Understanding title loan semi-monthly payments is key for managing boat or vehicle equity financing in Fort Worth. This structured approach divides loans into equal parts every two weeks, offering predictable expenses and better financial control. By budgeting specifically for these payments, borrowers maintain stability, avoid missed payments, and minimize costs through proactive financial planning.

Title loans offer a unique repayment structure through semi-monthly payments, breaking down the cost over time. This article demystifies this process, providing insights into how these regular installments work. We explore the advantages of a fixed schedule and offer practical tips for budgeting and managing your title loan costs effectively. By understanding these aspects, borrowers can make informed decisions and ensure financial stability during their loan repayment journey.

- Understanding Title Loan Semi-Monthly Payments

- Advantages of Fixed Schedule Repayments

- Tips to Manage and Budget for Loan Costs

Understanding Title Loan Semi-Monthly Payments

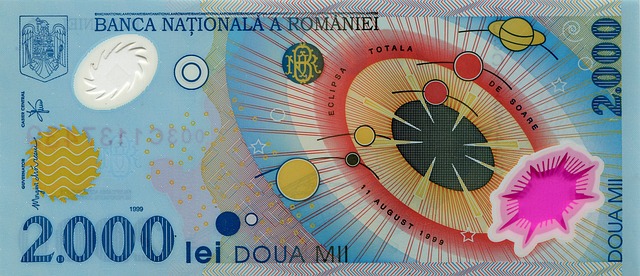

Many people considering a Title Loan in Fort Worth or looking into options like Boat Title Loans or Vehicle Equity loans are often confused by the term “semi-monthly payments.” This simply means that instead of making one large monthly payment, you’ll be breaking down your loan repayment into two equal portions every two weeks. Think of it as making 26 half-payments a year, rather than one big one.

This structure can actually work in your favor by keeping your expenses predictable and manageable. By understanding Title Loan semi-monthly payments, you can better anticipate your cash flow needs and plan accordingly. This clarity is crucial when dealing with loans secured against your vehicle’s equity, ensuring you stay on track with repayments and maintain control of your finances throughout the loan period.

Advantages of Fixed Schedule Repayments

When it comes to managing a title loan, having a fixed schedule for repayments can be immensely beneficial. This approach offers borrowers clarity and control over their finances. With semi-monthly payments, borrowers commit to making regular contributions at consistent intervals—typically every two weeks. This structure eliminates the stress of unpredictable due dates, allowing individuals to budget effectively. By spreading out the loan payoff across numerous smaller installments, it becomes easier to stay on top of repayments without the burden of a large, looming sum.

The advantages extend beyond convenience. A fixed schedule encourages responsible borrowing and helps borrowers avoid the pitfalls of missed payments or late fees. Additionally, it facilitates better financial planning as semi-monthly repayments align with many individuals’ pay cycles. This alignment ensures that repaying the loan doesn’t strain one’s finances, promoting a sense of financial stability during the repayment period, especially with the quick funding title transfer process.

Tips to Manage and Budget for Loan Costs

Managing a title loan can be easier when you break down the costs into manageable semi-monthly payments. One effective strategy is to create a detailed budget that allocates specific funds for each payment due. This approach ensures you set aside money regularly, avoiding the temptation to defer or miss payments, which can lead to additional fees and penalties.

By budgeting responsibly, you gain financial control and peace of mind. Consider using available tools and resources to track your expenses and plan accordingly. If unexpected costs arise, explore options for loan extensions as a temporary solution, ensuring you still meet the semi-monthly payment schedule. Remember, proactive financial planning and timely actions can help minimize the overall cost of your emergency funding needs.

Title loans, with their structured semi-monthly payments, offer a clear repayment path. By understanding these fixed schedule repayments, borrowers can better manage their finances and budget for associated costs. This approach ensures transparency and allows individuals to plan ahead, making it a practical solution for short-term financial needs.