Woodway TX title loans offer quick emergency funding with less strict credit requirements, using your vehicle's title as collateral. Prequalifying is crucial for informed decisions, involving document submission and comparing lender terms. Responsible repayment through budgeting and timely payments avoids stress, penalties, and improves future lending opportunities. Maintain open communication with lenders.

In the competitive financial landscape of Woodway, TX, understanding your options is crucial. This guide provides insights into navigating Woodway title loans, a secure borrowing option for those in need of quick cash. From comprehending the fundamentals of these loans to prequalifying efficiently and repaying responsibly, we demystify the process. Whether you’re a first-time borrower or seeking tips to manage an existing loan, this resource offers practical advice tailored to Woodway’s unique financial environment.

- Understanding Woodway TX Title Loans: Basics Explained

- Prequalifying for Your Loan: A Step-by-Step Guide

- Repaying Your Title Loan Responsibly: Tips and Best Practices

Understanding Woodway TX Title Loans: Basics Explained

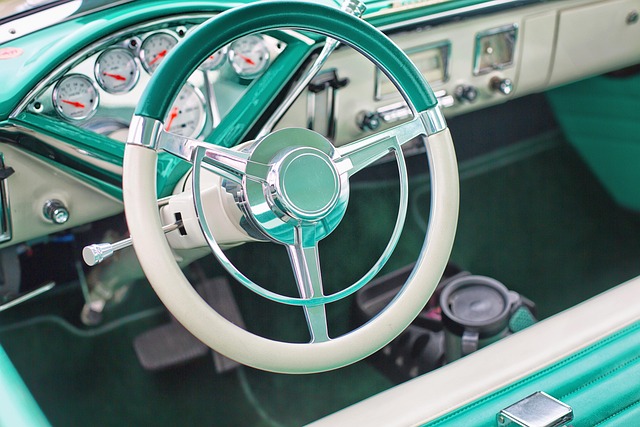

Woodway TX Title loans are a form of secured lending that uses your vehicle’s title as collateral. This type of loan is designed for individuals needing quick access to emergency funding, often with less stringent credit requirements than traditional bank loans. It works by allowing lenders to hold onto your vehicle’s title until the loan is repaid, including interest and any fees.

Unlike unsecured loans, Woodway title loans offer flexible payment plans tailored to borrowers’ financial capabilities. This makes them an attractive option for those facing unexpected expenses or seeking a solution to short-term cash flow issues. The process typically involves providing proof of vehicle ownership, income verification, and a valid driver’s license. Once approved, lenders disburse the funds, allowing borrowers to gain access to much-needed emergency funding.

Prequalifying for Your Loan: A Step-by-Step Guide

Before applying for a Woodway TX title loan, prequalifying is a crucial step to ensure you’re making an informed decision. Here’s a step-by-step guide to help you navigate this process smoothly.

1. Assess Your Loan Needs: Start by determining how much funding you require. This will depend on your financial goals, whether it’s for emergency expenses or a larger purchase. Woodway title loans are designed to offer quick access to cash using your vehicle’s equity as collateral.

2. Check Your Vehicle Equity: Next, assess the current value of your vehicle and calculate its equity. The loan amount you can secure will be based on the vehicle’s worth. Remember, the equity is the difference between the vehicle’s market value and any outstanding loans or liens against it (including any existing title pawn).

3. Research Lenders: Explore reputable lenders offering Woodway title loans. Compare their interest rates, repayment terms, and fees to find a suitable option. Ensure they operate within legal boundaries and have positive reviews from previous clients.

4. Provide Necessary Documentation: When prequalifying, you’ll likely need to submit basic information such as your personal details, vehicle registration documents, proof of income, and identification. Some lenders may also require a clear title to evaluate your vehicle’s equity accurately.

5. Complete the Prequal Application: Fill out the lender’s prequal application form, providing honest and accurate information. This step will give you an estimate of your loan eligibility based on the initial assessment of your vehicle’s equity.

Repaying Your Title Loan Responsibly: Tips and Best Practices

Repaying your Woodway TX title loan responsibly is a crucial step to ensuring financial stability and avoiding stress. Start by creating a budget that allocates funds specifically for loan repayment, prioritizing timely payments to maintain good terms with your lender. Set up automatic payments or reminders to ensure you never miss a deadline. This not only prevents penalties but also demonstrates your commitment to the agreement.

Additionally, explore options like paying off the loan ahead of schedule if feasible. Early repayment can save you significant interest costs and act as a positive sign to lenders for future transactions, such as Boat Title Loans. Remember, transparency and open communication with your lender are key; discuss any challenges or concerns promptly, as many lenders offer flexible solutions without needing a “no credit check” approach, ensuring a smoother borrowing experience.

Managing a Woodway TX title loan responsibly is key to avoiding financial strain. By understanding the basics of these loans, prequalifying to ensure affordability, and adhering to best practices for repayment, you can leverage this secured lending option to meet your short-term financial needs effectively. Remember, responsible borrowing enhances your creditworthiness and opens doors to future financing opportunities. When considering a Woodway title loan, prioritize transparency, fair terms, and timely repayment to create a positive financial footprint.