Understanding title loan minimum requirements for classic and specialized vehicles is crucial. Borrowers need valid ID, stable income, clear title ownership, and a clean or acceptable credit history to qualify. Lenders assess vehicle value as collateral and may repossess if defaulted on, but extension options exist. The process starts with an online application, requiring financial and employment details, registration, insurance documents, and a vehicle condition assessment for approval and funding.

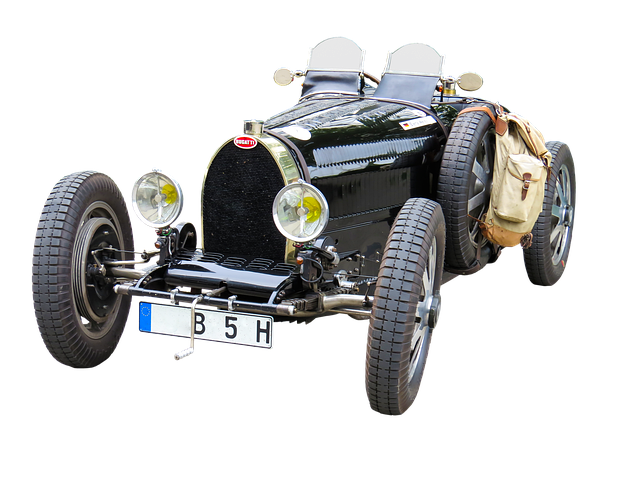

Looking to finance your classic car restoration with a title loan? Understanding the minimum requirements is key to securing funding. This guide breaks down the essential factors lenders consider when assessing applications for classic car title loans. From vehicle condition and age to borrower creditworthiness, discover the basic criteria that could impact your loan approval chances. By grasping these title loan minimum requirements, you’ll be better equipped to navigate the process and fund your dream restoration project.

- Understanding Title Loan Basics for Classic Cars

- Eligibility Criteria: Who Qualifies for a Title Loan?

- Minimum Requirements: Unlocking Loan Approval

Understanding Title Loan Basics for Classic Cars

When considering a loan for your classic car, understanding the basics of a title loan is crucial. A title loan, in its simplest form, allows lenders to use your vehicle as collateral. This means that if you fail to repay the loan, the lender has the legal right to repossess your vehicle. However, this process isn’t as straightforward as it sounds, especially for classic cars which often have unique values and varying market prices. Lenders will typically assess the value of your vehicle and offer a loan amount based on that evaluation.

In the case of Dallas Title Loans or similar financial institutions, the minimum requirements for securing a title loan on a classic car can vary. Generally, you’ll need to provide proof of ownership, a valid driver’s license, and a clear vehicle title. The lender will also require detailed information about your vehicle, including its make, model, year, and any modifications or restoration work. For those interested in financing for semi-trucks or other specialized vehicles, the process is similar but may have additional considerations due to their size, value, and unique operational needs.

Eligibility Criteria: Who Qualifies for a Title Loan?

To qualify for a title loan on a classic car, borrowers must meet certain eligibility criteria. Typically, lenders require individuals to be at least 18 years old and have a valid driver’s license or state ID. They must also demonstrate a stable source of income, such as employment or retirement benefits, to ensure repayment ability. A clean credit history is often preferred, but some lenders cater specifically to those with less-than-perfect credit, focusing more on the value of the classic car than on traditional credit checks.

Additionally, borrowers should have clear title ownership of their classic vehicle. This means no outstanding loans or liens on the car. The loan amount typically depends on the car’s value, and a secured loan structure is common, using the vehicle as collateral to mitigate risk for the lender. In case of default, the lender may initiate a title transfer process to repossess and sell the classic car to recover their investment, though loan extension options might be available under certain circumstances.

Minimum Requirements: Unlocking Loan Approval

To unlock loan approval for a classic car, understanding the minimum requirements set by lenders is key. One of the most essential factors is demonstrating valid vehicle ownership. This typically involves providing proof of registration and insurance, ensuring your classic car is legally yours. Additionally, lenders will assess the overall condition and value of the vehicle to determine its security as collateral.

The process starts with a thorough inspection of your truck title loans application. Lenders will evaluate your income, credit history, and employment status to gauge your ability to repay. An online application streamlines this, allowing you to submit necessary documents digitally. Once your application is complete and all required documentation is in order, lenders can make an informed decision on the loan approval, potentially paving the way for funding to acquire or enhance your cherished classic car.

In understanding the basics of title loans for classic cars and the eligibility criteria, it’s clear that meeting the minimum requirements is key to securing approval. By ensuring you and your vehicle meet these standards, you’re taking a significant step towards accessing the funds needed to preserve or enhance your cherished classic. Remember, each lender may have specific guidelines, so comparing offers and understanding the full scope of title loan minimum requirements is essential before making a decision.