the key requirements, meticulously following a step-by-step guide for inclusion of crucial elements, and steering clear of common pitfalls, lenders can ensure their applications are legally sound. This not only protects the lender but also provides a transparent and secure process for borrowers, fostering trust in the title loan industry.