Seniors considering title loans for quick cash should be aware of high interest rates and repossession risks. Using their vehicle title as collateral, these loans often come with shorter terms but significant financial peril if defaulted. Exploring safer alternatives like government aid or senior financial advisors is crucial to avoid loss of primary transportation and potential debt cycles.

“Title loans for seniors, while offering a quick financial fix, come with significant risks. This article delves into the intricacies, starting with an explanation of these loans and their appeal to older adults facing monetary challenges. We then explore the perils of defaulting on such loans, including severe consequences like home forfeiture. Furthermore, we present alternative solutions designed to alleviate senior financial strains without the associated dangers of title loans.”

- Understanding Title Loans for Seniors: The Basics

- Risks and Consequences of Defaulting on These Loans

- Exploring Alternatives to Mitigate Senior Financial Struggles

Understanding Title Loans for Seniors: The Basics

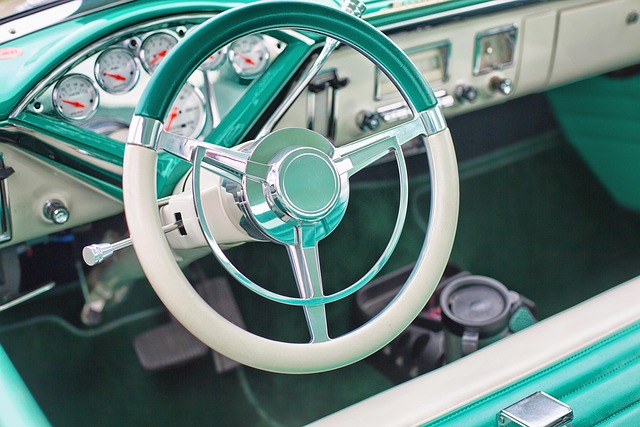

Title loans for seniors are a type of secured lending where an individual’s vehicle title is used as collateral to secure a loan. This option provides quick access to cash, often appealing to those in need of immediate financial assistance, especially among older adults with limited banking options. The process typically involves assessing the value of the senior’s motor vehicle and offering a short-term loan based on that appraisal. Repayment is usually structured over a shorter period compared to traditional loans.

While truck title loans can be a quick solution for seniors seeking financial assistance, it’s crucial to understand the terms and potential risks. These include high-interest rates and the possibility of default, which could lead to repossession of the vehicle. Additionally, the loan payoff might become a burden if not managed carefully, impacting the senior’s ability to meet other financial obligations. Therefore, seniors considering this option should thoroughly evaluate their repayment capacity and explore alternative sources of credit when possible.

Risks and Consequences of Defaulting on These Loans

When seniors consider title loans as a financial solution, they must be aware that defaulting on these loans can lead to severe consequences. One of the primary risks is the potential loss of their vehicle, which serves as collateral for the loan. If the borrower fails to make payments as agreed, the lender has the right to repossess the vehicle, leaving the senior without a means of transportation. This can significantly impact their daily lives, especially if the car is their primary mode of getting around.

Moreover, defaulting on a title loan may result in financial strain and additional fees. Late payment charges, prepayment penalties, and even legal actions by the lender are possible outcomes. These repercussions can further exacerbate an already challenging financial situation for seniors. Repayment options should be thoroughly understood before taking out such loans, ensuring that keeping your vehicle remains feasible if unforeseen circumstances arise.

Exploring Alternatives to Mitigate Senior Financial Struggles

Senior citizens often face financial challenges due to various factors like health issues, reduced income, or unexpected expenses. While taking out a loan can be a solution, it’s crucial to explore alternatives that offer more stability and less risk for this demographic. For seniors considering short-term solutions like title loans for seniors, understanding the full implications is essential. These quick cash options, such as Dallas title loans or boat title loans, come with high-interest rates and the potential for a cycle of debt.

Instead of turning to these risky methods, seniors can look into more sustainable options. Financial assistance programs tailored for the elderly, community support groups, government aid, and consulting with senior financial advisors are all viable alternatives. The title loan process, while swift, may not be the best fit for long-term financial planning. By considering these alternatives, seniors can navigate their financial struggles with more security and avoid the potential pitfalls of high-interest lending.

Taking out a title loan can seem like a quick solution for senior citizens facing financial emergencies, but it’s crucial to weigh the risks. The high-interest rates and potential loss of asset ownership if the loan goes into default can severely impact an already vulnerable demographic. Before considering this option, exploring alternative solutions such as government aid programs or community resources is essential. By understanding both the basics of title loans and their associated dangers, seniors can make informed decisions to navigate their financial challenges without putting their assets at significant risk.