A strategic Title Loan Payoff Strategy leverages tax refunds to consolidate and repay secured loans like truck or boat title loans swiftly. Evaluate financial situation, understand loan terms, allocate tax refunds for repayment, and prioritize high-interest debts for optimal debt management. This approach minimizes interest accrual, offers financial freedom, and enhances financial health.

Looking for a way to swiftly repay your title loan? Discover the power of tax refund payments as a strategic tool. This comprehensive guide explores the intersection of title loans and tax refunds, offering valuable insights into an effective payoff strategy.

Learn how to navigate this financial path, understand the benefits, and master the step-by-step process of leveraging your annual tax refund to settle your title loan debt faster.

- Understanding Title Loans and Tax Refunds

- Strategies for Effective Title Loan Payoff

- Leveraging Tax Refund Payments: A Step-by-Step Guide

Understanding Title Loans and Tax Refunds

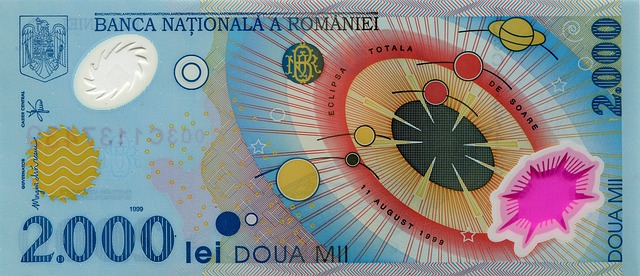

Title loans are a type of secured lending where an individual uses their vehicle’s title as collateral to borrow money. This loan process typically involves a quick evaluation of the vehicle’s value, after which the lender provides a cash advance based on that assessed value. Once approved, borrowers have access to funds, often with relatively flexible repayment terms. However, it’s crucial to understand the implications and potential drawbacks before pursuing such loans, especially when considering a title loan payoff strategy.

Tax refunds, on the other hand, are payments made by the government to individuals who have overpaid their taxes or meet specific eligibility criteria. These refunds can provide a much-needed financial boost during tax season. Incorporating tax refund payments into a title loan payoff strategy is an innovative approach to debt consolidation, allowing borrowers to use these funds to settle outstanding title loans. This method can simplify repayment by consolidating multiple debts into one lump sum, potentially saving interest and fees associated with various loans, including semi-truck loans or other specialized financing options.

Strategies for Effective Title Loan Payoff

When planning a Title Loan Payoff Strategy, especially for secured loans like Truck Title Loans or Boat Title Loans, a structured and strategic approach is vital. The first step involves evaluating your financial situation to determine how much you can realistically pay back without causing undue strain on your budget. This includes assessing the loan terms, interest rates, and any additional fees associated with the title loan. A responsible strategy should aim to pay off these loans as quickly as possible to minimize interest accrual and reduce overall debt.

One effective method is to allocate a significant portion of your tax refund towards the loan repayment. Tax refunds can provide a substantial lump sum, which can be directed towards settling secured loans. By doing so, you can accelerate the payoff process and save on interest costs. Additionally, consider prioritizing high-interest debts first within your overall debt management strategy for optimal financial health.

Leveraging Tax Refund Payments: A Step-by-Step Guide

Leveraging Tax Refund Payments for a Title Loan Payoff Strategy is a smart financial move that can help you regain control over your debts. Here’s a step-by-step guide to make this process seamless. First, assess if you are eligible for a tax refund and determine the amount you anticipate receiving. This could be from your annual income taxes or even semi truck loans that have been repaid early. Once you have a clear idea of your upcoming funds, decide how much you want to allocate towards paying off your title loan.

Next, initiate communication with your lender about your payoff intent. They will provide instructions on the required documents and amounts needed to complete the title loan process. It’s crucial to act swiftly as timely repayment can help avoid penalties or additional interest charges, especially in cases of bad credit loans. By strategically utilizing your tax refund payments, you can significantly reduce or even eliminate your outstanding title loan balance more quickly than traditional payment methods, empowering you with financial freedom.

A title loan payoff strategy that incorporates tax refund payments can be a powerful tool for managing debt efficiently. By understanding the dynamics of title loans and utilizing your annual tax refund, you gain an innovative approach to repaying these types of secured loans swiftly. This step-by-step guide offers a clear path to financial freedom, allowing you to leverage your tax refund to settle title loans once and for all. With careful planning and execution, you can transform your debt burden into a manageable process, paving the way for a brighter financial future.