Car title loans Lockhart TX provide secured cash advances using vehicle titles as collateral for those with poor credit or no history. Approvals are swift, offering direct deposits with simple applications focusing on vehicle and income details. Refinancing is available to improve financial well-being, requiring a good working vehicle, stable income, and positive repayment history. Steps involve assessing current loan terms, comparing rates, researching alternative lenders, gathering documents, and submitting applications for customized offers.

Looking to refinance your car title loan in Lockhart, TX? This guide breaks down everything you need to know. We’ll walk you through understanding car title loans specific to Lockhart, evaluating your eligibility for refinancing, and outlining a straightforward process with clear steps. If you’re in or around Lockhart and considering refinancing, this is the comprehensive resource you’ve been searching for on car title loans Lockhart TX.

- Understanding Car Title Loans in Lockhart TX

- Eligibility Criteria for Refinancing in Lockhart

- Refinancing Process: Steps to Follow

Understanding Car Title Loans in Lockhart TX

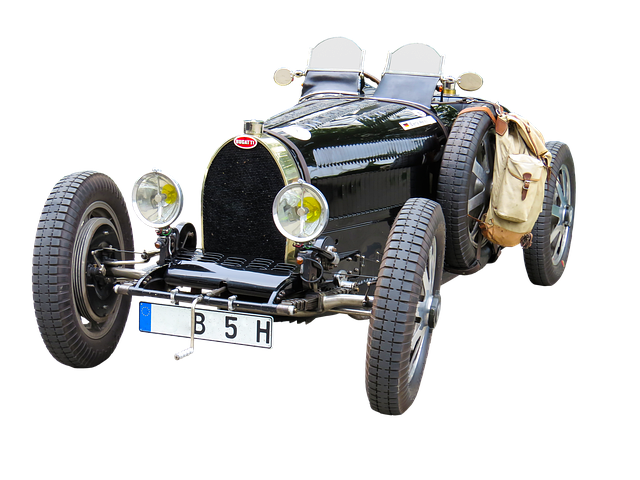

Car title loans Lockhart TX are a type of secured loan where individuals use their vehicle’s title as collateral. In this arrangement, lenders provide cash advances based on the value of the borrower’s car. This option is particularly appealing to folks with less-than-perfect credit or no credit history, as traditional loan applications may be denied. The process involves a simple application, where borrowers submit their vehicle information and details about their income and employment. Upon approval, lenders issue a loan amount, typically offering quick funding through direct deposit.

One significant advantage of Car title loans Lockhart TX is the streamlined eligibility criteria. Lenders usually don’t conduct extensive credit checks, making it accessible to many. This alternative financing method provides fast access to funds, catering to urgent financial needs. Borrowers retain possession of their vehicles during the loan period, ensuring they can continue using them for daily activities without disruption.

Eligibility Criteria for Refinancing in Lockhart

In Lockhart, Texas, refinancing a car title loan is an option for those seeking to improve their financial situation. To be eligible for refinancing, borrowers must generally meet certain criteria. Firstly, the vehicle used as collateral for the original loan must still be in good working condition and have significant remaining value. This ensures that the lender has security over an asset of substantial worth. Additionally, borrowers should have a stable source of income to demonstrate their ability to make consistent repayments. A solid repayment history on previous loans or other financial obligations is also favorable as it indicates responsible borrowing behavior.

Another key aspect of refinancing car title loans Lockhart TX involves the borrower’s creditworthiness. While bad credit loans are available, lenders will typically conduct a credit check to assess the borrower’s risk. Refinancing can be particularly beneficial for individuals with less-than-perfect credit who have since improved their financial standing. By demonstrating a history of timely repayments and responsible financial management, borrowers can increase their chances of qualifying for better terms and rates during refinancing, ultimately offering a more sustainable financial solution.

Refinancing Process: Steps to Follow

Refinancing your Car Title Loans in Lockhart TX can be a strategic move to manage your finances better. The process involves several steps designed to ensure transparency and fairness. First, assess your current loan terms from your existing lender in Lockhart TX. Compare interest rates, repayment periods, and any additional fees charged. This step is crucial as it helps you understand the potential savings or benefits of refinancing.

Next, research alternative lenders in Lockhart TX who offer car title loans. Evaluate their terms, including interest rates, payment plans, and keeping your vehicle as a collateral requirement. Look for options that align with your financial needs and goals, such as those offering lower rates or more flexible payment structures. Once you’ve identified suitable lenders, gather the required documentation, which typically includes your vehicle’s title, proof of income, and identification. Submit these documents to the chosen lender, who will then assess your application and provide a customized offer for refinancing your Car Title Loans in Lockhart TX.

If you’re considering refinancing your car title loan in Lockhart, TX, understanding the process and eligibility criteria is key. By following the steps outlined in this article, you can navigate the refinance journey with confidence. Remember, car title loans in Lockhart TX offer a quick cash solution, but refinancing allows for better terms and rates. With careful planning and knowledge of your options, you can make informed decisions to suit your financial needs.