Car title loan security measures protect both lenders and borrowers through strict credit checks, online applications with data encryption, competitive interest rates based on creditworthiness, clear insurance requirements and repayment schedules, fraud prevention, direct deposit fund transfers, and enhanced transparency, fostering trust and making car title loans a reliable option for emergency funds.

Car title loans, a convenient borrowing option for many, come with robust security measures designed to protect both lenders and borrowers. This article delves into the intricate world of car title loan security, exploring how these measures safeguard borrowers’ interests and facilitate secure payment processing. From data encryption to title retention, we uncover the critical protocols ensuring transparency and reducing risk in this alternative financing sector.

- Understanding Car Title Loan Security Measures

- How Do Security Measures Protect Borrowers?

- Enhanced Payment Processing Through Security Protocols

Understanding Car Title Loan Security Measures

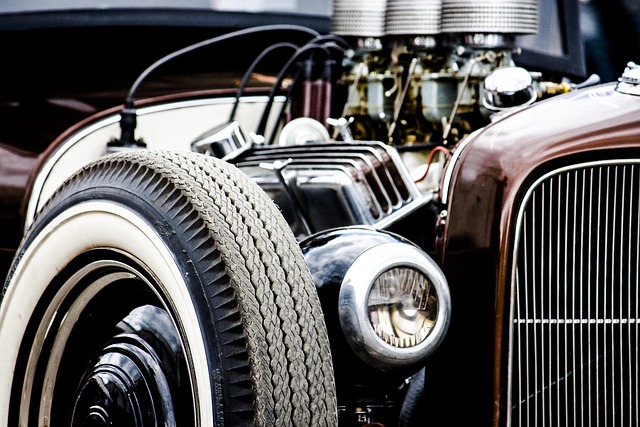

Car title loan security measures are designed to protect both lenders and borrowers by ensuring that the collateralized asset—in this case, a vehicle—maintains its value throughout the loan period. These measures start with a thorough credit check to evaluate the borrower’s financial health and ensure they can responsibly manage the loan. An Online Application process streamlines the initial steps, allowing borrowers to apply from the comfort of their homes, enhancing convenience while maintaining security through encrypted data transfer.

Interest rates are another critical aspect, with competitive rates reflecting responsible lending practices that consider both the borrower’s creditworthiness and the inherent risk associated with secured loans. By adhering to robust car title loan security measures, lenders can offer favorable terms, ensuring a win-win scenario for all involved parties while fostering trust in the lending ecosystem.

How Do Security Measures Protect Borrowers?

Car title loan security measures play a pivotal role in safeguarding borrowers from potential financial risks. These protective mechanisms ensure that both parties involved in the transaction adhere to the agreed-upon terms, minimizing the chances of default or fraud. By leveraging the value of their vehicles as collateral, borrowers can access much-needed funds without incurring high-interest rates typically associated with traditional loans.

Security measures, such as comprehensive insurance requirements and transparent repayment schedules, empower borrowers by providing clear guidelines for loan payoff. This includes outlining the consequences of missed payments or default, giving borrowers ample time to rearrange their finances or consider options like loan refinancing if unexpected challenges arise. Such precautions contribute to a positive lending environment, fostering trust between lenders and borrowers while ensuring a secure payment processing experience.

Enhanced Payment Processing Through Security Protocols

Car title loan security measures play a pivotal role in ensuring secure payment processing. These protocols are designed to safeguard both lenders and borrowers by verifying the authenticity of transactions and minimizing risks. By implementing robust security measures, lenders can trust that funds are transferred directly to their accounts via secure methods like direct deposit, eliminating any concerns about fraudulent activities or delayed payments.

The enhanced payment processing through these security protocols not only speeds up the overall loan process but also provides borrowers with peace of mind. Knowing that their emergency funds are accessed safely and securely allows them to focus on managing their debts effectively without worrying about potential financial setbacks. This transparency fosters a transparent relationship between lenders and borrowers, making car title loans a viable option for those seeking quick access to emergency funds.

Car title loan security measures play a pivotal role in ensuring a safe and secure borrowing experience for all parties involved. By understanding these protocols, borrowers can feel confident knowing their interests are protected. Advanced security measures not only safeguard sensitive data but also streamline payment processing, making the entire process more efficient and reliable. Embracing these robust security protocols is a game-changer in the automotive lending industry, fostering trust and peace of mind for both lenders and borrowers alike.