In Texas, a title loan provides short-term financing secured by a vehicle, with repayment typically structured over a shorter period. Bankruptcy doesn't automatically disqualify borrowers, but approval depends on meeting repayment terms while adhering to regulations. During bankruptcy, a structured repayment plan managed by a trustee allows borrowers to pay off loans over time, subject to the terms of their agreement. Crafting an effective loan payoff strategy for Texas title loans requires legal guidance to ensure compliance. Borrowers have protections under the law; proactively communicate with creditors and legal representatives to understand repayment options under the bankruptcy code.

In Texas, understanding how a title loan works during bankruptcy can be crucial for individuals seeking financial relief. This article provides a comprehensive guide to navigating this process, focusing on Texas title loans and their interaction with bankruptcy laws. We’ll explore the basics of these loans, how bankruptcy affects repayment obligations, and most importantly, the rights and options available to borrowers. By delving into these aspects, we aim to equip folks with knowledge to make informed decisions during challenging financial times.

- Understanding Texas Title Loans: A Brief Overview

- Bankruptcy and Loan Repayment: What You Need to Know

- Navigating the Process: Rights & Options for Borrowers

Understanding Texas Title Loans: A Brief Overview

In Texas, a title loan is a short-term financing option secured by an individual’s vehicle. It allows borrowers to access a predetermined amount based on their vehicle’s value, with repayment typically structured over a shorter period compared to traditional loans. This type of loan can be appealing for those in need of quick cash during challenging financial times, including individuals navigating bankruptcy.

When considering a Texas title loan during bankruptcy, it’s essential to understand the process and its implications. While bankruptcy may impact loan availability, it doesn’t automatically disqualify borrowers. Loan approval still depends on various factors, such as the borrower’s ability to meet repayment terms while adhering to bankruptcy regulations. In some cases, individuals might even explore options for truck title loans or consider a loan extension if their financial situation improves post-bankruptcy.

Bankruptcy and Loan Repayment: What You Need to Know

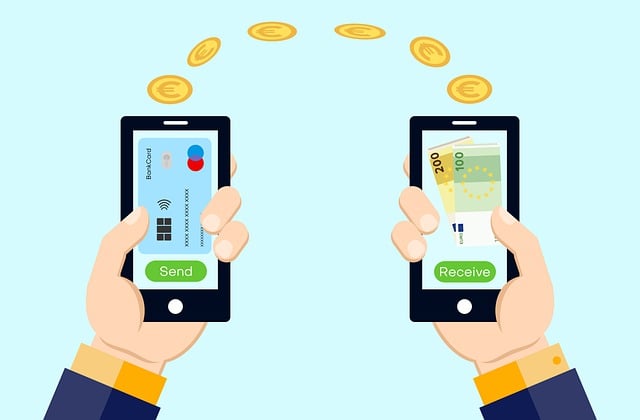

When facing financial difficulties, many individuals consider bankruptcy as an option to alleviate debt. However, understanding how this process impacts existing loans, like Texas title loans, is crucial. During bankruptcy, lenders are required to abide by specific rules, ensuring fair treatment for borrowers. One common question that arises is whether a Texas title loan can be repaid during the bankruptcy process.

In many cases, repaying high-interest loans such as Houston title loans or boat title loans might be challenging initially. Bankruptcy allows individuals to create a repayment plan, often through a court-appointed trustee, who distributes funds based on priority. This means that while repaying these loans is possible, it may take time and be subject to the overall terms of the bankruptcy agreement. A loan payoff strategy should be carefully considered in conjunction with legal advice to ensure compliance with local regulations regarding Texas title loans during bankruptcy.

Navigating the Process: Rights & Options for Borrowers

Navigating bankruptcy can be a complex process for anyone, but understanding your rights and options is crucial. When it comes to Texas title loans during bankruptcy, borrowers should know they have certain protections under the law. The first step is to evaluate your financial situation and determine which type of bankruptcy best suits your needs. Once this is established, you can explore repayment options that may work with your current circumstances. Car title loans, for instance, offer a way to access emergency funds quickly without traditional credit checks, but it’s essential to understand the terms and conditions before taking out such a loan.

During bankruptcy proceedings, lenders are restricted in their ability to garnish wages or take other immediate actions. This provides borrowers with an opportunity to manage their debt and potentially reorganize their financial obligations. It’s important to be proactive and communicate openly with your creditors and legal representatives to explore all repayment options available under the bankruptcy code. This proactive approach can help streamline the process and lead to better outcomes for individuals seeking relief from overwhelming debt, including those considering Texas title loans as a short-term solution.

A Texas title loan can be a viable option for individuals facing financial challenges, especially during bankruptcy proceedings. While it’s crucial to understand the potential impact on your repayment options and future borrowing capacity, navigating this process offers borrowers rights and flexible avenues. By exploring their rights and understanding the mechanics of a Texas title loan during bankruptcy, individuals can make informed decisions, ensuring they receive the best possible terms and maintain control over their financial future.