Car title loans Henderson TX provide quick cash with minimal paperwork but carry significant risks, including high-interest rates, repossession, and debt cycles due to short repayment terms. Using your vehicle's title as collateral offers accessibility but poses a risk if payments are missed, potentially leading to loss of the vehicle. Despite benefits like flexible terms and lower rates compared to other short-term financing, these loans trap borrowers in escalating debt and can disrupt daily life or income generation.

Car title loans in Henderson, Texas, offer a unique financing option for those needing quick cash. This article delves into the pros and cons of this alternative lending method. We’ll start by explaining car title loans and how they work specifically in Henderson TX. Then, we’ll explore potential benefits, such as fast approval times and less stringent requirements. However, it’s crucial to also understand the drawbacks, including high-interest rates and the risk of vehicle repossession. By weighing these factors, borrowers can make informed decisions regarding car title loans in Henderson TX.

- Understanding Car Title Loans in Henderson TX

- Potential Benefits of Securing a Loan

- Drawbacks and Risks to Be Aware Of

Understanding Car Title Loans in Henderson TX

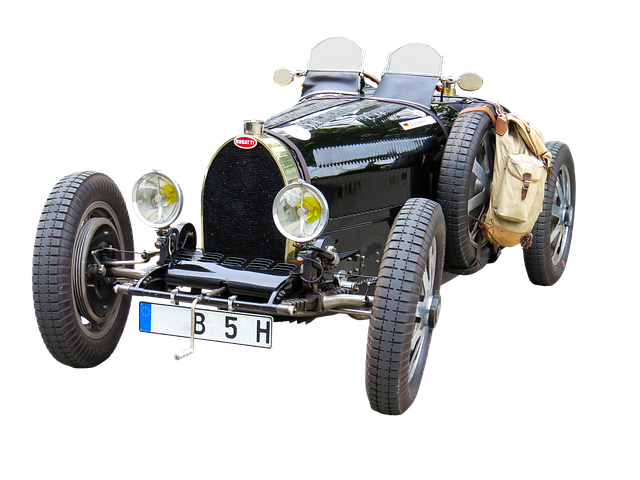

Car title loans Henderson TX are a type of secured lending where individuals use their vehicle’s title as collateral to secure a loan. This alternative financing option is designed for borrowers who need quick access to cash and may not qualify for traditional bank loans or credit lines. The process involves a simple application, quick approval, and the lender holds onto the car title until the loan is repaid in full.

In Henderson TX, these loans offer several advantages, particularly for those facing financial emergencies. They provide fast approval and access to funds within hours, making them ideal for unexpected expenses or urgent needs. Moreover, repayment options can be tailored to fit borrowers’ budgets, allowing them to manage their debt effectively. However, it’s crucial to consider the potential drawbacks, such as the risk of repossession if payments are missed, higher interest rates compared to conventional loans, and the possibility of falling into a cycle of debt due to the short repayment period.

Potential Benefits of Securing a Loan

Car title loans Henderson TX can offer potential benefits for those in need of quick financial assistance. One significant advantage is the ease and speed of obtaining a loan compared to traditional banking options. The process typically involves using your vehicle’s title as collateral, which streamlines the approval process and allows for faster access to funds. This can be particularly beneficial for individuals with less-than-perfect credit or those who need money urgently.

Additionally, these loans often come with flexible repayment terms and lower interest rates compared to other short-term financing options. Loan requirements are generally more relaxed, focusing on the value of your vehicle rather than strict credit checks. This makes car title loans Henderson TX a viable option for folks seeking financial stability and looking to maintain control over their assets while accessing much-needed capital.

Drawbacks and Risks to Be Aware Of

While car title loans Henderson TX can provide quick access to cash for those in need, there are several drawbacks and risks to be aware of before taking out such a loan. One significant downside is that these loans often come with extremely high-interest rates, making them one of the most expensive borrowing options available. The interest rates on car title loans tend to far surpass those of traditional personal loans or credit cards. This can lead to a cycle of debt where borrowers struggle to repay the loan and end up paying significantly more in interest than the original loan amount.

Another potential risk is the possibility of losing your vehicle if you fail to repay the loan as agreed. In the event of default, the lender has the right to initiate a title transfer or even a title pawn, which means they can sell your car to recoup their losses. This can be particularly concerning for those who rely on their vehicle for daily transportation or income-generating activities. Compared to Houston title loans or other forms of secured lending, car title loans Henderson TX often have shorter repayment periods, leaving borrowers with less time to adjust their financial plans and potentially causing further financial strain.

Car title loans Henderson TX can provide quick cash solutions, but it’s crucial to weigh the potential benefits against the drawbacks. While these loans offer accessibility for those with poor credit or no credit history, the risks of defaulting on such loans are significant, potentially leading to repossession of your vehicle. Before securing a car title loan in Henderson TX, thoroughly understand the terms and conditions, and ensure you have a solid repayment plan to avoid financial strain.