Title loans for cars offer emergency funding using vehicle titles as collateral, with lenders assessing car value and retaining the title until repayment. Repayment periods vary, and high-interest rates are common, so understanding and preparedness are key to avoid adverse outcomes. Lenders use specialized tools for valuations, and flexible payment plans are available despite bad credit. Timely repayments prevent penalties, and comparing multiple Houston lenders like Houston Title Loans ensures the best deal. Maintain insurance and vehicle maintenance for a smooth process.

Title loans for cars have evolved to provide a unique financing option for borrowers. In today’s fast-paced financial landscape, understanding this alternative lending method is crucial. This article delves into the intricacies of how title loans work, offering a clear guide on the basics, assessment process, and repayment considerations. By exploring these aspects, you’ll gain valuable insights into securing funds using your vehicle’s title as collateral, ensuring an informed decision in the world of title loans for cars.

- Understanding the Basics of Title Loans for Cars

- How Lenders Assess and Value Your Vehicle

- Repayment Process and Considerations for Borrowers

Understanding the Basics of Title Loans for Cars

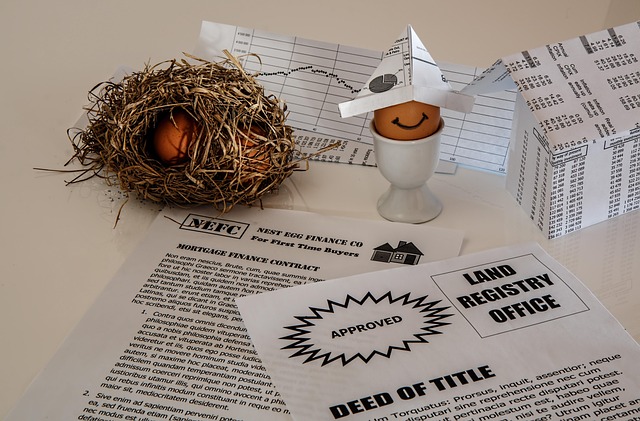

Title loans for cars are a type of secured lending that allows individuals to borrow money using their vehicle’s title as collateral. This option is particularly appealing for those in need of emergency funding, as it offers relatively quick access to cash without the extensive application processes often associated with traditional bank loans. The process begins by evaluating the vehicle’s value, which determines the loan amount available to the borrower. Once approved, the lender retains the car title until the loan is repaid, including interest and any fees. This secure arrangement ensures that the lender has recourse if the borrower defaults on their payments.

In cities like San Antonio, car title loans have gained popularity due to their accessibility and potential for fast approval. Individuals facing financial emergencies can tap into this alternative funding source, but it’s crucial to understand the terms and conditions thoroughly before signing any agreements. Repayment periods vary, and interest rates can be high, so borrowers must be prepared to meet the obligations to avoid potential consequences.

How Lenders Assess and Value Your Vehicle

When it comes to title loans for cars, lenders carefully assess your vehicle’s value to determine the loan amount. This process involves several factors, including the make and model, year, overall condition, mileage, and current market trends. Lenders often use specialized tools and databases to compare your vehicle with similar ones on the market, ensuring a fair and accurate valuation. The Vehicle Valuation is a critical step as it directly impacts how much cash you can access through the title loan.

Additionally, lenders consider the unique features and any modifications made to the car. While Bad Credit Loans are available, these loans often come with higher interest rates. However, many reputable lenders offer flexible payment plans tailored to individual needs, making it a viable option for those requiring quick funding.

Repayment Process and Considerations for Borrowers

When taking out a title loan for cars, borrowers should be aware that the repayment process typically involves making regular payments over a set period, often 30 days to a year. These payments are applied towards the outstanding loan balance, with interest accrued throughout the term. It’s crucial for borrowers to maintain timely payments to avoid penalties and keep their vehicle’s title in their possession.

Considerations for borrowers include understanding the full cost of the loan, including interest rates and fees. Additionally, keeping up with insurance requirements and vehicle maintenance is essential. For those exploring options in Houston, Houston Title Loans can provide access to quick funds by using the car’s title as collateral, but it’s vital to compare rates and terms from various lenders to secure the best possible deal, ensuring loan eligibility based on factors like credit history and vehicle value.

Title loans for cars have evolved to provide a quick and accessible borrowing solution. By understanding the simple process, borrowers can navigate this option with confidence. Lenders assess vehicle value through comprehensive inspections, ensuring a fair evaluation. Repayment terms are flexible, allowing individuals to manage their finances effectively. With transparent conditions and straightforward assessments, title loans offer an alternative financing method for those in need of immediate cash.