Bellaire title loans offer fast, flexible financial solutions for individuals needing cash quickly, leveraging vehicle equity as collateral with approval times up to 30 minutes and repayment periods from 30 days to several months. State regulations in Bellaire protect borrower rights, setting clear guidelines on interest rates, loan terms, and collection procedures. The process is straightforward: apply, have your vehicle inspected, receive a customized repayment plan, and repay over several months with transparent communication throughout.

“Bellaire residents often turn to innovative financing options, and among them, Bellaire title loans have emerged as a significant alternative. This comprehensive guide delves into the intricacies of these loans, offering a clear understanding for those considering this option. With state regulations in place, borrowers’ rights are protected, ensuring a secure lending environment in Bellaire. From application to repayment, this article navigates the loan process, providing insights that empower informed decisions regarding Bellaire title loans.”

- Understanding Bellaire Title Loans: A Comprehensive Guide

- State Regulations: Protecting Borrowers' Rights in Bellaire

- Loan Process: From Application to Repayment in Bellaire

Understanding Bellaire Title Loans: A Comprehensive Guide

Bellaire title loans offer a unique financial solution for individuals seeking quick access to cash, leveraging their vehicle’s equity. This alternative financing method involves pledging your vehicle title as collateral in exchange for a loan amount. Unlike traditional loans that often require stringent credit checks, Bellaire title loans focus more on the value of your vehicle than your personal credit history. This makes them an attractive option for those with less-than-perfect credit or no credit at all.

The process is designed to be flexible and efficient. After completing a simple application, you may be approved for a loan in as little as 30 minutes. Once approved, the funds can typically be transferred into your account promptly, providing immediate access to the money you need. Moreover, Bellaire title loans offer the advantage of flexible payments, allowing borrowers to repay the loan at their own pace within a set period, usually 30 days to several months. Upon full repayment, the title transfer process is reversed, and the vehicle’s title is returned to the borrower.

State Regulations: Protecting Borrowers' Rights in Bellaire

In Bellaire, like many states across the nation, regulations governing Bellaire title loans are designed to protect borrower rights and ensure fair lending practices. These rules are particularly crucial for individuals considering using their vehicle equity as collateral for a loan. The state’s legislation sets clear guidelines on interest rates, loan terms, and collection procedures, ensuring borrowers are treated fairly and have adequate protection.

Key regulations include provisions that cap annual percentage rates (APRs), establish minimum repayment periods, and mandate transparent communication between lenders and borrowers. Furthermore, Bellaire’s laws allow borrowers to repay the vehicle collateral loan in installments and extend the loan term if needed, providing flexibility in managing their finances. These protections are essential for residents seeking short-term funding, ensuring they have a clear understanding of the terms and conditions of their Bellaire title loans.

Loan Process: From Application to Repayment in Bellaire

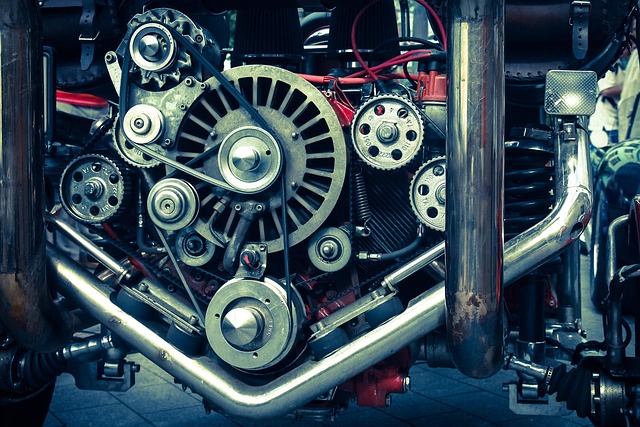

In Bellaire, obtaining a loan using your vehicle’s title as collateral, commonly known as Bellaire title loans, is a straightforward process designed to provide financial assistance to borrowers quickly. It begins with a simple application where potential lenders supply essential information about their vehicle and personal details. Once approved, the lender arranges for a quick vehicle inspection to verify its condition and value, a crucial step in determining the loan amount. This efficient procedure ensures that residents of Bellaire can access much-needed funds within a short time frame.

Repayment terms are flexible and tailored to the borrower’s comfort, often extending over several months. Borrowers can choose from various repayment options, ensuring they find a plan suitable for their financial capabilities. Throughout the loan period, clear communication between the lender and borrower is essential, ensuring all parties understand the terms and conditions of the Bellaire title loans. This transparency fosters trust and allows individuals to access financial assistance without the burden of unexpected fees or complexities.

Bellaire title loans, while offering a unique financial solution, are subject to stringent state regulations designed to protect borrowers. By understanding the loan process and these regulations, individuals can make informed decisions when considering a Bellaire title loan. This overview equips readers with the knowledge to navigate this alternative financing option securely, ensuring a positive experience in Bellaire.