When considering a title loan, Veterans and Seniors should focus on title loan APR comparison. Rates vary based on vehicle valuation, emergency funds needs, and credit history. Reputable lenders offer competitive rates, same-day funding (using vehicle equity), and flexible repayment options. Careful consideration of loan limits, periods, and potential fees is crucial to avoid long-term financial strain, especially impacting retirement savings.

“In today’s financial landscape, understanding title loan APR (Annual Percentage Rate) is crucial for Veterans and Seniors seeking short-term funding. This article delves into the intricacies of title loan APRs, comparing rates for these two demographics. We uncover potential disparities and provide key factors to consider when borrowing. Additionally, we offer strategies to help Veterans and Seniors secure favorable terms, ensuring informed decisions with transparent lending practices.”

- Understanding Title Loan APR: Key Factors to Consider

- Veterans vs Seniors: Uncovering Rate Disparities

- Strategies for Securing Favorable Title Loan Terms

Understanding Title Loan APR: Key Factors to Consider

When comparing Title Loan APRs, it’s crucial to grasp the factors that determine this interest rate. The Annual Percentage Rate (APR) reflects the total cost of borrowing, including interest and fees, over a year. For Veterans and Seniors considering a title loan, understanding these elements is key to making an informed decision.

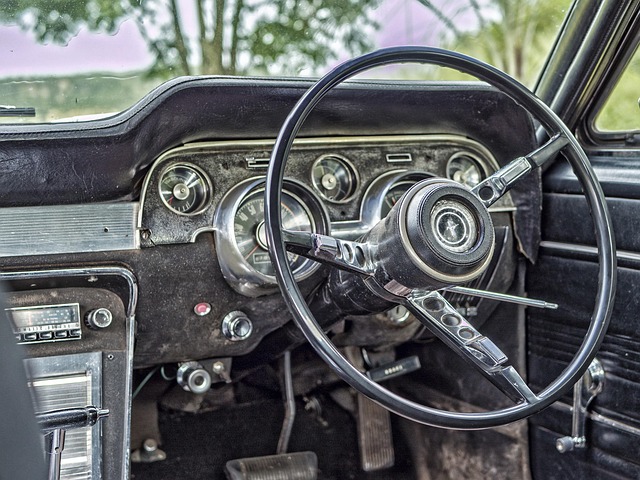

Several factors influence your Title Loan APR. One significant factor is the vehicle’s valuation, as loans are typically secured against the value of your vehicle. Emergency funds needs might also play a role, as lenders may offer lower rates for borrowers with established credit or sufficient savings, believing they pose less risk. Additionally, since title loans are secured loans, the lender assesses the potential loss if you default on the loan, which can affect the APR.

Veterans vs Seniors: Uncovering Rate Disparities

When it comes to financial solutions for Veterans and Seniors seeking fast cash, a crucial factor is the Annual Percentage Rate (APR) associated with title loans. A Title loan APR comparison reveals striking disparities between these two demographics. Veterans, historically benefited by a range of financial support services tailored to their unique needs, often find themselves at a disadvantage when it comes to the overall cost of borrowing. While senior citizens, on average, pay slightly higher rates due to market trends and risk assessment, the gap can be substantial.

This disparity is further amplified by the allure of same day funding promised by many title loan providers. Veterans, accustomed to streamlined processes in their careers, might find themselves enticed by this quick financial solution without fully understanding the long-term implications. For seniors, while a fast cash option may be appealing, they should delve deeper into the APR to ensure they’re not paying unnecessary fees that could impact their retirement savings and overall financial well-being.

Strategies for Securing Favorable Title Loan Terms

When considering a title loan APR comparison between Veterans and Seniors, securing favorable terms is paramount. One effective strategy involves shopping around for lenders who specialize in offering competitive rates tailored to these demographics. Many reputable lenders provide dedicated programs with lower interest rates and flexible repayment options, recognizing the unique financial needs of seniors and veterans. Additionally, building an excellent credit history or demonstrating financial stability through documentation can significantly influence securing better terms.

Another crucial step is understanding the quick funding potential of car title loans. These short-term loans use your vehicle’s equity as collateral, allowing for swift approval and access to cash in a matter of days. However, it’s essential to balance the convenience with the associated risks. Comparisons between lenders should consider not only the APR but also the loan limits, repayment periods, and any hidden fees, ensuring that the chosen financial solution aligns with your ability to repay without causing undue strain.

When comparing title loan APRs, both Veterans and Seniors can find favorable terms by understanding key factors and employing effective strategies. Despite historical rate disparities, informed borrowing decisions can lead to significant savings for all age groups. By examining interest calculations, term length options, and lender reputation, individuals can make informed choices that align with their financial needs. Embracing proactive measures ensures a smoother borrowing experience, ultimately facilitating access to much-needed funds. In the context of a title loan APR comparison, knowledge is power—empowering Veterans and Seniors alike to navigate this financial landscape with confidence.