Car title loans Mineral Wells TX offer quick cash using vehicle titles as collateral, bypassing credit checks. While beneficial for those with limited credit history, they carry risks of penalties and high interest rates through flexible payment plans. Borrowers must carefully weigh advantages and disadvantages to avoid losing their vehicles in case of late payments.

Car title loans Mineral Wells TX have gained popularity as a quick financing option. This article explores how these loans can impact your credit score, offering a balanced view with pros and cons. We delve into the risks and benefits for borrowers seeking liquidity through their vehicles. Understanding car title loans in Mineral Wells TX is crucial before making a decision that could affect your financial health and credit standing.

- Understanding Car Title Loans in Mineral Wells TX

- Impact on Your Credit Score: Pros and Cons

- Navigating Risks and Benefits for Borrowers

Understanding Car Title Loans in Mineral Wells TX

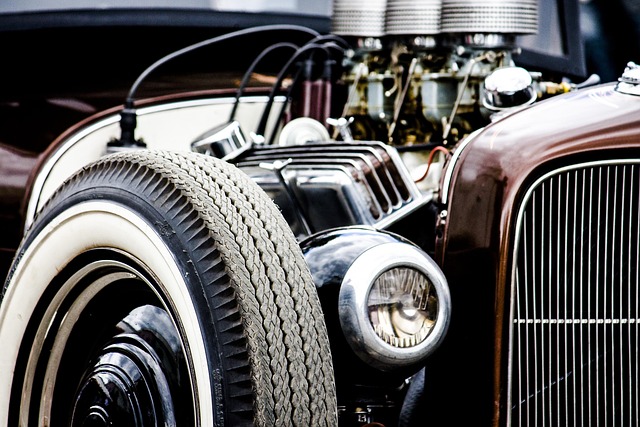

In Mineral Wells, Texas, car title loans have emerged as a popular solution for individuals seeking fast cash. This alternative lending method allows borrowers to use their vehicle’s title as collateral in exchange for a loan. Once approved, the lender places a lien on the vehicle, ensuring they have the right to repossess it if the borrower defaults on payments. The process is designed to be swift and efficient, making car title loans in Mineral Wells TX a convenient option for those with limited credit options or urgent financial needs.

This type of loan stands out due to its accessibility. Unlike traditional loans that heavily rely on credit scores and extensive documentation, car title loans consider the value and condition of your vehicle as primary factors. This makes it possible for individuals with poor credit or no credit history to gain access to much-needed funds quickly. The ‘title transfer’ process is straightforward, ensuring borrowers understand their obligations while providing a clear path to obtaining fast cash in Mineral Wells TX.

Impact on Your Credit Score: Pros and Cons

Car title loans Mineral Wells TX can have a significant impact on your credit score, both positively and negatively. When you apply for a car title loan, the lender will conduct a thorough vehicle inspection to assess its value. This process is a pro as it allows borrowers to access a substantial amount of cash using their vehicles as collateral. It’s also beneficial for those with limited or no credit history, as it can help build or establish credit.

However, there are cons associated with these loans. The primary drawback is the potential risk of damaging your credit if you fail to make payments on time. Late or missed payments can lead to penalties and a lower credit score. Moreover, car title loans often come with higher interest rates compared to traditional loans, which can result in substantial debt consolidation costs if not managed properly. Despite these drawbacks, borrowers appreciate the flexibility of payment plans offered by such loans, allowing them to repay over time.

Navigating Risks and Benefits for Borrowers

When considering a Car Title Loan Mineral Wells TX, borrowers must weigh both the risks and benefits. These loans are designed for individuals who own their vehicles free and clear, allowing them to use their car’s title as collateral. The main allure lies in the flexible payments and potential access to quick funds without a credit check. However, the risk is that if you fail to make payments on time, you could lose your vehicle.

A crucial aspect of these loans is the vehicle inspection process. Lenders will assess your car’s value to ensure it meets their loan-to-value requirements. This ensures they have adequate collateral. While this can provide a level of security for borrowers, it also means giving up ownership temporarily if the loan goes into default. Balancing these factors is key; understanding that while Car Title Loans Mineral Wells TX offer flexibility, they require responsible borrowing and adherence to repayment plans to avoid potential financial strain.

Car title loans Mineral Wells TX can provide a quick financial fix, but they significantly impact your credit score. Understanding both the pros and cons is crucial before borrowing. While these loans offer accessibility, they come with risks, including high-interest rates and potential vehicle repossession. Borrowers should carefully navigate these factors to make an informed decision about their financial future in Mineral Wells, TX.