Sweetwater Title Loans provide quick cash using your vehicle's title as collateral, ideal for emergencies. With simple applications and flexible terms, they offer short-term financial relief but carry repossession risks if not repaid promptly. Responsible borrowing requires understanding rates, periods, and penalties; exploring alternatives is crucial before agreeing to such loans.

“Discover how Sweetwater title loans can offer both financial solutions and challenges. In this comprehensive guide, we demystify these secured lending options, equipping you with knowledge to make informed decisions. From understanding the mechanics of Sweetwater title loans to balancing their benefits and risks, we navigate the landscape. Learn essential best practices for safeguarding yourself during the borrowing process, ensuring a positive experience in the world of Sweetwater title loans.”

- Understanding Sweetwater Title Loans: A Comprehensive Guide

- Benefits and Risks: Weighing Your Options

- Safeguarding Yourself: Best Practices for Borrowing

Understanding Sweetwater Title Loans: A Comprehensive Guide

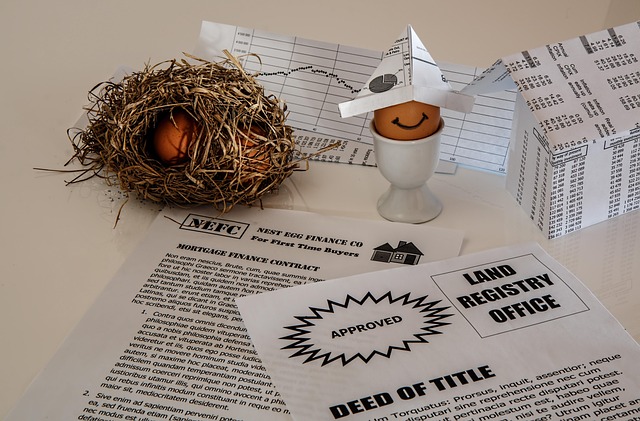

Sweetwater Title Loans offer a unique financial solution for individuals seeking quick access to cash. This type of loan utilizes the equity in your vehicle as collateral, providing a fast and convenient alternative to traditional banking options. Unlike Dallas Title Loans, which often come with stringent requirements and lengthy processes, Sweetwater Title Loans streamline the experience. The application process is straightforward, typically involving a simple form and a quick credit check. Once approved, you can receive your funds promptly, making it an ideal choice for unexpected expenses or financial emergencies.

Understanding how these loans work is essential. When you take out a Sweetwater Title Loan, you’re essentially borrowing against the value of your vehicle. This means that your car remains in your possession, and you continue to use it as usual. The loan payoff period is flexible, allowing borrowers to repay the amount over a set period, usually ranging from several months to a year. This flexibility, coupled with competitive interest rates, makes Sweetwater Title Loans an attractive option for those needing immediate financial assistance without the burden of long-term debt.

Benefits and Risks: Weighing Your Options

When considering Sweetwater title loans, it’s crucial to balance their potential benefits with inherent risks. These loans use your vehicle’s title as collateral, offering a unique advantage: access to funds quickly and easily. This can be particularly beneficial if you need cash fast for an emergency or unexpected expense. Additionally, loan eligibility isn’t as stringent as traditional loans, making them accessible to more people. The process is often streamlined, allowing you to complete an online application and receive funds within a short time frame.

However, the risks associated with Sweetwater title loans cannot be overlooked. Failure to make payments on time can result in repossession of your vehicle. These loans are designed for short-term financial needs, but extending them beyond the intended duration can lead to substantial interest charges. It’s essential to carefully consider your ability to repay the loan within the specified timeframe and explore alternatives like personal or unsecured loans if feasible. Flexible payments aren’t always guaranteed, so ensuring you understand the repayment terms is vital to avoid potential financial strain.

Safeguarding Yourself: Best Practices for Borrowing

When considering a Sweetwater title loan, it’s crucial to adopt best practices for borrowing to safeguard yourself. First and foremost, thoroughly understand the terms and conditions associated with the loan. This includes interest rates, repayment periods, and any potential penalties for early repayment or default. It’s important to ask questions and seek clarification from the lender until you are completely comfortable with the agreement.

Additionally, ensure that you only borrow what you absolutely need. While Sweetwater title loans can be a financial solution in a pinch, they come with significant risks if not managed responsibly. Consider alternatives like emergency savings or assistance from family and friends whenever possible. Remember, securing a loan using your vehicle’s title means giving up the car until the debt is repaid, so make sure it’s a last resort. For specialized needs, explore options like car title loans or even semi truck loans if applicable, but always weigh the benefits against the potential drawbacks.

When considering a Sweetwater title loan, it’s crucial to balance the benefits with the risks. By thoroughly understanding your options, evaluating your financial situation, and adhering to best practices, you can protect yourself and make an informed decision. Remember, sweet water may quench thirst, but knowledge is power when navigating financial waters, so do your research before borrowing against your title.