Car title loans have become popular across diverse age groups for short-term financing, especially in cities like Dallas, catering to both younger adults and older borrowers with limited credit options. Demographically, these loans disproportionately attract lower to moderate income earners who need quick cash. The geographic distribution reveals high concentrations in urban and suburban areas with high low-to-middle-income populations due to ease of access from numerous nearby lenders. Demand peaks during economic downturns or high cost of living.

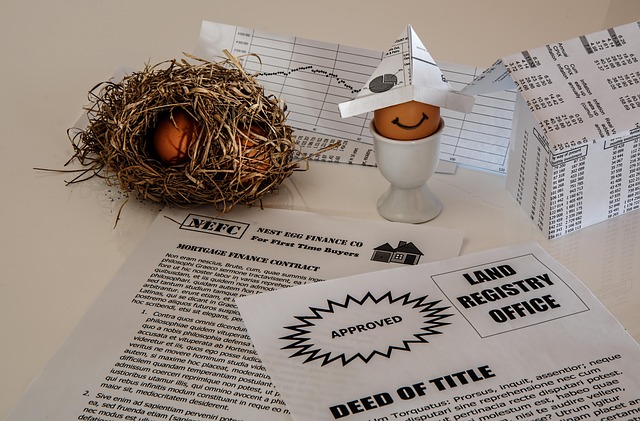

“Uncovering the demographic landscape of car title loan customers is essential for understanding a unique segment of borrowers. This article delves into the age and income trends that shape this market, offering insights into three key areas. First, we explore the age groups, revealing who is most likely to seek these loans. Second, we analyze income levels, providing a snapshot of their financial standing. Lastly, we examine the geographic distribution, showcasing the regional variations in car title loan uptake. By the end, readers will grasp the multifaceted nature of this customer demographic.”

- Exploring Car Title Loan Customer Age Groups

- Income Levels: Who Takes Out These Loans?

- Geographic Distribution: Where Are They Located?

Exploring Car Title Loan Customer Age Groups

In the landscape of short-term lending, car title loans have emerged as a significant segment, attracting customers across various age groups. When examining the geographic distribution of Dallas Title Loans, for instance, it’s evident that these services cater to a diverse range of individuals. Younger adults, often facing unexpected expenses or seeking rapid cash solutions, find appeal in this option, despite potential risks associated with high-interest rates and loan terms. Conversely, older borrowers may resort to car title loans due to limited credit options or financial emergencies, highlighting the need for comprehensive understanding and regulatory oversight within this sector.

The appeal of car title loans transcends age barriers, as demonstrated by their widespread availability and relatively permissive criteria, including no credit check requirements. However, it’s crucial to consider the implications on borrowers’ financial health. With varying loan eligibility standards across regions, understanding the demographics helps in gauging the demand for alternative lending solutions, especially in urban centers like Dallas where economic disparities and financial literacy gaps may influence borrowing behaviors.

Income Levels: Who Takes Out These Loans?

When it comes to understanding who takes out car title loans, income levels play a significant role. These loans are often sought by individuals with lower to moderate incomes who need quick access to emergency funding. In many cases, borrowers use these funds for unexpected expenses or to bridge financial gaps until their next pay check. The geographic distribution of car title loan customers reveals a certain level of consistency; they tend to be concentrated in areas with higher populations and a mix of economic statuses, reflecting the accessibility and need for such short-term financing options.

Car title loans serve as a form of cash advance secured by the borrower’s vehicle, allowing them to tap into the equity of their asset for immediate relief. The vehicle’s valuation is a critical factor in determining the loan amount offered, ensuring that the lender has collateral to safeguard their investment. This type of lending is particularly appealing to those facing financial emergencies and seeking a convenient solution without the stringent requirements often associated with traditional bank loans.

Geographic Distribution: Where Are They Located?

The geographic distribution of car title loan customers reveals interesting patterns that often mirror economic conditions and regional disparities within a country. These loans, characterized by quick availability and high-interest rates, attract individuals across various age groups but tend to be prevalent in specific areas. Urban and suburban regions, particularly those with higher populations of low-to-middle-income earners, often see a concentration of title loan seekers. This is due, in part, to the ease of access these regions provide, with numerous lenders operating within close proximity.

For instance, metropolitan areas facing economic downturns or high cost of living may experience elevated demand for car title loans as residents seek immediate financial relief through short-term solutions like cash advances or loan refinancing. However, it’s essential to consider that while geographic distribution offers insights into customer demographics, loan eligibility criteria and local regulations also play significant roles in shaping the accessibility and appeal of these credit options.

In exploring the demographics of car title loan customers, we’ve uncovered distinct age and income trends that shed light on this unique credit segment. Younger borrowers, aged 25-44, represent a significant portion, indicating a growing need for accessible short-term financing among this demographic. Income levels vary widely, with many customers falling in the $30,000-$70,000 range, suggesting these loans cater to those with moderate to upper-middle incomes. Furthermore, our analysis of car title loan geographic distribution reveals concentrated activity in specific regions, highlighting the importance of understanding local financial landscapes and needs when providing such services.