Understanding income requirements is key for title loan cash income acceptance. Lenders assess stable earnings and vehicle equity to gauge repayment ability. Gather essential docs like ID, proof of residency, pay stubs or bank statements. Maximize earnings, streamline finances through debt consolidation for approval chances.

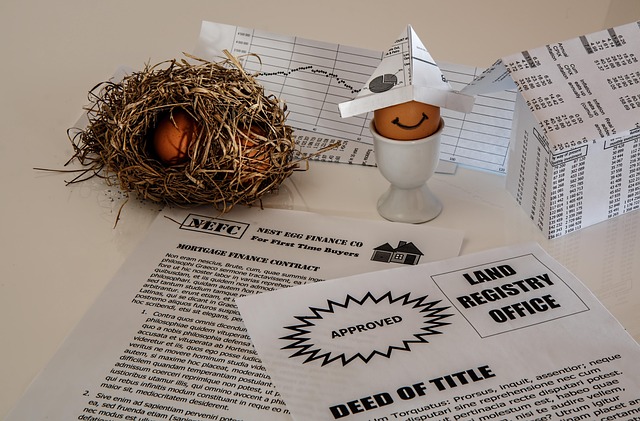

Need a quick financial boost? Title loans could be an option, but securing approval depends on understanding income requirements. This guide breaks down the process, from meeting basic title loan cash income standards to maximizing your earnings for faster acceptance. By following these steps, you’ll increase your chances of getting the funds you need without delay. Discover how to navigate this alternative financing path confidently and efficiently.

- Understanding Title Loan Cash Income Requirements

- The Steps to Achieve Approval for Title Loans

- Maximizing Your Earnings for Title Loan Cash Acceptance

Understanding Title Loan Cash Income Requirements

When applying for a title loan cash income approval, understanding the income requirements is crucial for a smooth process. Lenders will assess your ability to repay the loan based on your financial stability and regular income sources. This often involves verifying employment and providing proof of consistent earnings. The goal is to ensure you have the means to cover the loan payments without facing financial strain.

Your income plays a significant role in securing quick funding through a title loan. Lenders typically consider stable, verifiable income sources such as payroll stubs or bank statements. For those with non-traditional employment or self-employment, providing detailed financial records can be essential. Additionally, the amount of vehicle equity you have can impact the loan-to-value ratio, affecting your credit check and overall approval chances.

The Steps to Achieve Approval for Title Loans

Achieving approval for a title loan requires a clear understanding of the process and gathering the necessary documentation. The first step is to determine your vehicle’s value, which will dictate the amount of cash you can access through the loan. This involves providing details about your vehicle, including its make, model, year, mileage, and overall condition. Once your vehicle’s worth is assessed, lenders will evaluate your income to ensure it meets their minimum requirements for repayment.

The next critical step is to prove your identity and income. Lenders typically require a valid government-issued ID, proof of residency, and recent pay stubs or bank statements to verify your employment and income source. It’s important to be transparent about your financial situation, as lenders often offer flexibility with their terms and conditions, including options for loan extensions if needed. They also generally don’t conduct a credit check, making these loans an attractive option for those with less-than-perfect credit.

Maximizing Your Earnings for Title Loan Cash Acceptance

Maximizing your earnings is a strategic move to boost your chances of securing a title loan cash income acceptance. Lenders assess your ability to repay the loan based on your financial health, and demonstrating steady, substantial income can significantly impact the approval process. One effective way to do this is by ensuring your vehicle, whether it’s a car or motorcycle, has a high valuation. This increases the equity you have in the asset, making the loan riskier for lenders but potentially easier to qualify for if your credit history is less than ideal.

Additionally, considering debt consolidation as a strategy can streamline your financial situation and improve your income appearance. By combining multiple debts into one loan with a lower interest rate, you reduce the overall monthly payments, leaving more room in your budget for other expenses, including repaying the title loan. This demonstrates to lenders that you’re actively managing your finances responsibly, increasing your likelihood of gaining approval for title loan cash income acceptance.

Securing a title loan cash income approval can be a viable option for those in need of quick funding. By understanding the requirements, following the necessary steps, and maximizing your earnings, you can increase your chances of getting approved. Remember, responsible borrowing is key, so ensure you have a clear repayment plan before taking out any type of loan. With the right approach, you can navigate the process successfully and access the financial support you need.