Texas title loan storefront locations provide tailored financial solutions, free consultations, and personalized services for diverse loan needs, including vehicle titles. These stores offer expert advice, accessible in-person experiences, and faster funding compared to online lenders, catering to borrowers with less-than-perfect credit or immediate financial requirements like Fort Worth loans or Truck Title Loans.

“In the competitive landscape of financial services, Texas title loan storefront locations stand out for offering free consultations. Exploring these physical stores provides a unique advantage over online counterparts. This article delves into the growing trend of Texas title loan storefronts, focusing on how free consultations benefit borrowers. We examine location-based advantages and provide insights into navigating these crucial financial decisions in person, ensuring informed choices for folks across Texas.”

- Exploring Texas Title Loan Storefronts

- Free Consultations: A Beneficial Offer

- Location-Based Advantages Explained

Exploring Texas Title Loan Storefronts

When exploring Texas title loan storefront locations, it’s important to understand that these establishments cater to a wide range of financial needs, especially for those with less-than-perfect credit. Beyond offering quick cash solutions, many Texas title loan stores provide free consultations to help borrowers navigate their options and choose the most suitable loan type. Whether you’re in need of emergency funds or considering alternatives like truck title loans due to bad credit, these storefronts serve as valuable resources.

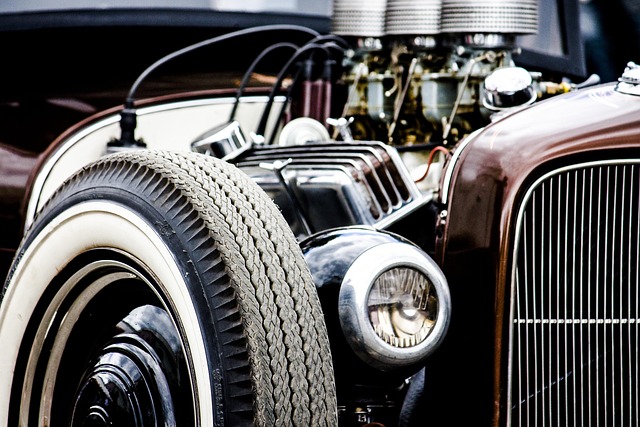

Each Texas title loan storefront location typically has its own set of requirements and loan offerings. Some may specialize in secured loans, such as vehicle titles, while others might provide access to other types of bad credit loans. Exploring these local options allows borrowers to find personalized solutions that meet their specific circumstances. In today’s digital age, many stores also offer online platforms for convenience, making it easier than ever to connect with a loan specialist and secure the funding you need.

Free Consultations: A Beneficial Offer

At Texas Title Loan storefront locations, free consultations are an offer that shouldn’t be overlooked. This service provides individuals with a chance to gain valuable insights and expert advice without any financial obligation. When considering a Texas title loan, whether for emergency funding or other needs, having a consultation first can make all the difference. It allows borrowers to understand their options, explore alternative solutions, and navigate the process with confidence.

Moreover, these consultations are particularly beneficial for those who might be new to such financial services or have concerns about their creditworthiness. With no credit check required, many individuals in San Antonio loans and beyond can take advantage of this opportunity to secure the fast cash they need while learning about responsible borrowing practices.

Location-Based Advantages Explained

One of the key advantages of visiting a Texas title loan storefront location is the accessibility and convenience it offers. Unlike online-only lenders, these physical locations provide an in-person experience, allowing customers to walk in, discuss their options with knowledgeable staff, and even receive free consultations. This personalized approach ensures borrowers understand the terms of their loan, including interest rates, repayment schedules, and potential fees, empowering them to make informed decisions.

Additionally, having a dedicated Texas title loan storefront can facilitate faster funding processes. Customers who bring in their vehicle’s title can expect quicker turnaround times compared to mail-in applications. This speed is especially beneficial for those seeking immediate financial assistance, such as those needing Fort Worth loans or exploring Truck Title Loans. The ability to securely lend against the value of a vehicle’s title provides a reliable source of cash, offering payment plans tailored to individual needs.

Texas title loan storefront locations offering free consultations provide a valuable service, allowing borrowers to explore their options without financial strain. These consultations not only offer guidance but also highlight the advantages of location-based access, making it easier for folks across Texas to navigate their financial needs and take control of their future.