Unbanked individuals rely on alternative lenders for flexible credit, with title loans offering transparency and education to build trust. These loans provide clear terms, interest rates, and repayment plans, empowering borrowers to make informed decisions without hidden fees. By offering straightforward processes and no credit check, title loans give unbanked customers financial stability and control using vehicle ownership as collateral. Educational initiatives foster trust, ensuring secure access to funds for this specific demographic.

Many individuals, often referred to as “unbanked,” lack access to traditional banking services. This article explores how title loans offer a unique opportunity for this demographic to gain financial confidence through transparency and empowerment. By understanding the specific financial needs of unbanked customers, we highlight how transparent lending practices in title loans can serve as a game-changer, building trust and providing much-needed access to credit.

- Understanding Unbanked Customers' Financial Needs

- Transparency in Title Loans: A Game-Changer

- Building Trust: Empowering Unbanked Individuals

Understanding Unbanked Customers' Financial Needs

Unbanked customers, those who lack access to traditional banking services, often face unique financial challenges and have distinct needs when it comes to borrowing. Understanding their motivations and circumstances is key to providing solutions that foster confidence and financial stability. Many unbanked individuals rely on alternative lenders due to a lack of credit history or poor credit scores, which can make it difficult to secure loans from mainstream institutions. This demographic may include low-income earners, freelancers, or those with limited employment history, all of whom require flexible and accessible lending options.

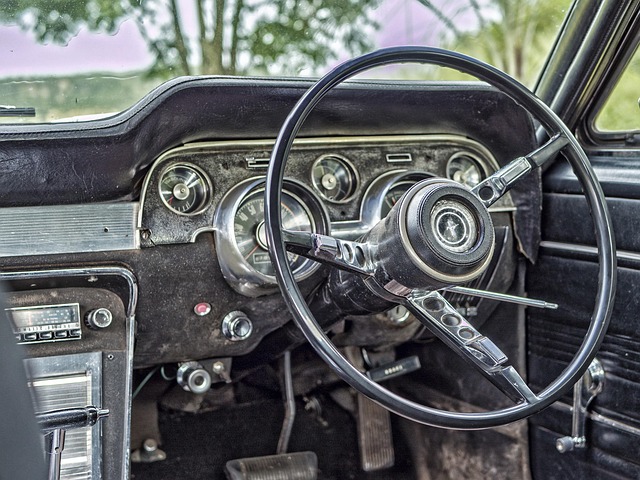

In Dallas, for instance, where motorcycle title loans are popular among unbanked residents, transparency in loan requirements and processes can empower these customers. Clear communication about interest rates, repayment terms, and the security involved in a title loan helps build trust. By educating unbanked borrowers about their rights and obligations, lenders can ensure that they make informed decisions, gain financial confidence, and establish a positive relationship with alternative financing methods like Dallas title loans.

Transparency in Title Loans: A Game-Changer

For many unbanked or underbanked individuals, accessing traditional financial services can be a significant challenge. This demographic often relies on alternative lending options to meet their immediate financial needs. Title loans, specifically truck title loans, have emerged as a powerful financial solution for these customers. The key differentiator? Transparency.

Lenders who offer clear and straightforward terms, interest rates, and repayment plans are revolutionizing the way unbanked customers approach short-term financing. Unlike other loan types with complex hidden fees and unclear regulations, truck title loans provide a transparent financial path. This transparency builds trust and confidence among borrowers, especially those lacking access to conventional banking services. By removing the mystique and offering no credit check options, lenders cater to the unique needs of unbanked customers, empowering them to make informed decisions about their finances.

Building Trust: Empowering Unbanked Individuals

For unbanked individuals, navigating financial services can be a daunting task due to a lack of access to traditional banking options. However, innovative solutions like Dallas Title Loans offer a ray of hope and confidence in their financial future. By providing a straightforward and transparent process, these loans empower those without a bank account or credit history to gain financial stability. The key lies in building trust through educational initiatives that demystify loan terms, ensuring every customer understands the agreement.

This approach is particularly beneficial for Title Loan unbanked customers who often rely on their vehicle ownership as collateral. With no credit check required, these loans offer a safety net, enabling individuals to access much-needed funds and build financial confidence. Transparency fosters a sense of security, encouraging unbanked folks to take control of their monetary well-being without the usual barriers.

Unbanked individuals, lacking traditional financial services access, face unique challenges. However, with transparency as a cornerstone, title loans offer a viable solution for gaining confidence and empowerment. By providing clear terms and conditions, unbanked customers can make informed decisions, fostering trust and enabling them to navigate their financial landscapes more effectively. This shift in approach is crucial in meeting the needs of this underserved demographic.