Texas no credit check title loans offer a quick financial solution using vehicle equity, providing an alternative to payday loans with higher interest rates and shorter terms. These loans streamline the process, require minimal paperwork, and offer extended repayment periods, making them suitable for debt consolidation but carrying the risk of asset loss if not repaid.

In the state of Texas, borrowers often seek quick funding options, leading to a debate between Texas no credit check title loans and payday loans. This article aims to demystify these two distinct lending methods. We’ll explore how each operates within Texas’ regulatory framework, focusing on the benefits and risks associated with them. By understanding these alternatives, borrowers can make informed decisions tailored to their unique financial situations.

- Understanding Texas No Credit Check Title Loans

- How Payday Loans Work in Texas

- Comparing Risks and Benefits: Title vs Payday Loans

Understanding Texas No Credit Check Title Loans

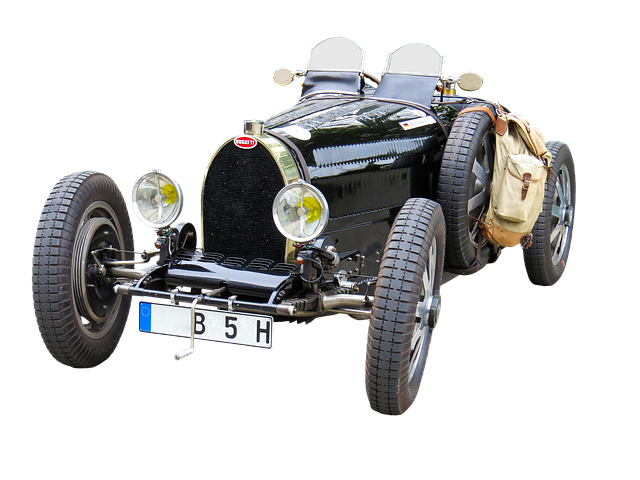

Texas no credit check title loans offer a unique financial solution for residents seeking quick cash. Unlike traditional loans that require extensive credit checks, these loans allow individuals with poor or limited credit histories to access funding secured by their vehicle. The process involves a simple application, requiring only basic personal information and details about the borrower’s vehicle. Lenders conduct a brief vehicle inspection to assess its value and condition, ensuring it meets the loan requirements. This alternative financing option is particularly appealing for those in need of immediate funds, as it provides faster access to money compared to other types of loans.

Secured loans, such as Texas no credit check title loans, are characterized by the use of an asset as collateral, which in this case is the borrower’s vehicle. This ensures lenders have security and reduces the risk associated with lending to individuals with less-than-perfect credit. The loan amount typically corresponds to the value of the vehicle, making it a relatively small sum compared to unsecured loans. This type of loan serves as a practical solution for short-term financial needs, allowing borrowers to regain stability without facing the potential long-term consequences of high-interest rates and stringent repayment terms often associated with payday loans.

How Payday Loans Work in Texas

In Texas, payday loans operate as a short-term financial solution for individuals who need cash quickly. Borrowers typically provide a lender with their next paystub and agree to repay the loan on their next paycheck. This process is often streamlined and efficient, allowing applicants to receive funds within a few hours or the same day. The key aspect of these loans lies in their accessibility; they don’t require a credit check, making them an option for those with poor or no credit history.

While the application process may seem straightforward, it’s crucial to understand the terms and conditions. Payday loans in Texas are known for their high-interest rates and short repayment periods, often ranging from 14 to 30 days. Borrowers must ensure they can repay the loan on time, as failure to do so may result in penalties and a cycle of debt. However, an alternative approach is available: Texas no credit check title loans offer a different payment structure with more flexibility, including potential extended repayment plans and the ability to keep your vehicle, all while providing a secure loan based on the value of your vehicle.

Comparing Risks and Benefits: Title vs Payday Loans

When comparing Texas no credit check title loans to payday loans, understanding the risks and benefits is crucial for making an informed decision. Title loans, like Houston title loans, offer a unique advantage in that they allow borrowers to use their vehicle’s equity as collateral. This means even with poor credit or no credit history, individuals can still gain access to funds. The process involves a simple title transfer, making it a quicker alternative compared to traditional loan options. On the other hand, payday loans have shorter repayment terms and typically require a portion of your next paycheck as collateral, often leading to cycles of debt if not managed carefully.

While title loans provide a more extended repayment period and may assist in debt consolidation, they carry the risk of losing one’s vehicle if the loan is not repaid. Payday loans, despite their shorter-term nature, can result in higher interest rates and fees, potentially exacerbating financial strain. Comparing these options, it’s clear that Texas no credit check title loans present a more sustainable solution for borrowers seeking financial support while retaining ownership of their assets.

When considering financial options in Texas, understanding the differences between Texas no credit check title loans and payday loans is crucial. While both offer quick access to cash, no credit check title loans provide a more secure and flexible alternative by using your vehicle’s equity. In contrast, payday loans carry higher risks with shorter repayment terms. By evaluating your financial needs and understanding the risks involved, you can make an informed decision to choose the best option for your situation.