Rockport auto title loans offer quick cash using your vehicle's ownership as collateral. The process involves three steps: application, vehicle evaluation, and document signing. Online applications provide convenience, with funds available within days. Choosing a legitimate lender with clear terms, flexible repayment options, and competitive rates is crucial for safe and dependable Rockport auto title loans.

In the financial landscape of Rockport, auto title loans have emerged as a viable option for quick cash. Understanding this process involves grasping the basics of Rockport auto title loans—what they are and how they work. This article delves into the intricacies, highlighting key factors to consider when choosing a provider. We emphasize ensuring reputability and security, guiding you in navigating this alternative lending option effectively.

- Understanding Rockport Auto Title Loans Basics

- Key Factors to Consider When Choosing a Provider

- Ensuring Reputability and Security in Rockport Auto Title Loans

Understanding Rockport Auto Title Loans Basics

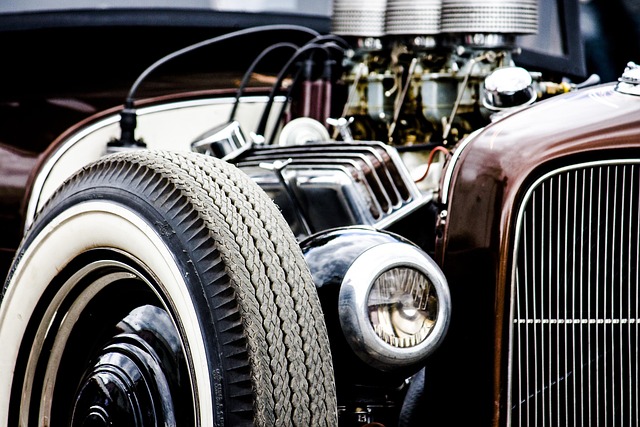

Rockport auto title loans are a form of secured lending where borrowers use their vehicle’s ownership as collateral to secure a loan. This type of loan is designed for individuals who need quick access to cash, typically offering faster approval and more flexible terms compared to traditional bank loans. The process involves a simple three-step procedure: applying, evaluating your vehicle’s value, and signing the title transfer documents. Once approved, you can receive funds relatively promptly, often within the same day or a few business days later.

Key aspects of Rockport auto title loans include the requirement to keep your vehicle as a guarantee for the loan, ensuring its condition meets the lender’s standards. Additionally, an online application process makes it convenient for borrowers, allowing them to complete the initial steps from the comfort of their homes. This modern approach streamlines traditional borrowing methods, making auto title loans a viable option for those in need of immediate financial support while providing a clear path to repaying the loan over time.

Key Factors to Consider When Choosing a Provider

When selecting a provider for Rockport auto title loans, several key factors come into play. Firstly, ensure that the lender is licensed and operates within the legal framework in your state or region. This is crucial as it safeguards your rights and offers protection against fraudulent practices. Reputable providers will typically display their licenses prominently on their websites.

Secondly, consider the transparency of their terms and conditions. A reliable Rockport auto title loans provider should offer clear information about interest rates, repayment periods, and any additional fees. Additionally, they should be prepared to conduct a thorough vehicle inspection to assess its value accurately, which is essential for determining the loan amount you can secure. The process of submitting an online application is another convenience offered by top-tier lenders, making it efficient and hassle-free for borrowers in need of emergency funding.

Ensuring Reputability and Security in Rockport Auto Title Loans

When exploring Rockport auto title loans options, prioritizing reputability and security is paramount. Begin by verifying the lender’s legitimacy through state-issued licenses and insurance certifications. Reputable providers hold these to ensure they operate within legal boundaries and safeguard your interests. Online reviews from past borrowers offer valuable insights into a company’s track record and customer service quality.

Seek lenders renowned for transparent Loan Terms, flexible repayment options, and competitive interest rates. A reliable Rockport auto title loans provider should be willing to discuss the entire process openly, outlining potential fees, penalties, and the timeline for loan approval and disbursement. Opting for a secure platform ensures your personal and financial information remains confidential, providing you with a more dependable and safe financial solution.

When selecting a provider for Rockport auto title loans, it’s crucial to balance convenience with security. By understanding the basics, considering key factors, and ensuring reputable practices, you can make an informed decision that best suits your financial needs. Remember, a trustworthy lender prioritizes transparency, fair rates, and customer satisfaction, making them a valuable partner in navigating this type of loan.