Alvin Auto Title Loans offer quick, accessible financing for individuals with vehicle equity, providing an alternative to traditional bank loans. Ideal for emergencies, these loans have competitive rates and flexible terms. However, responsible borrowing is crucial; assess your financial situation, create a repayment plan, understand lender requirements, and ensure short-term needs don't strain your budget.

“Alvin auto title loans offer a unique financial solution for those in need of quick cash. This type of loan uses your vehicle’s title as collateral, providing access to funds without strict credit checks. However, understanding when and how to utilize these loans responsibly is key. In this article, we explore the basics of Alvin auto title loans, delve into scenarios where they might be necessary, and provide essential tips for responsible borrowing to ensure a positive experience.”

- Understanding Alvin Auto Title Loans: The Basics

- When Is an Auto Title Loan Necessary?

- Responsible Borrowing: Tips and Best Practices

Understanding Alvin Auto Title Loans: The Basics

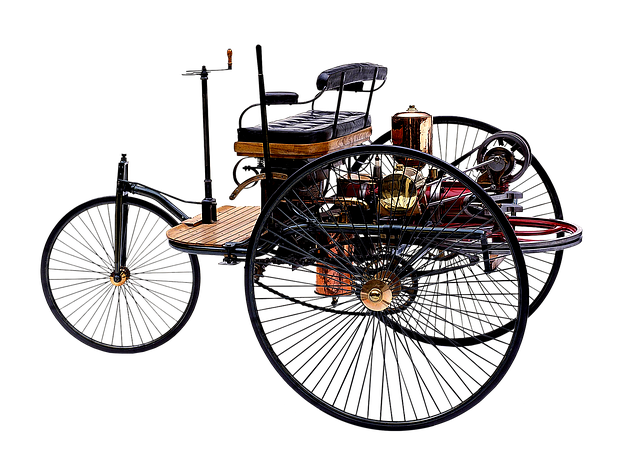

Alvin Auto Title Loans are a type of secured financing option designed for individuals who own a vehicle, allowing them to use their car’s equity as collateral. This alternative lending method provides a quick and accessible way to receive financial assistance for various needs. By pledging your vehicle’s title, lenders can offer competitive rates and flexible repayment terms compared to traditional bank loans.

These loans are particularly useful for those requiring immediate funds, such as during emergencies or unexpected expenses. It is especially beneficial for semi-truck owners who may need financial support for maintenance, upgrades, or even purchasing new equipment. Understanding the loan eligibility criteria is crucial; lenders assess factors like vehicle value, income, and credit history to determine repayment capacity, ensuring a responsible borrowing experience.

When Is an Auto Title Loan Necessary?

In today’s world, unexpected financial challenges can arise at any moment, leaving individuals seeking quick and accessible solutions. This is where Alvin auto title loans step in as a viable option for those in need. These loans are designed to offer a financial safety net when traditional borrowing methods may be out of reach. Whether it’s an emergency repair, unexpected medical bills, or covering essential expenses during a financial downturn, Alvin auto title loans provide a convenient and relatively straightforward way to gain access to funds.

When considering an auto title loan, it’s often necessary due to the absence of other credit options. Unlike bank loans that may require extensive documentation and strict credit checks, these loans are less stringent in terms of eligibility criteria. Individuals with poor or no credit history can still apply for Alvin auto title loans, making them an attractive financial solution. The process is further simplified by online applications, allowing borrowers to complete the initial steps from the comfort of their homes, ensuring a swift and efficient way to secure the necessary funds.

Responsible Borrowing: Tips and Best Practices

When considering Alvin auto title loans, responsible borrowing is paramount. Before applying, assess your financial situation and ensure you can comfortably repay the loan. These loans are designed for short-term financial needs and should not strain your budget. Start by evaluating your income, existing debts, and monthly expenses to determine a realistic repayment plan.

Remember that lenders will evaluate your creditworthiness based on factors like credit history, debt-to-income ratio, and vehicle value. Understanding these requirements beforehand can help you gather necessary documents and increase your chances of securing loan approval quickly. Quick funding is a benefit of Alvin auto title loans, but responsible borrowing ensures this process serves its purpose without adding to your financial burden.

Alvin auto title loans can be a helpful financial tool when used responsibly. By understanding the basics and following best practices, borrowers can navigate this option with confidence. When considering an auto title loan, it’s crucial to determine if it’s necessary and to borrow only what you can afford. Remember, responsible borrowing ensures that you can maintain your vehicle and manage your debt effectively without causing long-term financial strain.