Texas City residents turn to car title loans for quick cash access with lower interest rates and flexible terms compared to payday or semi truck loans. This alternative uses vehicle equity without credit checks, offering longer repayment periods and avoiding payday lending's debt traps while maintaining ownership.

In the financial landscape of Texas City, understanding your loan options is crucial. This article delves into two distinct approaches: Texas City car title loans and payday loans. By exploring these alternatives, you can make informed decisions tailored to your needs. We’ll guide you through the intricacies, comparing benefits and risks to help you navigate this complex realm effectively.

- Understanding Texas City Car Title Loans

- Exploring Payday Loan Alternatives

- Comparing Benefits and Risks

Understanding Texas City Car Title Loans

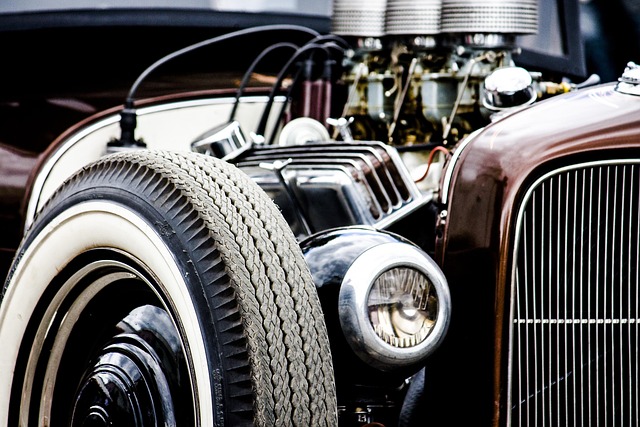

In Texas City, car title loans have emerged as a popular alternative to traditional banking options for many residents seeking financial assistance. This type of loan utilizes a person’s vehicle, typically their car or truck, as collateral, offering several advantages. Unlike payday loans, which often come with high-interest rates and short repayment terms, Texas City car title loans provide a more flexible and potentially affordable solution. Borrowers can access a cash advance secured by the value of their vehicle, allowing them to maintain control over their asset while receiving the funds they need.

The process for obtaining these loans is generally straightforward and efficient. Lenders in Texas City often advertise quick approval times, making it convenient for borrowers who require financial support promptly. While the specific terms and conditions may vary between lenders, car title loans can be an excellent choice for those looking to avoid the stringent requirements and waiting periods associated with other loan types, including Semi Truck Loans.

Exploring Payday Loan Alternatives

In Texas City, exploring alternative financing options to payday loans is a savvy choice for many residents. One such option gaining popularity is Texas City car title loans. These loans offer a unique and flexible approach to borrowing money by utilizing your vehicle’s equity as collateral. Unlike traditional payday loans that often come with high-interest rates and strict repayment terms, car title loans provide a more favorable experience. With no credit check required, borrowers can gain access to emergency funds quickly, ensuring same-day funding.

By tapping into the value of their vehicles, Texas City residents can borrow money based on the equity they have built up. This alternative not only offers better interest rates but also allows for more extended repayment periods. It’s a great way to avoid the debt cycle that often accompanies payday loans and provides a sense of financial security without sacrificing your vehicle’s ownership.

Comparing Benefits and Risks

When comparing Texas City car title loans to payday loans, it’s crucial to weigh both the benefits and risks associated with each option. Texas City car title loans offer several advantages, such as longer repayment periods and lower interest rates compared to payday loans. Additionally, these loans often have more flexible terms and can be used for a wider range of purposes. The process for obtaining a car title loan involves a simple application, vehicle inspection, and quick approval, making it a convenient choice for those in need of immediate funding.

On the other hand, payday loans may provide faster access to cash with minimal requirements, but they come with significantly higher interest rates and shorter repayment periods. Unlike Texas City car title loans, which allow you to retain your vehicle during the loan period, payday loans often require you to surrender your vehicle title until the loan is repaid. This can be a significant risk for borrowers who may struggle to meet the high-interest payments on time. A semi truck loan, though not directly comparable, offers an alternative for those with specialized vehicles, ensuring they can access funds while keeping their assets intact.

When considering financial options in Texas City, it’s clear that Texas City car title loans offer a unique and potentially beneficial alternative to traditional payday loans. By leveraging the equity in your vehicle, these loans provide access to capital without the same high-interest rates and short repayment terms associated with payday lending. While there are risks involved, such as potential vehicle repossession, understanding these options allows folks in Texas City to make informed decisions tailored to their financial needs.