San Antonio residents can access quick cash through title loans, an alternative financing option using vehicle titles instead of credit scores. This process involves simple application, assessment, and verification, with flexible repayment terms and no credit check. However, navigating legal complexities is crucial to avoid predatory practices and credit traps. Seeking professional title loan legal assistance ensures fair terms, protects rights, and prevents long-term negative credit impacts.

“Looking for a fast financial solution without sacrificing your credit score? Discover the power of title loan legal assistance. This comprehensive guide breaks down ‘Understanding Title Loans’ and navigates the complexities, ensuring ‘Navigating Legalities’ for fair practices. Learn how to protect your rights and steer clear of ‘Credit Traps’. By utilizing professional help, you can access much-needed funds while maintaining a positive financial standing.”

- Understanding Title Loans: A Comprehensive Guide

- Navigating Legalities: Ensuring Fair Practices

- Protecting Your Rights: Avoiding Credit Traps

Understanding Title Loans: A Comprehensive Guide

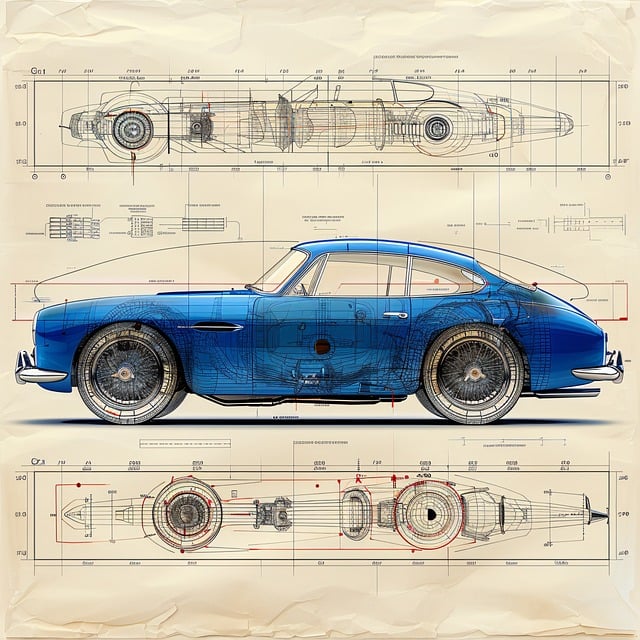

Title loans are a type of secured lending that allows individuals to borrow money using their vehicle’s title as collateral. Unlike traditional loans that rely heavily on credit scores, title loans offer an alternative option for those with poor or no credit history. This form of financing is particularly useful in San Antonio and other urban areas where folks often need quick access to cash. The process typically involves a simple application, a brief assessment of the vehicle’s value, and a quick verification of the borrower’s identity.

Once approved, lenders conduct a thorough vehicle inspection to assess its condition and determine its worth. This inspection ensures that the loan amount offered is fair and aligned with the car’s market value. San Antonio loans often come with flexible repayment terms, making them manageable for borrowers. Moreover, since these loans are secured by the vehicle title, there’s no need for a credit check, making it an attractive option for those seeking Title loan legal assistance without negatively impacting their credit rating.

Navigating Legalities: Ensuring Fair Practices

Navigating the legal landscape surrounding title loans is essential to ensure fair and transparent practices. When seeking title loan legal assistance, borrowers should look for professionals well-versed in this specific area of law, who can guide them through the process, protecting their rights every step of the way. Many states have strict regulations regarding these loans, designed to prevent predatory lending and ensure consumers are treated fairly.

Lenders offering same-day funding, vehicle equity loans, or loan refinancing options should be held accountable for adhering to these rules. Reputable legal assistance can help borrowers understand their rights, negotiate terms, and avoid hidden fees or unfair interest rates. By ensuring compliance with regulations, both lenders and borrowers can benefit from a mutually beneficial transaction, fostering a healthier lending environment.

Protecting Your Rights: Avoiding Credit Traps

When considering a title loan, it’s crucial to prioritize your financial well-being and protect your rights. One common pitfall is falling into a cycle of debt known as credit traps. These can arise from predatory lending practices that offer quick cash but impose harsh repayment terms and high-interest rates. A savvy approach involves seeking Title loan legal assistance to understand your rights and navigate the process safely.

Expert guidance ensures you make informed decisions, like comparing San Antonio Loans from different lenders, understanding Loan Terms, and avoiding hidden fees. By taking this proactive step, you can secure a financial solution that aligns with your best interests, steering clear of potential long-term negative credit impacts.

When considering a title loan, it’s crucial to balance your financial needs with protecting your rights. By understanding the process, navigating legalities, and seeking expert legal assistance, you can avoid potential credit traps associated with these loans. Remember, informed decisions are key to managing your financial health, ensuring a positive outcome without negatively impacting your credit score. Reach out to professionals specializing in title loan legal assistance for guidance tailored to your situation.