Car title loans Mineral Wells TX offer quick cash secured by vehicle registration, assessing car value over creditworthiness with flexible terms but potential interest charges. Defaulting may lead to repossession, while timely repayments can improve credit standing. Responsible management involves maintaining vehicle ownership and structured payments, enhancing future financial access.

Car title loans in Mineral Wells, TX, are a quick source of cash for those needing immediate financial support. However, understanding their impact on your credit score is crucial. This article delves into the intricacies of how these loans function and explores their effects on your financial health. We examine the relationship between car title loans and credit scores, as well as the repayment process and its influence on future loan opportunities in Mineral Wells, TX.

- Understanding Car Title Loans in Mineral Wells TX

- Impact on Your Credit Score: The Effects

- Repayment and Its Influence on Future Loan Opportunities

Understanding Car Title Loans in Mineral Wells TX

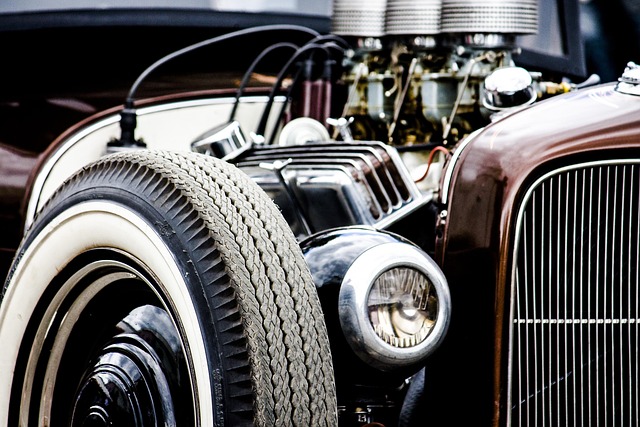

Car title loans Mineral Wells TX are a type of secured lending where individuals use their vehicle’s registration as collateral to borrow money. This option is popular among those needing quick access to cash, especially for emergency funds. The process involves providing the lender with your car’s title, which they hold until the loan is repaid. Unlike traditional loans that may require strict credit checks, car title loans focus on the value of your vehicle rather than your credit score.

In Mineral Wells TX, these loans offer a flexible payment structure, allowing borrowers to pay back the amount over time, often with interest. This makes it an attractive solution for people facing financial challenges or unexpected expenses. However, it’s important to be mindful that if you fail to repay, the lender may repossess your vehicle.

Impact on Your Credit Score: The Effects

Car title loans Mineral Wells TX can significantly impact your credit score, both positively and negatively, depending on how you manage the loan. When you take out a car title loan, lenders will assess your vehicle’s value to determine its worth as collateral. This process, while securing the loan, also means that any defaults or late payments could lead to repossession of your vehicle, which can severely damage your credit rating.

On the other hand, successfully repaying a car title loan over time demonstrates responsible borrowing habits and can actually improve your credit score. Lenders view consistent, on-time payments as a sign of financial reliability. Moreover, if you maintain proper Vehicle Ownership and ensure timely Flexible Payments, these positive actions can contribute to rebuilding or enhancing your credit standing in the long run.

Repayment and Its Influence on Future Loan Opportunities

When it comes to Car Title Loans Mineral Wells TX, understanding repayment and its impact on future loan opportunities is paramount. Successful repayment not only clears your debt but also enhances your credit profile, making it easier to access financial assistance in the future. Lenders view timely payments as a sign of responsible borrowing, which can open doors to better interest rates and more favorable terms for subsequent loans.

Repayment options for Car Title Loans Mineral Wells TX are typically structured to align with borrowers’ income cycles. Regular payments, often automated through direct debit from your bank account, ensure that your loan stays current. This not only avoids penalties but also demonstrates your ability to manage debt effectively. A positive repayment history can significantly improve your credit score, making it simpler to secure another cash advance or financial assistance when needed.

Car title loans Mineral Wells TX can provide quick cash but significantly impact your credit score. Understanding the effects on both your current financial standing and future loan opportunities is crucial. While these loans offer accessibility, the potential drawbacks must be considered to make an informed decision regarding short-term financing in Mineral Wells, TX.