Unbanked individuals facing emergency funding needs can access quick cash through title loans, secured by their vehicle. Unlike traditional bank loans, these offer a less stringent process with no need for financial history or credit scores. However, they come with strict repayment terms, high-interest rates, and repossession risks, including potential debt traps when extended through options like boat title loans.

In today’s financial landscape, many individuals lack traditional banking access, leaving them with limited options for securing loans. Title loans emerge as a viable alternative for these unbanked customers, offering a unique solution where vehicles serve as collateral. This article explores the mechanics of title loans tailored to unbanked individuals, delving into how cars become a security asset in loan processes. We also analyze the dual benefits and risks associated with this innovative approach.

- Understanding Title Loans for Unbanked Individuals

- How Vehicles Become Collateral in Loan Processes

- Benefits and Risks for Unbanked Customers Using Cars as Security

Understanding Title Loans for Unbanked Individuals

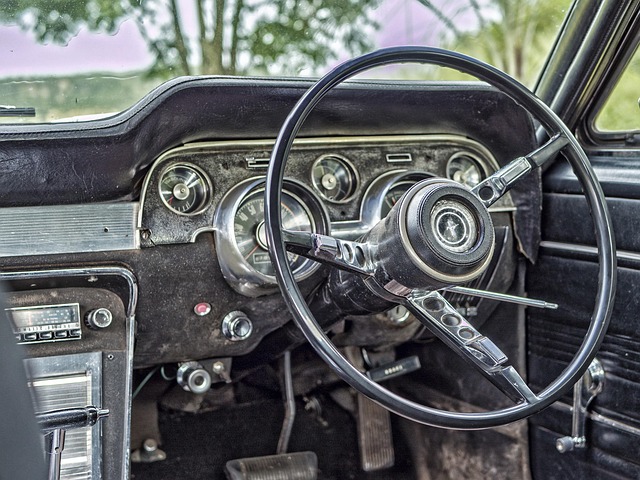

For unbanked individuals, accessing traditional loan options can be challenging due to a lack of established financial history or credit scores. This is where title loans step in as a viable alternative for those in need of emergency funding. A title loan is secured by an asset, most commonly a vehicle, allowing lenders to offer loans without the stringent requirements often associated with bank loans. In this case, the individual retains ownership of their vehicle but agrees to transfer its title to the lender until the loan is repaid.

This type of lending is particularly attractive for unbanked customers as it provides quick access to cash, even if they have limited or no credit history. For instance, a truck title loan can serve as a short-term solution for those facing unexpected expenses, offering a straightforward and potentially less stringent application process compared to bank loans. The title transfer serves as collateral, ensuring the lender’s interest is protected while providing much-needed liquidity for borrowers.

How Vehicles Become Collateral in Loan Processes

When unbanked customers need access to cash quickly, title loans offer a unique solution by utilizing their vehicles as collateral. This alternative financing method is particularly appealing for those lacking traditional banking services or facing challenges in meeting loan eligibility criteria. The process begins with the borrower bringing their vehicle’s title to a lender, who then assesses its value and the customer’s ability to repay. If approved, the lender facilitates a direct deposit of funds into the borrower’s account, providing immediate access to capital.

Unlike unsecured loans that rely on creditworthiness alone, secured loans like title loans are backed by the collateral—in this case, the vehicle. This ensures lenders have a source of repayment if the borrower defaults. The simplicity and accessibility of this approach make it an attractive option for unbanked individuals seeking financial support without the stringent requirements often associated with traditional banking services.

Benefits and Risks for Unbanked Customers Using Cars as Security

For unbanked customers, turning to a title loan using their vehicle as collateral offers both opportunities and challenges. One significant advantage is access to much-needed funds that traditional banking methods may not readily provide. This alternative financing option can be a game-changer for individuals lacking a stable financial history or credit score, enabling them to secure loans for various purposes, from emergency expenses to business investments.

However, there are risks associated with this practice. Repayment options are often stringent, and defaulting on the loan can lead to repossession of the vehicle. The high-interest rates characteristic of such loans can also trap borrowers in a cycle of debt. Additionally, extending the loan term through boat title loans or similar arrangements might provide some breathing room but could increase overall costs.

Title loans offer a unique solution for unbanked individuals seeking financial support, allowing them to use their vehicles as collateral. This alternative financing method provides access to much-needed capital, bridging the gap for those excluded from traditional banking services. However, it’s crucial for borrowers to weigh the benefits and risks, ensuring they understand the implications of using their cars as security to avoid potential financial hardships. Responsible borrowing and a thorough grasp of the process are essential for unbanked customers considering this option.