Title loan customer reviews in Texas offer crucial insights for borrowers and lenders alike. While scrutinizing these reviews, be wary of biases and scams by checking for specific details, consistent themes, and avoiding manipulated feedback. Use reputable review platforms that verify authenticity and showcase diverse sentiments to make informed decisions about short-term financing in Texas.

Evaluating Texas title loan reviews is crucial for understanding the lending landscape. These reviews offer insights into lender reputation, interest rates, and repayment terms. However, they can also be biased or scammy. This article guides you through navigating Texas title loan customer reviews effectively. Learn to uncover potential biases, verify lender credibility, and make informed decisions using available tools and tips. Maximize your knowledge and protect your financial well-being when considering a title loan in Texas.

- Understanding Texas Title Loan Reviews: What They Reveal

- Uncovering Bias and Scams in Customer Feedback

- Verifying Credibility: Tools and Tips for Effective Evaluation

Understanding Texas Title Loan Reviews: What They Reveal

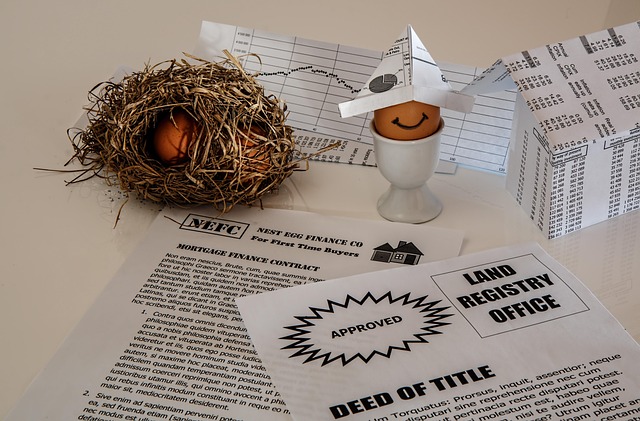

Texas title loan customer reviews are a crucial resource for borrowers navigating the often complex world of short-term financing. These reviews offer insights into various aspects of the loan process, from the ease of application to repayment terms and overall customer satisfaction. By reading through real experiences shared by past borrowers, prospective lenders can gain a clearer understanding of what to expect when availing Fort Worth loans or similar services.

Key pieces of information revealed through title loan customer reviews in Texas include details about loan terms, including interest rates, fees, and repayment periods. Borrowers often highlight the speed of Same Day Funding, which is a significant advantage for those in urgent need of cash. Reviews also shed light on the professionalism and transparency of lenders, as well as their willingness to accommodate individual circumstances. This information can help borrowers make informed decisions, ensuring they choose reputable lenders who offer terms that align with their financial capabilities.

Uncovering Bias and Scams in Customer Feedback

When evaluating Texas title loan customer reviews, it’s crucial to remain vigilant for potential biases and scams. Many online platforms may feature overly positive or negative feedback, often manipulated by marketing interests or disgruntled customers seeking revenge. To uncover authentic experiences, focus on reviews that provide specific details about the loan process, interest rates, and customer service. Look out for consistent themes across multiple sources, as genuine concerns or praises tend to emerge organically.

One common tactic to watch out for is promotions centered around keywords like “direct deposit” or “bad credit loans,” which might appear in reviews as subtle endorsements. Legitimate reviews often highlight the transparency, flexibility, and fairness of payment terms, including options for flexible payments. Remember, genuine customers are more likely to share their experiences honestly, especially regarding challenges faced during the loan period. By critically analyzing these insights, you can separate valuable feedback from biased or manipulated opinions, ensuring a clearer understanding of Texas title loan services.

Verifying Credibility: Tools and Tips for Effective Evaluation

Evaluating Texas title loan customer reviews is a crucial step before engaging with any lender. The credibility of the source and the authenticity of the feedback are paramount to ensuring a fair and secure transaction. Start by checking the review platform’s reputation; reliable sites have robust verification processes, often employing third-party checks to confirm user identities and review accuracy. Look for detailed, specific reviews that mention real-life experiences with clear dates and facts.

Beware of fabricated or overly positive reviews, especially those lacking personal details. Be skeptical of reviews mentioning “miracle” solutions like debt consolidation without explaining the methods used. Focus on diverse feedback, as both positive and negative experiences can shed light on a lender’s practices. Remember, reputable platforms often display a range of sentiments, indicating genuine user interactions. For instance, some customers might praise quick processing times for Car Title Loans or highlight successful Debt Consolidation stories, while others may share challenges with Semi Truck Loans, offering valuable insights for informed decision-making.

Evaluating Texas title loan customer reviews is crucial for navigating this financial landscape. By understanding the insights these reviews offer, identifying potential biases, and utilizing verification tools, consumers can make informed decisions. Remember, a well-informed choice regarding title loans in Texas is a safe and beneficial one. When it comes to title loan customer reviews Texas, staying vigilant, discerning, and empowered is key.