Title loans for cars provide quick cash using your vehicle's title as collateral. Gather documents, apply online or in-person, and lenders assess your vehicle value & financial health. Repayments are structured, flexible, and can improve credit score. Communicate openly with lenders for guidance during repayment.

Looking to gain quick access to cash using your car’s title? A title loan could be an option, but understanding the process is crucial. This comprehensive guide breaks down the steps involved in obtaining a title loan for your vehicle, from initial inquiry to repayment. We demystify the application process and offer tips for successful management of your loan. By the end, you’ll be equipped with the knowledge to make an informed decision about leveraging your car’s value.

- Understanding Title Loans for Cars: Basics Explained

- Step-by-Step Application Process: What to Expect

- Repaying Your Loan: Options and Tips for Success

Understanding Title Loans for Cars: Basics Explained

Title loans for cars are a type of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This alternative financing option is popular among individuals who need quick access to cash and own a car with a clear title. The process involves several steps, from applying to receiving funds, all while maintaining ownership of your vehicle.

In the case of Dallas Title Loans, for instance, borrowers can expect a straightforward application process. Lenders will assess the value of your vehicle through a comprehensive Vehicle Valuation to determine the loan amount. Repayment Options are flexible and tailored to fit individual needs, making it a convenient solution for short-term financial requirements. Understanding these basics is the first step in navigating the Title Loans for Cars process effectively.

Step-by-Step Application Process: What to Expect

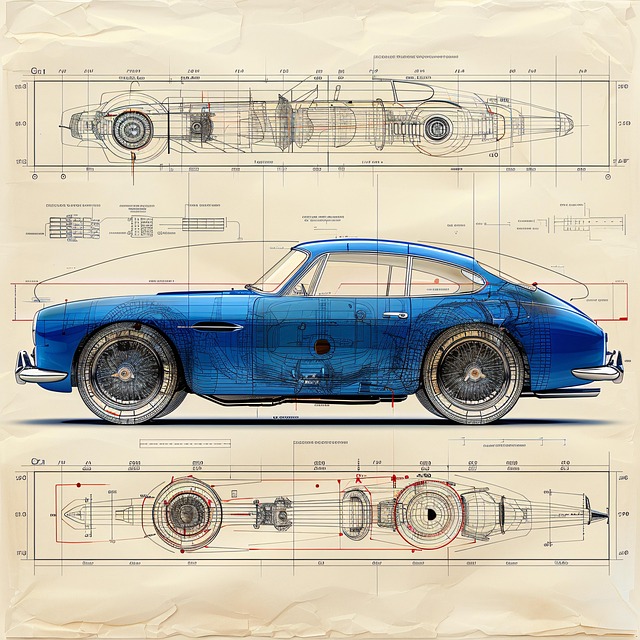

When considering a Title loan for cars, understanding the step-by-step application process is crucial. The first step involves gathering necessary documents such as your vehicle’s registration, proof of income, and a valid driver’s license. This ensures that you meet the basic eligibility criteria for these types of loans, which often require less stringent qualifications than traditional bank loans.

Next, you’ll submit an online application or visit a lender’s office. Here, you’ll provide details about your vehicle—make, model, year, and overall condition—which plays a significant role in determining the loan amount. After reviewing your application and documents, the lender will assess your financial health and vehicle value to approve your requested Loan Payoff amount. Once approved, they’ll discuss Payment Plans with you, outlining repayment terms and interest rates clearly. This transparent process ensures you understand the costs involved before finalizing the Semi Truck Loans.

Repaying Your Loan: Options and Tips for Success

Repaying a title loan for a car is a crucial step toward regaining control of your financial situation. The process typically involves making regular payments according to the agreed-upon schedule, which can range from several months to a year or more. Many lenders offer flexible repayment options, including weekly, biweekly, or monthly installments, catering to various income patterns. One popular method is setting up a direct deposit, ensuring funds are automatically transferred from your bank account on specified dates, simplifying the repayment process.

To achieve success in repaying your loan, consider making extra payments whenever possible. This approach can significantly reduce the total interest incurred and the length of the loan term. Additionally, maintaining timely payments enhances your credit score, providing a solid financial foundation for future endeavors. Remember, keeping open lines of communication with your lender is essential, as they can offer tailored advice and guidance to help you navigate any challenges during the repayment journey.

Title loans for cars can be a viable option for those needing quick access to cash. By understanding the basics, navigating the application process, and adopting responsible repayment strategies, you can make an informed decision. Remember, while title loans offer benefits, it’s crucial to explore all alternatives and choose a lender that provides fair terms and transparent practices.