Business owners with limited credit history can access quick cash through a title loan for business expenses, using their vehicle's title as collateral. This alternative financing offers flexible repayment terms, direct deposit funding, and faster approval times compared to traditional bank loans, easing financial strain on small businesses with fluctuating cash flows or immediate needs.

In today’s competitive business landscape, funding options are crucial. When traditional banks say no to loan applications, entrepreneurs often turn to alternative financing solutions. One such option gaining traction is the title loan for business expenses. This article delves into understanding title loans as a viable solution, exploring scenarios where banks may decline requests, and offering insights into navigating alternatives to meet pressing business needs effectively.

- Understanding Title Loans for Business Expenses

- When Traditional Banks Say No

- Navigating Alternatives to Meet Business Needs

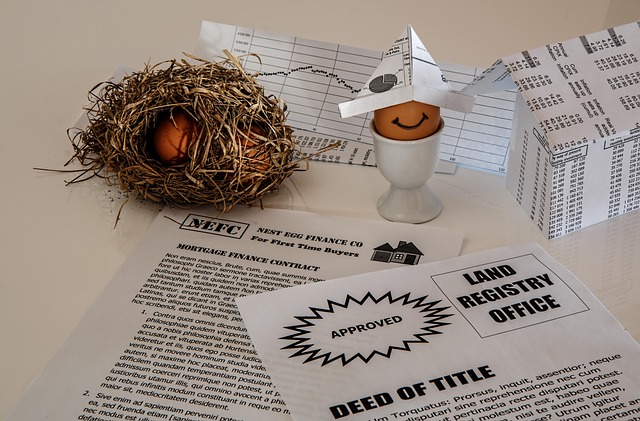

Understanding Title Loans for Business Expenses

When traditional financing options like banks or investors say no to funding your business expenses, a title loan can offer an alternative solution. A title loan for business expenses leverages the value of your vehicle as collateral, allowing entrepreneurs access to quick cash. This type of loan is particularly appealing to small business owners who need immediate financial support and may not have a strong credit history.

Unlike other loans, a title loan provides flexible payments, making it manageable for businesses with fluctuating cash flows. The process is straightforward, involving the transfer of your vehicle’s registration in exchange for funds. Repayment options are tailored to suit individual business needs, ensuring entrepreneurs can focus on their operations without the added stress of overwhelming debt repayments.

When Traditional Banks Say No

When Traditional Banks Say No, business owners often find themselves in a bind, especially when immediate cash flow is crucial. The traditional lending process can be stringent, with banks demanding perfect credit scores and extensive financial records. For many entrepreneurs, this becomes an obstacle, as they may not have the required documentation or their credit history might not meet the bank’s standards. This is where alternative financing options step in, offering a lifeline when banks say no to title loan for business expenses.

One such option gaining popularity is using assets as collateral, like vehicle titles. This includes semi truck loans and boat title loans, providing a quick and accessible way to secure funding. These direct deposit loans can be a game-changer for businesses in need, offering faster approval times compared to conventional bank loans. It’s an efficient solution, especially when time is of the essence during business emergencies or unexpected expenses.

Navigating Alternatives to Meet Business Needs

When banks deny loan applications, especially for business expenses, it’s far from the end of the road for entrepreneurs. Navigating alternatives to meet these financial needs is a crucial step in ensuring your business can keep thriving. One option gaining traction is a title loan for business expenses, which allows business owners to leverage their vehicle’s title as collateral for quick funding. This flexible financing solution can be particularly appealing for those who need fast access to cash without the lengthy approval processes of traditional loans.

By opting for a title loan process, business owners can maintain ownership of their vehicles while securing much-needed capital. The benefits extend beyond keeping your vehicle; direct deposit options mean funds are accessible promptly, enabling businesses to seize opportunities or manage unexpected costs effectively. This alternative financing method is a game-changer for many, offering speed, convenience, and the potential to keep operations running smoothly without the usual banking barriers.

While traditional banks may not always approve business expense loans, title loans offer an alternative solution for entrepreneurs in need. By utilizing their business assets as collateral, owners can secure funding for unexpected costs or growth opportunities. Understanding these loans and navigating the process is key to ensuring a successful financial strategy, especially when other options are limited. With careful consideration, a title loan for business expenses could be the game-changer your company needs to thrive in today’s competitive market.