Car title loans for veterans offer quick cash with simplified eligibility compared to traditional loans. Before applying, prepare essential documents like discharge papers and ID, assess your financial situation, and get vehicle inspected. Choose a suitable loan term, locate veteran-focused lenders, gather minimal paperwork, apply online/in-person, review documents, and access funds often same day.

Securing a car title loan as a veteran can be a swift financial solution, offering immediate access to funds. This article guides you through the process, ensuring a smooth and efficient experience. We’ll first demystify car title loans tailored for veterans, highlighting their benefits. Then, we provide essential preparations to have before applying, followed by step-by-step instructions for quick approval. By understanding these tips, veterans can access much-needed funds in no time while maintaining control over their vehicles.

- Understanding Car Title Loans for Veterans

- Preparations Before Applying for Veterans' Car Loans

- Quick Steps to Secure Car Title Loans for Veterans

Understanding Car Title Loans for Veterans

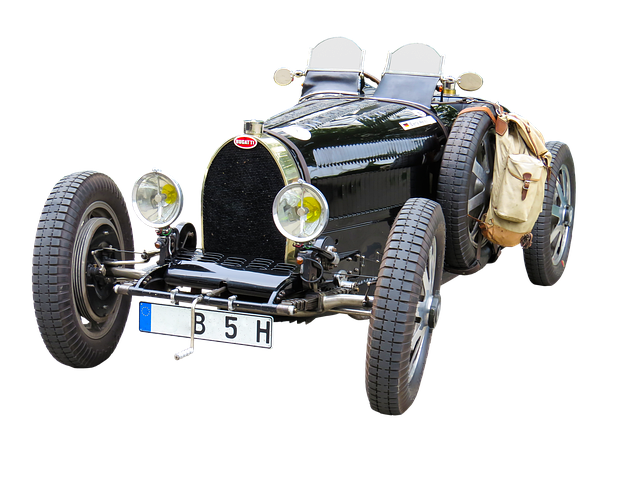

Car title loans for veterans are a specialized financial service designed to support former service members who may need access to quick cash. This type of loan allows veterans to use their car’s title as collateral, providing them with a fast and convenient borrowing option. The process is straightforward; veterans can apply for a loan by submitting their vehicle’s title, along with proof of military service and identification. Once approved, the lender will transfer the loan funds directly into the veteran’s account.

Understanding the loan requirements is crucial. Lenders typically require a minimum credit score and income verification to assess repayment ability. The title transfer process is also essential, ensuring that the vehicle remains in the veteran’s possession while serving as collateral for the loan. This option can be particularly beneficial during urgent financial situations, offering a reliable source of funding with relatively simpler eligibility criteria compared to traditional loans.

Preparations Before Applying for Veterans' Car Loans

Before applying for car title loans for veterans, it’s important to prepare thoroughly. One crucial step is to gather all necessary documents, including your military discharge papers and current identification. This ensures a smooth application process as lenders will need these verification materials. Additionally, assess your financial situation and calculate how much you can comfortably borrow against the value of your vehicle; this will help in determining the loan amount that aligns with your budget without causing strain.

Another important preparation is to ensure your vehicle is in good condition. A thorough vehicle inspection by a trusted mechanic can provide an accurate assessment of its current state, which will be considered during the lending process. This not only increases your chances of securing a loan but also helps in negotiating better terms as lenders may offer more favorable rates and terms if your vehicle is in excellent condition. Think of it as a proactive step to get the best financial solution for your needs.

Quick Steps to Secure Car Title Loans for Veterans

Securing a car title loan can be a swift financial solution for veterans looking to consolidate debt or cover unexpected expenses. Here’s a step-by-step guide to help you navigate the process quickly and efficiently:

1. Assess Your Needs: Start by determining how much money you require. Car title loans are ideal for short-term financial needs, so consider the specific amount needed for debt consolidation or any other purpose. This will help you choose a loan term that aligns with your repayment capabilities.

2. Locate Reputable Lenders: With numerous lenders available, it’s crucial to choose one that specializes in car title loans for veterans. These lenders understand the unique financial situations of service members and often provide flexible terms and competitive rates. You can find them online or through veteran’s organizations and networks.

3. Prepare Required Documents: The Title Loan Process typically requires minimal paperwork. Gather your vehicle’s registration, a valid driver’s license, proof of military service, and income verification. Some lenders may also ask for additional documentation, so ensure you have these documents readily available to expedite the process.

4. Apply Online or In-Person: Many reputable lenders offer an online application process, which is quick and convenient. Fill out the form with accurate information, including your contact details and loan preferences. If you prefer a more traditional approach, you can visit their branch offices for in-person applications.

5. Review and Sign Loan Documents: Once approved, carefully review the loan agreement. Understand the interest rates, repayment terms, and any associated fees. If everything seems clear, sign the documents, and your funds could be accessible within a short time frame, often on the same day.

Securing a car title loan as a veteran can be a swift and beneficial process. By understanding the basics of these loans, preparing your documents in advance, and following a streamlined application procedure, you can quickly access the funds you need. Remember that keeping your vehicle’s registration and insurance current is essential to the loan process. With the right preparation, car title loans for veterans can provide a convenient and reliable source of financial support when it matters most.