Car title loan modification rearranges loan terms for borrowers facing financial hardships, offering lower monthly payments or extended repayment periods. This option preserves vehicle ownership but carries risks of default and repossession due to high-interest rates and short terms. Compared to other loans, it may not be the best long-term solution.

Car title loans can be a quick solution for emergency funding, but modifying these loans offers a chance for debt relief and improved terms. This article delves into the intricacies of car title loan modifications, breaking down the basics, advantages, and potential drawbacks. Understanding both sides is crucial when considering this alternative to default or repossession. By examining these factors, borrowers can make informed decisions regarding their financial futures. Explore the pros and cons of car title loan loan modification to navigate your current situation effectively.

- Understanding Car Title Loan Modification: The Basics

- Advantages of Modifying Your Car Title Loan

- Potential Drawbacks and Risks to Consider

Understanding Car Title Loan Modification: The Basics

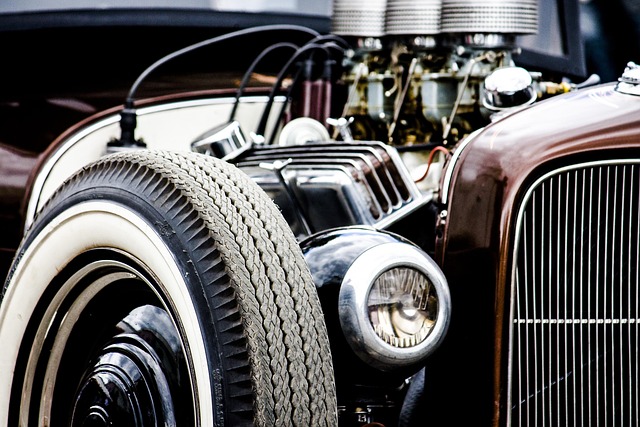

Car title loan modification is a process that allows borrowers with existing car title loans to adjust their loan terms, providing potential relief during financial hardships. This option is particularly beneficial when borrowers need a more manageable repayment plan due to unforeseen circumstances or emergency funds requirements. By modifying the loan, individuals can explore flexible payments and improved repayment options tailored to their current financial situation.

It typically involves rearranging the existing loan agreement, offering prospects for lower monthly installments or extended repayment periods. This alternative is especially useful for those facing temporary financial challenges, enabling them to avoid defaulting on their loans. With a car title loan modification, borrowers can prioritize other essential expenses while ensuring they remain current on their debt obligations.

Advantages of Modifying Your Car Title Loan

Modifying your car title loan can offer several benefits for borrowers who are struggling to make ends meet or facing unexpected financial challenges. One of the primary advantages is the flexibility it provides in terms of payment plans. Car title loan loan modification allows lenders to work with borrowers to create a more affordable repayment schedule, extending the loan term and reducing monthly payments. This can be especially helpful for individuals with variable incomes or those experiencing temporary financial difficulties.

Additionally, this process can help preserve the value of your vehicle by using it as vehicle collateral. Unlike traditional loans where asset repossession is a significant risk, car title loan modifications often keep your vehicle secure. As long as you meet the agreed-upon terms and conditions, you can retain ownership while enjoying the convenience of lower monthly payments and extended repayment periods. This makes it an attractive option for borrowers who want to maintain control over their assets during challenging financial times.

Potential Drawbacks and Risks to Consider

While a car title loan loan modification can provide much-needed relief for borrowers facing financial strain, several potential drawbacks and risks should be carefully considered before proceeding. One significant concern is the risk of defaulting on the loan, which could lead to repossession of your vehicle. If you’re unable to make payments as agreed, the lender has the legal right to seize your car, regardless of whether it’s been modified or not. This can cause significant stress and disrupt your daily commute, especially if public transportation isn’t an option.

Additionally, these loans often come with high-interest rates and short repayment terms, which can make it challenging for borrowers to fully regain financial stability. If you need emergency funds, exploring alternative options like personal loans or credit cards might be more beneficial in the long run, as they typically offer lower interest rates and more flexible repayment periods. Even in Dallas Title Loans, where car title loan modifications are prevalent, keeping your vehicle and maintaining a stable income should be primary concerns to avoid these potential pitfalls.

Car title loan loan modification can be a strategic financial decision, offering both benefits and potential drawbacks. By understanding the process and weighing the pros against the cons, borrowers can make informed choices. While it provides a way to access immediate funds and potentially lower monthly payments, it also carries risks such as higher interest rates and the possibility of losing one’s vehicle if repayments are missed. Thus, careful consideration is key before embarking on this financial path.