When considering a car title loan in Mercedes, TX, understanding interest rates and loan terms is vital. Rates vary based on credit history, vehicle value, and loan amount, with competitive options available compared to traditional loans. Lenders offer flexible payment structures but eligibility criteria differ. Shopping around and negotiating terms, such as extending repayment periods, can secure favorable rates. Being informed and strategic during negotiations is key to securing the best deals for car title loans in Mercedes, TX.

Negotiating the best car title loan rates for your Mercedes TX vehicle is a strategic process that can save you significant funds. In this guide, we’ll help you navigate the complexities of car title loans in Mercedes TX and ensure you get the lowest interest rates. By understanding the current market trends, comparing offers from multiple lenders, and employing effective negotiation tactics, you can secure favorable terms on your loan. Discover practical strategies to make the most of your vehicle’s equity and gain financial freedom.

- Understanding Mercedes TX Car Title Loan Rates

- Strategies for Negotiating Better Terms

- Securing Favorable Interest Rates on Your Loan

Understanding Mercedes TX Car Title Loan Rates

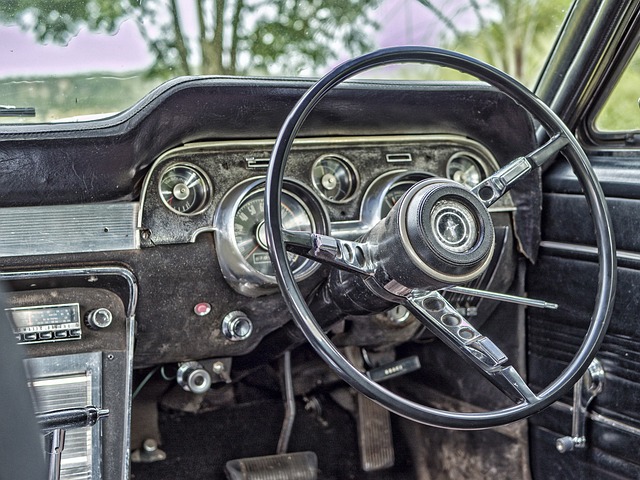

When considering a car title loan in Mercedes, TX, understanding the rates and terms is essential for making an informed decision. These loans are secured by your vehicle’s title, which means the lender has a claim on your car until the loan is repaid. The interest rates for car title loans can vary widely depending on several factors, including your credit history, the value of your vehicle, and the amount borrowed. In Mercedes TX, lenders often offer competitive rates compared to traditional personal loans, but it’s crucial to shop around to find the best deal.

Lenders may also structure their loan terms differently, with some providing flexible payments to suit various income levels. Loan eligibility criteria vary from lender to lender, so it’s beneficial to explore options in San Antonio and beyond. Understanding these rates and terms will empower you to negotiate favorable conditions for your car title loan, ensuring a borrowing experience that aligns with your financial needs.

Strategies for Negotiating Better Terms

When negotiating Car title loans Mercedes TX rates, understanding your financial position is key. Before heading into any discussions with lenders, prepare by gathering your financial records and budgeting details. This shows the lender your responsible borrowing habits and enables them to tailor terms that suit your needs, potentially offering lower rates for good credit or debt consolidation options. Presenting a clear picture of your finances can help you secure more favorable conditions, making your car title loan an affordable solution rather than a burden.

During negotiations, don’t shy away from asking questions and clarifying terms. Inquire about interest calculations, repayment periods, and any additional fees. Lenders who offer transparent information are often willing to negotiate, especially if they believe you’re a reliable customer. Consider proposing alternative arrangements like an online application process for faster approval or discussing flexible repayment plans that align with your cash flow. Remember, being informed and prepared is your best strategy for securing the best Car title loans Mercedes TX rates.

Securing Favorable Interest Rates on Your Loan

When securing a car title loan in Mercedes TX, negotiating favorable interest rates is a strategic move that can save you significant amounts over the life of your loan. Start by comparing offers from multiple lenders. This market research equips you with knowledge about average interest rates for car title loans Mercedes TX and helps identify any outliers that might offer better terms. Additionally, understanding your credit score and the lender’s specific criteria for approval can empower you during negotiations. Some lenders may be willing to adjust rates based on your financial history or the value of your vehicle.

During the application process, don’t hesitate to inquire about potential discounts or promotions. Lenders often have promotional offers that could lower your interest rate. Furthermore, consider negotiating loan terms, such as extending the repayment period, which can effectively reduce monthly payments and, consequently, the overall interest paid. Remember, a thorough understanding of both your financial situation and the lender’s assessment of your vehicle’s value is key to securing the best possible deal, especially when opting for a car title loan in Mercedes TX with no credit check.

When exploring car title loans in Mercedes, TX, understanding how interest rates are calculated and negotiating favorable terms can save you significant money over the life of your loan. By employing strategic tactics discussed in this article, such as comparing offers from multiple lenders and considering alternative payment plans, you can secure a lower rate and more manageable repayment terms. Remember, when it comes to car title loans Mercedes TX, knowledge is power – empower yourself with information to make the best financial decision for your situation.