La solicitud de un título de préstamo en español requiere comprender y cumplir con requisitos legales estatales, incluyendo la divulgación clara de términos y condiciones, especialmente para préstamos garantizados con vehículos. Los documentos detallan tasas de interés, plazos de pago y consecuencias por incumplimiento, siendo vital revisar estos aspectos para tomar decisiones informadas sobre refinanciamiento. Siga estos pasos: revise cuidadosamente los requisitos del préstamo, prepare documentos necesarios, lea y comprenda todos los términos, y firme el acuerdo con total claridad para un proceso exitoso que brinde acceso a fondos de emergencia cuando sea necesario.

“When considering a Title Loan Spanish Application, it’s paramount to grasp the legal disclosures and requirements. This article navigates the key aspects of Spanish title loan documents, ensuring compliance for applicants. We break down the understanding of legal obligations, highlight crucial disclosures in Spanish, and provide a step-by-step guide to streamline the process. For those seeking financial assistance, this comprehensive overview is your first step towards informed decision-making.”

- Understanding Legal Requirements for Title Loan Applications

- Key Disclosures in Spanish Title Loan Documents

- Ensuring Compliance: A Step-by-Step Guide for Applicants

Understanding Legal Requirements for Title Loan Applications

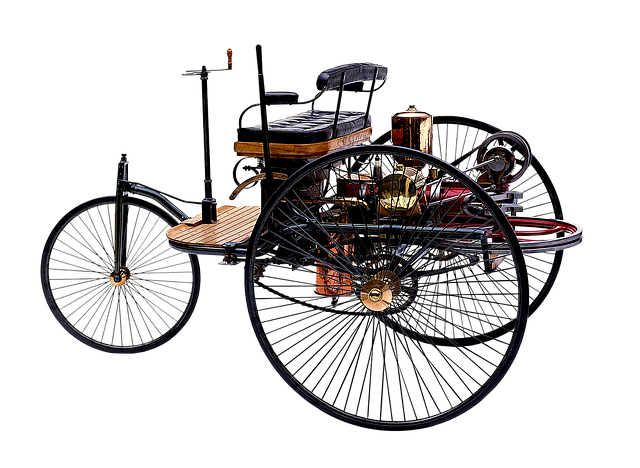

When applying for a Title Loan Spanish application, it’s crucial to understand and adhere to the legal requirements set forth by your state. This process involves careful disclosure of various terms and conditions that safeguard both lenders and borrowers. In the case of secured loans like motorcycle title loans, the borrower’s vehicle is used as collateral, making it imperative to clearly communicate this detail in the application.

The Title Loan Spanish application serves as a legal document that outlines crucial information, including interest rates, repayment terms, and potential consequences of default. For those considering loan refinancing options, understanding these disclosures becomes even more critical. By thoroughly reviewing the application’s legal requirements, borrowers can make informed decisions and ensure they fully comprehend their rights and obligations.

Key Disclosures in Spanish Title Loan Documents

Cuando se trata de solicitar un title loan en español, es fundamental entender los importantes avisos y revelaciones legales que se incluyen en los documentos. Estos proporcionan a los prestatarios información crucial sobre los términos y condiciones del préstamo. En primer lugar, los prestamistas deben revelar claramente el monto del préstamo y la tasa de interés aplicable, permitiendo así a los solicitantes comprender completamente el costo asociado con el title loan.

Además, los documentos deben detallar el proceso de titularización, explicando cómo se utiliza el título de propiedad del vehículo como garantía. También se debe informar al prestatario sobre las consecuencias en caso de incumplimiento, incluyendo posibles cargos por retraso y el derecho del prestamista a retener el vehículo. La valoración del vehículo es otro aspecto clave, donde se indica cómo se determina el valor del colateral, asegurando transparencia en todo el title loan proceso.

Ensuring Compliance: A Step-by-Step Guide for Applicants

Ensure Compliance: A Step-by-Step Guide for Applicants

When applying for a Title Loan Spanish application, it’s crucial to understand and comply with all legal disclosures to avoid any potential issues. Here’s a step-by-step guide to help you navigate this process smoothly. First, review the loan requirements thoroughly. This includes verifying your identity, checking your creditworthiness, and ensuring you meet the minimum age criteria. Next, be prepared to provide essential documents such as a valid driver’s license or state ID, proof of insurance, and a clear title transfer for the asset you’re using as collateral.

During the application process, carefully read and understand all the terms and conditions. Pay close attention to interest rates, repayment terms, and potential fees associated with the loan. Once you sign the agreement, it’s final—you’re legally bound by the terms. This ensures that your loan is not only approved but also provides a clear path for accessing emergency funds when needed. Remember, transparency and compliance are key to a seamless Title Loan Spanish application experience.

When navigating the process of a title loan Spanish application, understanding and comprehending legal disclosures is paramount. By familiarizing yourself with the requirements outlined in this article, you can ensure compliance and make informed decisions. Remember, transparency and knowledge are key to a successful title loan Spanish application journey.