Car title loan weekly payments offer a structured, cost-effective alternative to traditional financing. By using your vehicle's title as collateral, these loans provide fixed interest rates, manageable weekly payments, and potential savings on fees. This method enhances budget control, allows access to daily use of the vehicle, and offers competitive terms in San Antonio, making it an attractive option for emergency funding with minimal long-term commitment.

Thinking about a car title loan but worried about long-term costs? Explore the benefits of weekly payments. This article breaks down the traditional structure of car title loans and highlights the advantages of choosing a weekly payment plan. We’ll dive into how this simple change can lead to significant long-term cost savings for borrowers, offering a more manageable and budget-friendly option.

- Understanding Car Title Loan Structure

- Advantages of Weekly Payments

- Long-Term Cost Savings Analysis

Understanding Car Title Loan Structure

Car title loans are structured differently from traditional loans. When you take out a car title loan, you’re essentially using your vehicle’s title as collateral. The lender will hold onto the title until the loan is fully repaid. This type of loan often comes with a fixed interest rate and a specific repayment schedule, which includes weekly payments. Understanding this structure is crucial when considering how to manage your loan costs effectively in the long term.

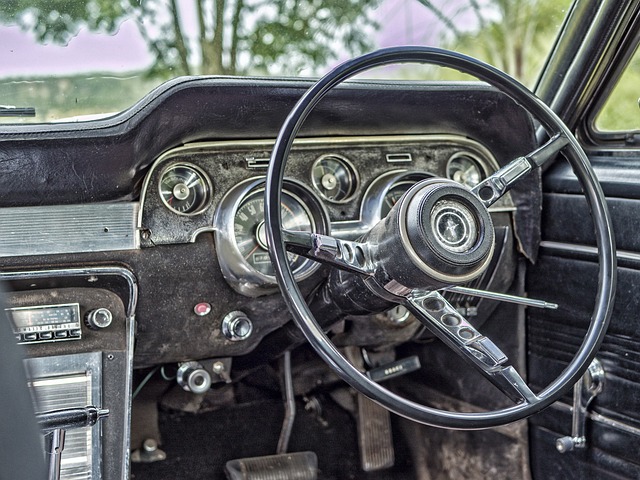

The title loan process typically involves a simple application, where lenders will perform a quick assessment of your vehicle’s value and your ability to repay. Unlike traditional loans that often require a credit check, car title loans offer a more flexible approach with no credit check needed. However, it’s important to be mindful of the potential consequences if you’re unable to make weekly payments on time, as late fees or defaulting could result in the lender repossessing your vehicle.

Advantages of Weekly Payments

Weekly payments for car title loans offer a range of advantages that can make this financing option an attractive choice for borrowers. One significant benefit is the potential to save on overall loan costs. By breaking down the repayment into smaller, more manageable weekly installments, borrowers can avoid the steep interest rates and hidden fees often associated with traditional long-term loans. This structured approach ensures consistent budget management, allowing individuals to allocate funds without financial strain.

Moreover, car title loan weekly payments provide a sense of control and flexibility. Borrowers can choose a repayment schedule that aligns with their income cycle, making it easier to meet their financial obligations while still having access to their vehicle for daily use. This is particularly advantageous for those seeking a quick approval process, as the collateralized nature of this type of loan enables lenders to offer more immediate financial solutions without extensive Vehicle inspections or complex credit checks, ensuring a streamlined borrowing experience.

Long-Term Cost Savings Analysis

When considering a car title loan, one of the most significant factors influencing the overall cost is the repayment structure. Opting for weekly payments instead of lump-sum settlements can lead to substantial long-term savings. This is particularly beneficial for San Antonio loans, where the market competition allows for more flexible terms. By breaking down the loan into smaller, manageable weekly installments, borrowers can effectively reduce the interest accumulated over time.

The analysis reveals that with car title loan weekly payments, there’s a direct correlation between shorter repayment periods and lower overall interest expenditures. This strategy not only eases the financial burden but also enables better access to emergency funds during the loan tenure. Moreover, competitive interest rates in San Antonio contribute to the overall cost-effectiveness of this approach, making it an attractive option for those seeking immediate funding with minimal long-term commitment.

By opting for weekly payments with a car title loan, borrowers can significantly reduce long-term costs. This structured approach allows for better financial management and offers peace of mind, as it prevents the accumulation of interest over an extended period. In light of this, choosing a weekly payment plan is a strategic move for those seeking affordable and manageable car title loan solutions.