Texas title loans cater to small business owners by offering flexible funding with vehicles as collateral, higher loan amounts, and no credit check. Focused on Houston, these loans provide quick access to capital for diverse entrepreneurs, with personalized repayment plans and minimal documentation needed. Key requirements include identification, business registration proofs, bank statements, and vehicle details.

“Texas title loans can be a financial lifeline for small business owners seeking capital. This article guides you through the process, demystifying eligibility criteria and outlining the essential steps to secure a loan. From understanding state regulations to gathering required documents, we break down everything you need to know to navigate this unique financing option effectively. Whether you’re a seasoned entrepreneur or just starting, this checklist ensures you’re prepared to access the funds your business needs.”

- Understanding Texas Title Loan Requirements

- Who Qualifies for Small Business Loans?

- Essential Documents for Loan Application

Understanding Texas Title Loan Requirements

Understanding Texas Title Loan Requirements for Small Business Owners

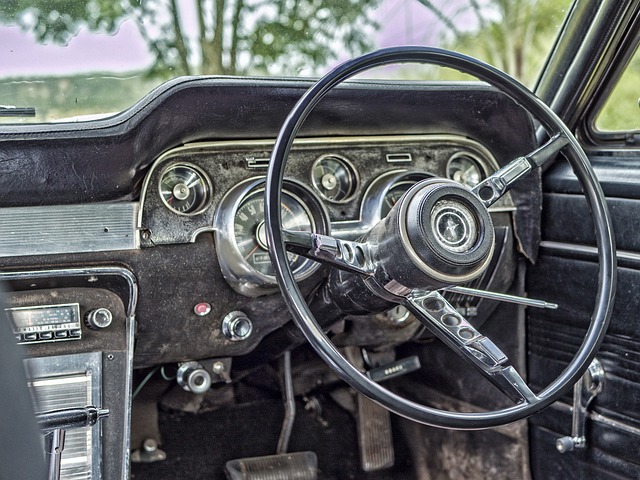

When considering a Texas title loan for small business owners, it’s crucial to grasp the specific requirements set forth by lenders. Unlike traditional bank loans, which often require extensive documentation and a flawless credit history, these loans are designed with the unique needs of entrepreneurs in mind. The primary security for such loans is typically the owner’s vehicle, especially their truck or car, making truck title loans and Houston title loans popular choices among local business owners.

Lenders will assess the value of the vehicle to determine loan eligibility, often offering relatively higher amounts compared to other short-term financing options. One significant advantage is that these loans usually come with no credit check, making them accessible to a broader range of small business owners, even those with less-than-perfect credit. This flexibility can be a game-changer for entrepreneurs looking to access capital quickly without the usual hurdles.

Who Qualifies for Small Business Loans?

Small business owners looking for capital to grow their ventures often explore various financing options. One unique and accessible route is securing a Texas title loan for small business owners. Unlike traditional loans, which can be stringent in their eligibility criteria, these loans are designed to support entrepreneurs with limited or no credit history. Any individual who owns a vehicle, regardless of employment status, may qualify for this type of loan. This includes self-employed individuals and those with non-traditional work histories, making it an attractive option for diverse business owners.

The beauty of Texas title loans lies in their flexibility, especially when compared to boat title loans or other secured loans that require specific assets. Loan terms are typically structured around the borrower’s ability to repay, offering a more personalized approach. While loan requirements may vary among lenders, generally, proof of ownership for a vehicle and a valid driver’s license are the primary documents needed. This simplified process ensures that small business owners can access funds quickly, enabling them to seize opportunities or manage cash flow challenges without extensive documentation.

Essential Documents for Loan Application

When applying for a Texas title loan for small business owners, having the right documents is crucial to expedite the process and increase your chances of approval. Essential among these are identification documents such as a valid driver’s license or state-issued ID card, which confirm your identity and residency. Additionally, you’ll need proof of your business registration, like a certificate of incorporation or DBA filing, to verify your enterprise’s legitimacy.

For financial assistance, it’s helpful to have recent bank statements reflecting your business’s financial health. This provides a clear picture of your business’s cash flow and ability to repay the loan. Furthermore, if you’re considering collateral in the form of a vehicle, such as a car or motorcycle title loans, be prepared to provide detailed information on the vehicle’s make, model, year, and current mileage, as well as the vehicle’s fair market value, which will determine its valuation for loan purposes.

Texas title loans can be a valuable resource for small business owners seeking quick funding. By understanding the eligibility criteria, required documents, and loan application process outlined in this article, entrepreneurs can make informed decisions. With the right preparation, small business owners in Texas can access the capital they need to grow and thrive, ensuring their businesses succeed in today’s competitive market.