Title loan licensing requirements vary by state and are crucial for protecting consumers from predatory lending practices. Lenders must undergo a rigorous process to obtain licenses, adhering to standards on interest rates, loan terms, and business practices. This includes comprehensive vehicle inspections during applications. Licensing ensures thorough credit checks, transparent terms, and fair practices, safeguarding borrowers in cities like San Antonio and fostering market integrity by preventing abusive lending cycles.

Title loan licensing requirements are essential pillars for maintaining legitimacy and consumer protection in the short-term lending sector. This article delves into the significance of understanding and enforcing these laws, focusing on three critical aspects: unraveling title loan licensing laws, highlighting the pivotal role they play in shielding consumers from predatory practices, and examining how regulation fosters integrity within the industry. By exploring these sections, we uncover why stringent licenses are indispensable for a fair and transparent lending landscape.

- Understanding Title Loan Licensing Laws

- Protecting Consumers: The Key Role of Licenses

- Maintaining Industry Integrity Through Regulation

Understanding Title Loan Licensing Laws

Title loan licensing requirements are a critical component in ensuring the legitimacy and fairness of the short-term lending industry. These laws vary from state to state but generally aim to protect borrowers by setting standards for lenders. Understanding these regulations is essential, as they cover various aspects, including interest rates, loan terms, and most importantly, how lenders can operate while offering quick approval and same-day funding.

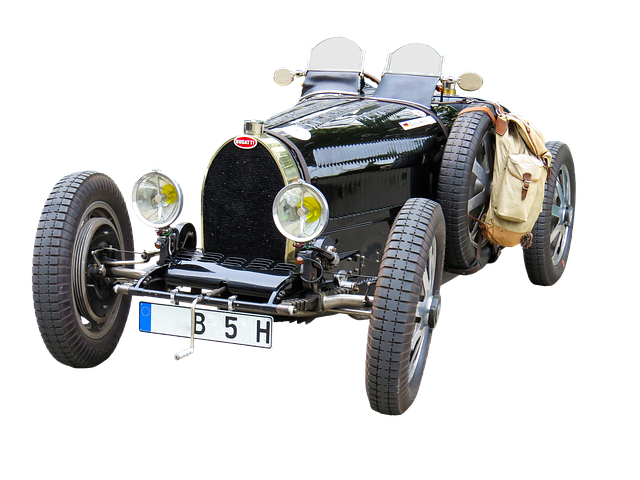

Lenders must undergo a thorough process to obtain the necessary licenses, which involves meeting specific criteria related to business practices, financial stability, and customer service. One key aspect is the requirement for a comprehensive vehicle inspection during the loan application process. This step ensures that the collateral for the loan—typically the borrower’s vehicle—meets certain safety and condition standards, protecting both the lender and the borrower.

Protecting Consumers: The Key Role of Licenses

Title loan licensing requirements play a pivotal role in protecting consumers from predatory lending practices. Without proper licensing, lenders can operate with little to no oversight, leading to high-interest rates, unfair terms, and potential financial exploitation of borrowers. These licenses act as a shield for folks seeking immediate financial solutions, such as San Antonio loans, by ensuring that the credit check process is thorough and that the loan terms are transparent and fair.

Lenders with proper licensing are held accountable for their actions, which includes adhering to state regulations regarding interest rates, repayment schedules, and borrowing limits. This not only safeguards consumers but also fosters a sense of trust in the lending industry. For instance, in a bustling city like San Antonio, where access to quick financial solutions is vital, licensed title loans offer a secure and reliable option for residents in need.

Maintaining Industry Integrity Through Regulation

The title loan industry, while offering a crucial financial assistance option for many, requires robust regulation to maintain its integrity. Title loan licensing requirements are non-negotiable as they act as a shield against predatory lending practices. These regulations ensure that lenders operate within ethical boundaries, protecting borrowers from unfair terms and conditions. By holding lenders accountable, licensing requirements promote transparency, clarity, and fairness in the lending process.

This oversight is vital for maintaining consumer trust and ensuring that individuals seeking quick funding through vehicle collateral receive a fair deal. Licensing standards enable authorities to monitor interest rates, loan terms, and repayment conditions, preventing abusive practices that can trap borrowers in cycles of debt. Ultimately, these requirements foster a sustainable and reputable title loan market, providing much-needed financial assistance while safeguarding the interests of all involved parties.

Title loan licensing requirements are not just regulatory formalities; they are critical safeguards for consumers, ensuring fair lending practices and maintaining the integrity of the industry. By adhering to these stringent standards, lenders foster trust and transparency, distinguishing legitimate operations from predatory practices. Understanding and enforcing these licenses is essential for a robust and ethical title loan market, benefiting both lenders and borrowers alike.