A car title loan joint application involves two individuals using one vehicle as collateral, increasing approval chances and securing better terms. Both applicants need valid insurance to protect the vehicle and ensure smooth valuation. Lenders require proof of insurance. This method aids debt consolidation but requires responsible borrowing and repayment management. Co-signing offers lower rates and faster approval but carries significant risk if one borrower defaults, impacting the co-signer's financial standing. In San Antonio Loans, careful consideration is crucial to avoid strain on relationships.

Considering a car title loan? Both applicants on a joint application need to understand their insurance obligations. This guide breaks down the essential insurance requirements for car title loan joint applications, offering a comprehensive look at what each borrower is responsible for. We also explore the risks and benefits of co-signing with friends or family, helping you make an informed decision in today’s financial landscape.

- Understanding Joint Applications for Car Title Loans

- Insurance Requirements: A Comprehensive Look

- Navigating Risks and Benefits of Co-Signing with Friends or Family

Understanding Joint Applications for Car Title Loans

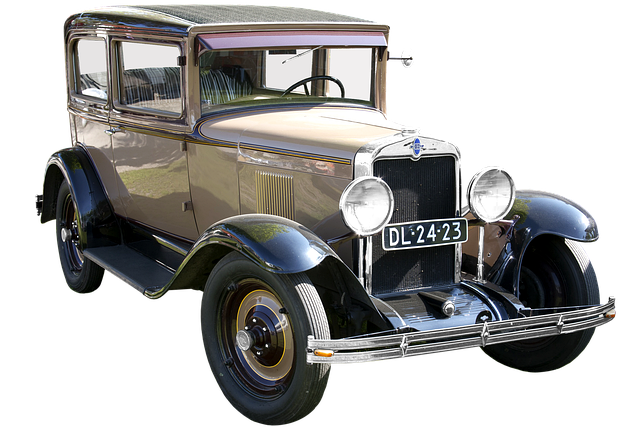

When considering a car title loan, many applicants often explore joint applications as a way to increase their chances of approval and potentially secure better terms. A car title loan joint application means that two individuals apply together for a loan using one of their vehicles as collateral. This is especially common among friends or family members who own a vehicle jointly. Understanding this process is crucial when navigating the title loan process.

In such scenarios, both applicants must have adequate insurance coverage to protect their investment and ensure a smooth vehicle valuation procedure. The lender will require proof of insurance for both parties, ensuring that the vehicle remains insured during the loan period. This step is essential, especially if one applicant relies on the vehicle for daily use or transportation, as it provides emergency funds and peace of mind in case of unforeseen circumstances.

Insurance Requirements: A Comprehensive Look

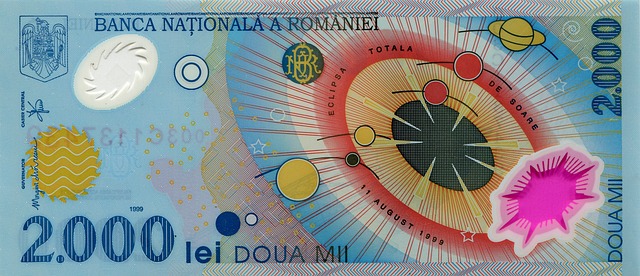

When applying for a car title loan together, understanding insurance requirements is paramount to ensuring a smooth process. Both applicants must have valid insurance coverage on their respective vehicles as collateral for the loan. This isn’t just a formality; it’s a crucial aspect of securing a secured loan and protecting the lender’s interest. The insurance policy should cover comprehensive and collision damage, with the lender often requiring proof of this coverage before disbursing funds.

Moreover, while a car title loan can serve as a means for debt consolidation or emergency funding, it’s essential to note that having insurance doesn’t necessarily absolve individuals of their debt obligations. Responsible borrowing and managing repayment plans alongside appropriate insurance are key to navigating such financial instruments effectively.

Navigating Risks and Benefits of Co-Signing with Friends or Family

When considering a car title loan joint application with friends or family, it’s essential to weigh the risks and benefits. Co-signing can be a way to access emergency funds quickly, especially if one party has better credit than the other. This option allows for a lower interest rate and potentially faster approval, as multiple income sources and strong relationships can enhance the application’s overall viability. However, this decision comes with significant implications. If one borrower defaults on the loan, it could severely impact the co-signer’s financial standing, damaging their credit score and causing potential strain in the relationship. It’s a delicate balance between facilitating access to short-term funds and protecting oneself from undue financial burden.

In San Antonio Loans or any title pawn scenario, having an additional co-signer can seem like a solution for those without a strong credit history. Yet, it’s crucial to remember that this practice isn’t without risks. Friends and family members should carefully consider their willingness to be held responsible for another person’s debt. They should also assess the borrower’s reliability in repaying the loan on time to avoid any potential financial dilemmas down the line.

When considering a car title loan joint application, understanding insurance requirements is crucial. Both applicants must be aware of their responsibilities regarding coverage, especially as co-signing comes with unique risks and benefits. By thoroughly reviewing insurance mandates and weighing the implications of shared liability, individuals can make informed decisions, ensuring a secure borrowing experience for all parties involved in a car title loan joint application.