Title loan instant approval platforms offer swift cash secured by vehicle titles but come with higher interest rates, risk of default loss, and potential debt cycle. Weighing benefits against risks, assessing financial health, credit score, and vehicle value is crucial for informed decisions, ensuring responsible lending from reputable lenders who keep your possession intact.

In today’s fast-paced world, immediate financial solutions are often sought after. Title loan instant approval services have gained popularity as a quick way to access cash. This article explores real user reviews of these services, delving into their experiences and insights. We uncover the benefits and drawbacks of title loans with instant approvals, offering strategies for smart borrowing to ensure informed decisions. Discover how these services work and what users truly think about their reliability and impact on personal finances.

- Exploring Real User Experiences with Title Loan Instant Approval Services

- Uncovering Benefits and Drawbacks of These Quick Loans

- Strategies for Smart Borrowing: Title Loan Instant Approval

Exploring Real User Experiences with Title Loan Instant Approval Services

When exploring the world of financial services, understanding real user experiences is invaluable. For those seeking quick cash solutions, title loan instant approval services have gained significant attention. These platforms promise rapid funding by leveraging an individual’s vehicle title as collateral, ensuring a seemingly seamless process. Many users appreciate the convenience and speed, with some sharing their positive encounters online. Testimonials often highlight how these services provided much-needed financial support during unexpected emergencies, offering a quick approval process that rivaled traditional loan alternatives.

However, amidst the praise, it’s crucial to consider diverse narratives. Some borrowers have expressed concerns about the overall cost of borrowing, arguing that while the quick approval process is attractive, the associated fees and interest rates can add up over time. For instance, in cities like Houston, where Houston Title Loans are prevalent, users have advocated for transparency and caution, emphasizing the importance of thorough research before committing to such financial arrangements.

Uncovering Benefits and Drawbacks of These Quick Loans

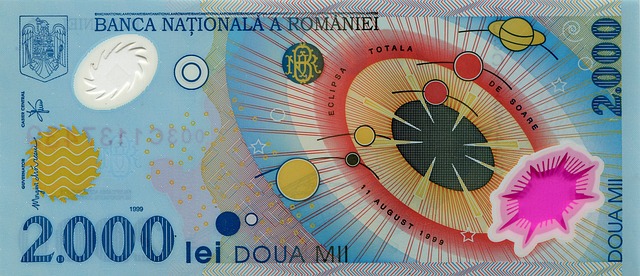

Uncovering the advantages and potential downsides of title loan instant approval services is essential for any borrower considering this unique financing option. Title loans, known for their swift approval process, offer a temporary financial solution secured by an individual’s vehicle title. This accessibility has made them a popular choice for those in need of quick cash. With just a few requirements, like a clear car title and a stable income, borrowers can secure funds within the same day, hence the appeal of “same-day funding.”

However, it’s crucial to weigh the benefits against potential drawbacks. Repayment options, while flexible, may come with higher interest rates compared to traditional loans. Borrowing against your vehicle title means you risk losing your transportation if unable to meet repayment terms. Moreover, the short-term nature of these loans can lead to a cycle of debt if not managed carefully. Understanding both the advantages and potential pitfalls is vital for making an informed decision when opting for a title loan instant approval service.

Strategies for Smart Borrowing: Title Loan Instant Approval

When considering a Title Loan Instant Approval, it’s crucial to adopt strategic and smart borrowing practices. Firstly, understand your loan eligibility; this involves evaluating your financial health, credit score, and the value of your vehicle. Reputable lenders assess these factors to ensure responsible lending, thereby protecting both the borrower and the lender. For instance, keeping a good credit history and having clear vehicle ownership can significantly enhance your loan eligibility.

Additionally, remember that keeping your vehicle is a significant advantage in this type of loan. Unlike traditional loans where collateral may be required, title loans allow borrowers to retain possession of their vehicles. This flexibility enables individuals to access quick funds while still having the freedom to use their asset without restrictions. A smart borrower will weigh these benefits against the interest rates and repayment terms offered by various lenders to make an informed decision.

Real user reviews offer valuable insights into the world of title loan instant approval services, highlighting both their benefits and drawbacks. By understanding these experiences, individuals can make informed decisions about smart borrowing strategies. While these quick loans provide immediate financial relief, it’s crucial to be mindful of potential risks and choose reputable lenders. With the right approach, title loan instant approval can serve as a temporary solution for those in need, ensuring a smoother financial journey.