Title loans on financed vehicles offer Fort Worth residents a swift and flexible cash solution, with faster approval times than traditional loans. These loans cater to less-than-perfect credit or urgent financial needs, providing manageable monthly payments tailored to individual income schedules. With flexibility in payment plans, refinancing opportunities, and same-day funding for qualifying borrowers, this alternative financing method distinguishes itself from shorter-term alternatives, making it a sustainable option for Fort Worth's loan requirements. To qualify, borrowers must verify vehicle ownership, provide proof of reliable income, and understand clear loan terms before signing.

Title loans on financed vehicles with flexible payments offer a unique financial solution for those in need of quick cash. This article delves into the intricacies of this alternative lending option, focusing on its benefits and how it differs from traditional loans. We’ll explore the advantages of flexible payment plans, the eligibility criteria, and practical steps to secure a title loan on your financed vehicle. Understanding these aspects is crucial for making informed decisions about short-term funding.

- Understanding Title Loans on Financed Vehicles

- Benefits of Flexible Payment Plans

- How to Qualify and Navigate the Process

Understanding Title Loans on Financed Vehicles

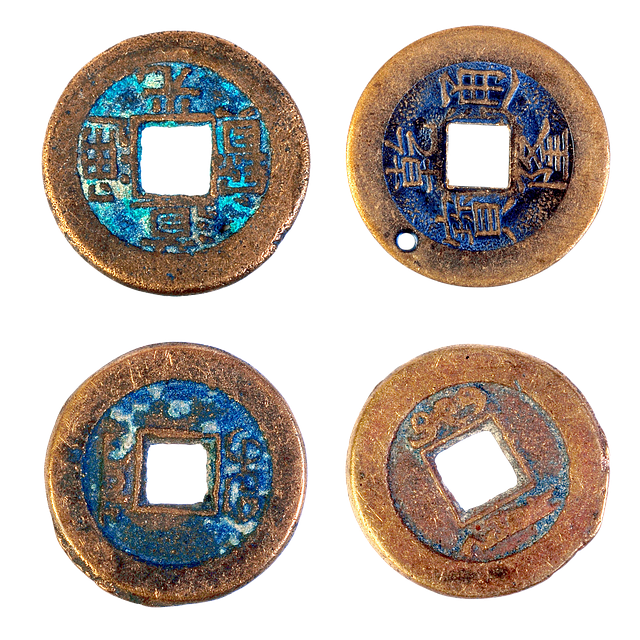

Title loans on financed vehicles offer a unique opportunity for individuals seeking quick cash solutions. This alternative financing method allows borrowers to use their vehicle’s title as collateral, providing access to funds with potentially faster approval times compared to traditional loan options. The process involves applying for a loan using your vehicle’s registration and title, which serves as security for the lender. If approved, you can receive fast cash in hand, making it an attractive option for Fort Worth Loans needs.

With flexible payment plans, borrowers can manage their loans more comfortably. These loans are designed to cater to individuals who may have less-than-perfect credit or a need for immediate financial support. The flexibility lies in the repayment terms, often structured to align with the borrower’s income schedule, ensuring manageable monthly payments. This feature distinguishes title loans on financed vehicles from some shorter-term alternatives, providing a more sustainable solution for those seeking quick cash.

Benefits of Flexible Payment Plans

One of the significant advantages of flexible payment plans for title loans on financed vehicles is the relief it offers borrowers from strict financial constraints. With traditional loan structures, making consistent payments can be challenging, especially when unexpected expenses arise. However, flexible payment options allow individuals to tailor their repayment schedules according to their cash flow patterns. This adaptability ensures that borrowers remain in control of their finances without the added stress of missed payments or penalties.

Additionally, these plans provide an opportunity for loan refinancing, enabling borrowers to optimize their terms and potentially lower interest rates, especially when comparing options like motorcycle title loans, truck title loans, or regular bank loans. Such flexibility is particularly beneficial for those with varying income cycles, ensuring they can maintain a healthy financial standing while managing other priorities.

How to Qualify and Navigate the Process

To qualify for a title loan on a financed vehicle with flexible payments, potential borrowers should first ensure their vehicle is free and clear of any existing loans or liens. This process involves verifying ownership through the vehicle’s registration and title documents. Lenders will assess the vehicle’s value, considering its make, model, year, condition, and current market prices. A reliable income source and proof of insurance are also necessary requirements.

Navigating the process involves filling out a loan application with accurate personal and financial information. Borrowers can expect to provide details about their employment, income, and existing debts. Once approved, lenders will outline clear terms, including interest rates, repayment schedules, and any associated fees. It’s crucial to read and understand these terms before signing. Same-day funding is often available for those who meet the criteria, allowing borrowers to access funds quickly while keeping their vehicle as collateral, a key advantage of secured loans in this scenario.

Title loans on financed vehicles with flexible payments offer a unique opportunity for individuals seeking quick cash. By leveraging their vehicle’s equity, borrowers can access substantial funds while maintaining control over their assets. The benefits of flexible payment plans include manageable monthly installments, no impact on credit scores, and the ability to pay off the loan at any time without penalties. Understanding the process and qualifying requirements is crucial before diving in. With careful consideration and responsible borrowing, title loans on financed vehicles can provide a reliable solution for short-term financial needs.