In today's digital age, car title loan emergency fund alternatives offer quick and less stringent funding for unexpected expenses. These loans use vehicle titles as collateral, providing swift cash access with lower interest rates than bank or credit card options. Online lenders like Dallas Title Loans and Fort Worth Loans streamline the process, catering to individuals facing financial crises who may not qualify for traditional loans.

In today’s digital era, unexpected financial crises can strike at any moment. Traditional bank loans may not always be accessible or timely. Online lenders offer a non-traditional yet effective solution: car title loan emergency fund alternatives. This article explores how these quick fixes, facilitated by streamlined processes, provide much-needed cash during emergencies. We delve into the benefits of car title loans as a viable option for those seeking immediate financial relief.

- Exploring Non-Traditional Emergency Funding Options

- Car Title Loans: A Quick Fix for Financial Crises

- Streamlined Processes for Urgent Cash Needs

Exploring Non-Traditional Emergency Funding Options

In today’s digital era, as traditional banking options continue to evolve, individuals are increasingly exploring non-traditional emergency funding sources. One such alternative gaining traction is the car title loan for immediate financial assistance. These loans, often referred to as car title loan emergency fund alternatives, provide a quick solution for those in need of cash. Instead of relying solely on bank loans or credit cards, which may come with stringent requirements and high-interest rates, this option offers a secured loan using one’s vehicle title as collateral.

By opting for a car title loan, borrowers can access funds faster and potentially avoid the cycle of mounting debt associated with traditional loans. It serves as an effective debt consolidation strategy, allowing individuals to manage multiple small debts under one roof. This approach is particularly appealing to those facing unexpected expenses or looking for a quick fix to bridge their financial gaps until they receive their next paycheck or benefit payment.

Car Title Loans: A Quick Fix for Financial Crises

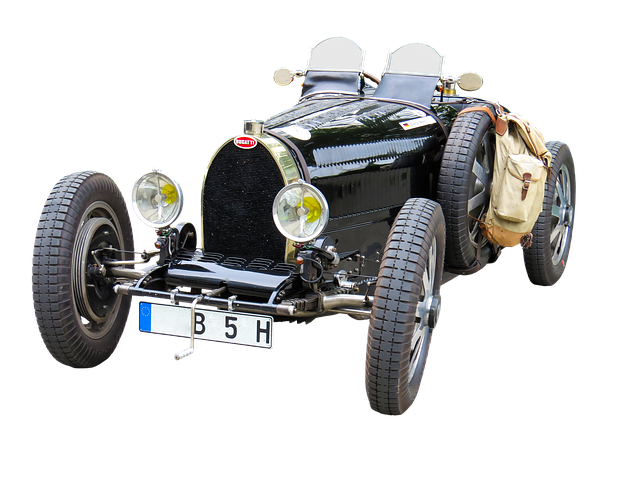

When financial emergencies arise, many individuals seek quick solutions to bridge the gap until their next paychecks or stable income sources kick in. Car title loans have emerged as a popular option for those in need of immediate financial assistance. These short-term, high-interest loans use a person’s vehicle, typically a car, as collateral. Lenders conduct a vehicle inspection to determine the value of the asset and assess the borrower’s ability to repay based on their loan eligibility.

This alternative to traditional banking offers several advantages for individuals looking for fast cash. It provides a convenient and relatively straightforward process, often with less stringent requirements compared to bank loans. Borrowers can access funds quickly, making it ideal for unforeseen circumstances like medical emergencies, home repairs, or unexpected bills. Moreover, car title loans can serve as a means for debt consolidation, helping individuals manage multiple debts by combining them into one loan with potentially lower interest rates.

Streamlined Processes for Urgent Cash Needs

In today’s fast-paced world, unexpected expenses can arise at any moment, leaving individuals in urgent need of quick cash solutions. Online lenders have revolutionized the way people access emergency funds by offering car title loan emergency fund alternatives. These streamlined processes are designed to cater to the immediate financial needs of borrowers without the usual hassle and lengthy waiting times associated with traditional banking methods.

One such alternative is Dallas Title Loans, which allows individuals to use their vehicle’s equity as collateral for a short-term loan. The application process is typically online, simple, and quick, enabling borrowers to receive funds within hours. Similar to Fort Worth Loans, these car title loans provide much-needed cash in times of crisis, offering flexible loan terms tailored to individual circumstances. This option is particularly appealing for those who need urgent funding and may not qualify for conventional loan products due to credit constraints.

In today’s digital era, exploring non-traditional financial options like car title loans can provide much-needed relief during financial crises. These alternative car title loan emergency fund alternatives offer streamlined processes and quick access to cash, making them viable solutions for urgent financial needs. While not without considerations, such loans can empower individuals to navigate unexpected challenges, ensuring they have a safety net when traditional funding options may be limited.