Applying for a Texas title loan requires proving vehicle ownership and income stability. Lenders assess collateral value, credit history, and vehicle condition to determine eligibility and loan amounts. Understanding these criteria beforehand simplifies the application process for a swift financial solution in Texas.

In the competitive landscape of Texas, understanding the intricacies of a title loan application can be a game-changer for borrowers. This article breaks down the critical criteria for navigating the Texas title loan application process successfully. From comprehending basic eligibility requirements to assessing your creditworthiness and income, we guide you through each step. Additionally, we delve into the essential aspects of documenting vehicle ownership and value. By the end, you’ll be equipped with the knowledge needed to make informed decisions regarding a Texas title loan application.

- Understanding Basic Eligibility Requirements

- Documenting Vehicle Ownership and Value

- Assessing Your Creditworthiness and Income

Understanding Basic Eligibility Requirements

Applying for a Texas title loan can be a quick solution for those needing emergency funds. However, understanding the basic eligibility requirements is crucial before submitting an application. To qualify, borrowers must generally demonstrate valid vehicle ownership, as the car serves as collateral for the loan. This ensures lenders have security in case of default.

Loan eligibility often hinges on factors like income and credit history. While not all lenders consider credit scores, having a steady income stream significantly improves your chances. The Texas title loan application process is designed to be straightforward, focusing on these key aspects to ensure responsible lending practices.

Documenting Vehicle Ownership and Value

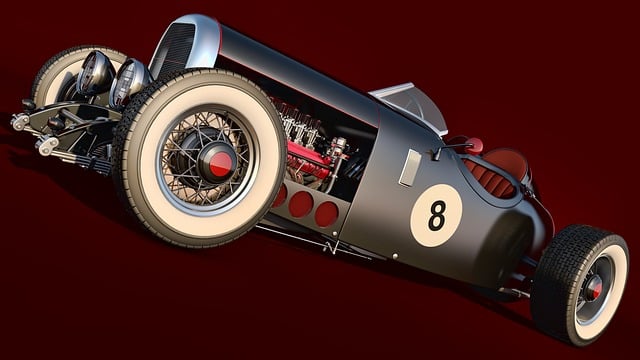

When applying for a Texas title loan, documenting your vehicle ownership and its value is a crucial step. Lenders require this information to assess the collateral’s worth and determine the loan amount they can offer. The process involves providing proof of ownership, which can be through the vehicle registration documents or the title itself. It’s essential to ensure these papers are up-to-date and accurately reflect your name as the legal owner.

In Dallas Title Loans, for instance, lenders often conduct a brief vehicle inspection to verify the information provided. This includes checking the odometer reading, overall condition, and any outstanding modifications or damage. The vehicle’s equity, which is the difference between its current market value and the remaining loan balance, plays a significant role in determining your loan eligibility. Understanding these requirements beforehand can streamline the Texas title loan application process.

Assessing Your Creditworthiness and Income

When applying for a Texas title loan, lenders will carefully assess your creditworthiness and income to determine if you’re a suitable candidate. This involves evaluating your credit history, including any past loans or debts, as well as your current financial situation. Lenders look for consistent employment and a stable source of income to ensure repayment capabilities. It’s important to demonstrate that you have the means to repay the loan on time to maintain good credit standing.

Your vehicle’s equity plays a significant role in the Texas title loan application process, serving as collateral for the secured loans. Lenders will appraise your vehicle’s value and consider its condition to determine the maximum loan amount they can offer. This ensures that the lender has a safeguard against potential defaults, providing them with a financial solution in case of repayment failures.

Breaking down each criterion of a Texas title loan application is crucial for borrowers looking to access quick funding. By understanding basic eligibility requirements, documenting vehicle ownership and value accurately, and assessing personal creditworthiness, individuals can navigate the process with confidence. Remember, a thorough understanding of these key factors ensures the best chance of securing a loan that meets your needs in the vibrant Texas market.