Galveston title loans provide quick and flexible funding using your vehicle's equity as collateral. With simple requirements like being 18+, having a clear vehicle title, and valid insurance, these loans offer immediate cash for unexpected expenses or business opportunities, without traditional credit checks. The process involves filling out an application, lender appraisal, temporary title transfer, and fixed monthly repayments.

“Galveston title loans have emerged as a powerful financial tool for those seeking quick and accessible funding. This comprehensive guide delves into the intricate world of Galveston title loans, offering a clear understanding of what they are and how they work. We explore the eligibility criteria to ensure you know who qualifies, and we break down the loan process step-by-step. By the end, you’ll be equipped with the knowledge to make informed decisions regarding Galveston title loans.”

- Understanding Galveston Title Loans: A Comprehensive Overview

- Eligibility Criteria: Who Qualifies for Galveston Title Loans?

- Loan Process: Steps to Secure Your Galveston Title Loan

Understanding Galveston Title Loans: A Comprehensive Overview

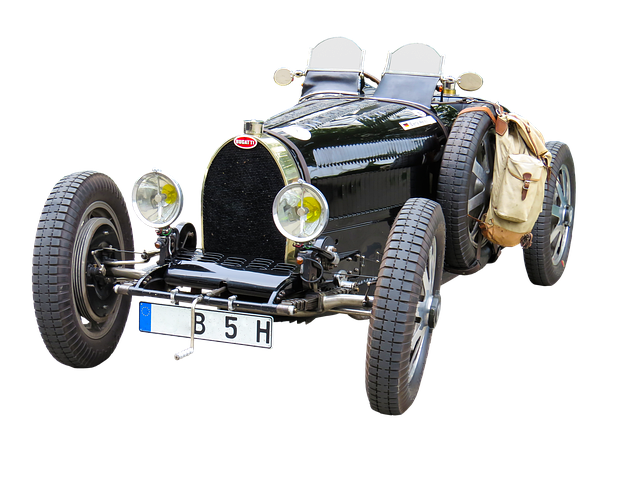

In the dynamic financial landscape of Galveston, Texas, understanding Galveston title loans is paramount for those seeking quick and accessible funding. These innovative financial solutions allow individuals to leverage their vehicle’s equity, offering a secure and convenient method to obtain cash advances. A Galveston title loan operates as a type of secured loan, using your vehicle’s title as collateral, ensuring a streamlined process with less stringent requirements compared to traditional bank loans.

Galveston title loans provide an attractive alternative for borrowers who need fast cash for various purposes. Whether it’s for unexpected expenses, business opportunities, or even motorcycle title loans, these loans offer flexibility in terms of repayment. Borrowers can opt for flexible payments tailored to their financial comfort, making it an adaptable solution. This accessibility, combined with the security of a defined repayment plan, makes Galveston title loans an appealing option for those seeking cash advances without the usual hurdles.

Eligibility Criteria: Who Qualifies for Galveston Title Loans?

In terms of Galveston title loans, eligibility criteria are designed to ensure responsible lending practices and fair access to capital. To qualify for a loan using vehicle equity, applicants must be at least 18 years old and hold clear title to a motor vehicle. The vehicle should have significant remaining value, allowing for a loan against its equity. Additionally, a valid driver’s license and proof of insurance are required, indicating the applicant’s ability to maintain and operate a vehicle. Fort Worth loans, while distinct from Galveston offerings, often share similar foundational requirements, focusing on vehicle ownership and responsible borrowing.

A crucial aspect of these loans is the absence of a traditional credit check. Lenders understand that not everyone has perfect credit history; hence, they focus on the value of the secured asset rather than an applicant’s credit score. This approach ensures that individuals with less-than-perfect credit can still access emergency funding during times of need. The process prioritizes the equity in the vehicle over any previous credit standing, making Galveston title loans a viable option for those seeking quick financial support.

Loan Process: Steps to Secure Your Galveston Title Loan

Securing a Galveston title loan is a straightforward process designed to provide you with quick access to cash using your vehicle’s equity as collateral. The first step involves filling out an application, which requires providing personal and vehicle information. Once submitted, a lender will evaluate your application, including assessing your vehicle’s value based on its make, model, year, and overall condition, ensuring that the loan amount aligns with the determined value.

If approved, you’ll need to initiate the title transfer process by signing over the title to the lender temporarily. This step is crucial for establishing legal ownership during the loan period. After the transfer, funds will be disbursed directly to you, offering a convenient and efficient way to access capital. Repayment typically involves fixed monthly payments, including both principal and interest, tailored to your agreed-upon payment plan, making it easier to manage without the hassle of hidden fees or complex terms.

Galveston title loans can provide a quick and convenient solution for those in need of emergency funds. By understanding the requirements and eligibility criteria, applicants can navigate the loan process with confidence. This comprehensive overview has highlighted the key steps to securing a Galveston title loan, ensuring that individuals who meet the qualifications can access the financial support they need without delay.