Hereford auto title loans offer quick cash using your vehicle's title as collateral, with simpler eligibility and flexible repayment plans. Before refinancing, prepare documents like ID, proof of ownership, financial statements, and calculate current loan details. Refinancing can save money by offering lower rates and extended terms; choose lenders with fast approvals and select new loan durations based on budget and debt goals while ensuring emergency funding is maintained.

Looking to refinance your Hereford auto title loan? This comprehensive guide is your navigation tool. First, unravel the fundamentals and advantages of Hereford auto title loans—a secure lending option backed by your vehicle’s title. Then, prepare meticulously by gathering essential documents. Finally, master strategies for a successful refinance, ensuring you get the best terms and rates available in the competitive market.

- Understanding Hereford Auto Title Loans: Basics and Benefits

- Preparing for Refinancing: Gathering Necessary Documents

- Strategies for Successful Refinancing of Your Loan

Understanding Hereford Auto Title Loans: Basics and Benefits

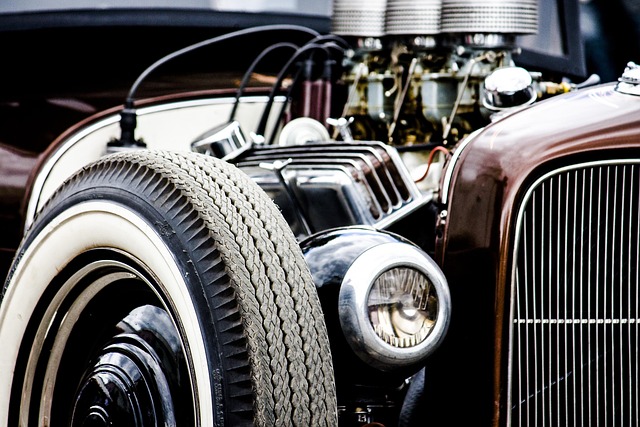

Hereford auto title loans are a unique financial solution designed to offer quick access to cash using your vehicle’s title as collateral. This type of loan is ideal for individuals seeking immediate funding, especially during unexpected financial emergencies. By leveraging the value of your vehicle, you can obtain a loan with relatively simpler eligibility criteria compared to traditional bank loans. The process involves providing the lender with your vehicle’s title and agreeing to a repayment plan, which typically includes regular installments over a set period.

One of the significant advantages of Hereford auto title loans is their flexibility in terms of payment plans. Lenders often work with borrowers to create customized repayment schedules that align with their financial capabilities, making it easier to manage loan obligations while ensuring access to emergency funds when needed. Unlike Houston title loans, which can be stringent, Hereford auto title loans offer a more tailored approach, allowing borrowers to maintain control over their vehicles throughout the loan period.

Preparing for Refinancing: Gathering Necessary Documents

Before considering refinancing your Hereford auto title loan, it’s crucial to prepare thoroughly. One of the first steps is gathering all the necessary documents. This includes a valid driver’s license or state ID, proof of vehicle ownership (like the title), and recent financial statements such as bank statements or tax returns. These documents not only verify your identity but also assess your current financial health.

Additionally, you should calculate your current loan balance and interest rate from the existing Hereford auto title loan. This information will help you determine how much you can save by refinancing and what new terms might be available to you, such as a lower interest rate or extended repayment period. Keep in mind that some lenders may offer direct deposit for refinanced loans, similar to a cash advance, which can provide immediate access to the funds. However, it’s essential to weigh these options carefully, considering both the benefits and potential fees associated with refinancing.

Strategies for Successful Refinancing of Your Loan

Refinancing Hereford auto title loans can be a strategic move to improve your financial situation. First, understand your current loan terms and calculate potential savings by comparing interest rates in the market. Look for lenders offering quick approval processes, as this can save you time and often results in faster access to funds.

When refinancing, explore different repayment options that suit your budget. Consider longer loan terms if they provide lower monthly payments, or opt for shorter terms if you want to pay off the debt faster while saving on interest. Remember, emergency funding should always be a priority, so ensure your refinanced loan fits within your financial safety net without causing strain.

Refinancing Hereford auto title loans can be a strategic move to save money and gain better terms. By understanding the basics, preparing thoroughly, and employing effective strategies, you can successfully navigate the refinancing process. Don’t let high-interest rates or rigid terms hold you back; take control of your loan with informed decisions. Remember, knowledge is power when it comes to managing your Hereford auto title loans.