Facing significant title loan debt? Explore private settlement methods like refinancing, negotiation for reduced balance or extended terms, and potential vehicle inspection for fairer settlement. Avoid court battles, restructure debt, and gain financial relief through these alternatives to traditional legal resolution for title loan debt settlement.

Struggling with a title loan debt? You might wonder if court intervention is necessary for resolution. In fact, there are legal and non-legal paths to title loan debt settlement, avoiding the courthouse altogether. This article explores these options in detail, guiding you through understanding your rights, negotiating strategies, and the pros and cons of each approach. By the end, you’ll be equipped with the knowledge to make an informed decision for your financial future.

- Understanding Title Loan Debt Settlement Options

- Legal vs. Non-Legal Means of Settlement

- Strategies for Negotiating Without Court Involvement

Understanding Title Loan Debt Settlement Options

When facing significant debt from a title loan, understanding your options for settlement is crucial. One alternative to court-ordered debt resolution is exploring private settlement methods. This process allows borrowers to negotiate directly with lenders or seek third-party assistance to restructure their debt and avoid lengthy legal battles.

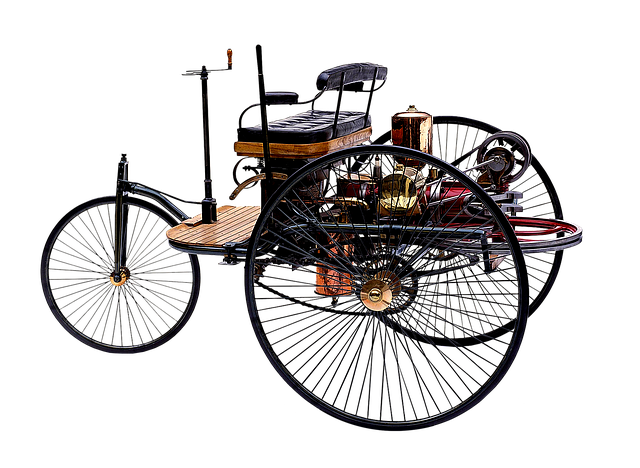

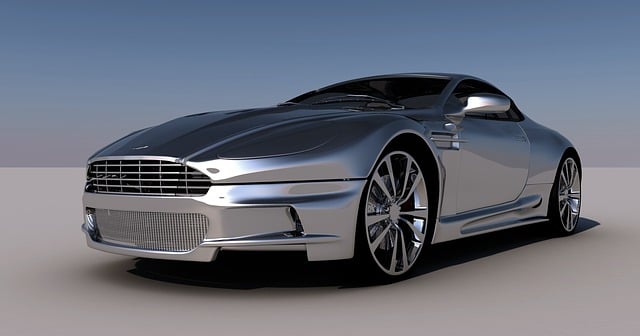

Title loan debt settlement can take various forms. One common strategy is loan refinancing, where you replace your existing high-interest title loan with a new loan at a lower interest rate, providing some financial relief. Another option involves negotiating with the lender for a reduced balance or extended repayment terms, which can help manage monthly payments and reduce overall interest costs. A vehicle inspection might also be involved in these negotiations, as it assesses the current value of your titled asset to determine a fair settlement amount.

Legal vs. Non-Legal Means of Settlement

When considering debt settlement for a title loan, individuals often ponder the options available to them—a decision that can significantly impact their financial situation. A key distinction lies between legal and non-legal means of resolving such debts. Legally, several states allow for negotiation and agreements outside of court, offering a more direct approach to title loan debt settlement. This may involve discussing repayment plans or arrangements with the lender directly or through a designated agent.

Non-legal methods, while less formal, require careful navigation. Some people opt for debt relief programs or negotiate terms with lenders for faster cash repayment options, such as settling the debt in full for a reduced amount (title loan process). These alternatives can provide quicker results, but they may also come with potential risks and long-term effects on credit scores. Understanding these options is crucial when exploring repayment options without involving legal proceedings.

Strategies for Negotiating Without Court Involvement

When considering a Title Loan Debt Settlement without court intervention, many borrowers opt for negotiation as a strategic approach. This method requires skill and persistence to achieve favorable terms directly with the lender. A key strategy is open communication, where borrowers express their willingness to repay but seek adjustments to the original loan agreement. This might include lowering interest rates, extending repayment periods, or negotiating a lump-sum settlement offer.

Borrowers can also leverage their unique asset—the vehicle’s title. By proposing a ‘title pawn’ or offering to use their truck (in the case of Semi Truck Loans or Truck Title Loans) as collateral for a new, more manageable loan, they may gain leverage. This approach allows them to avoid legal proceedings and potentially saves on court costs and associated fees while working towards debt resolution.

Many individuals seeking relief from overwhelming title loan debts often wonder if court involvement is necessary. As discussed, both legal and non-legal strategies exist for title loan debt settlement, offering alternative paths to repayment or negotiation without a lengthy legal process. By understanding the available options, negotiating directly with lenders, or exploring third-party assistance, it’s possible to achieve a favorable resolution. Remember, proactive measures can lead to better outcomes, allowing you to regain control over your financial future without always relying on court action.