Texas motorcycle title loans offer a specialized financing option for residents, using the vehicle's title as collateral with flexible terms up to 4 years, quick approval via online form and inspection, ideal for emergency funding, debt consolidation, but borrowers must weigh higher interest rates against convenience.

In the state of Texas, riders seeking fast financial support have two distinct options: Texas motorcycle title loans and payday loans. This article delves into these alternatives, offering a comprehensive comparison of their terms and conditions. Understanding the nuances between these loans is crucial for motorcyclists looking to access short-term funds, ensuring they make informed decisions tailored to their needs. Explore the benefits and drawbacks of each to determine the most suitable path forward.

- Understanding Texas Motorcycle Title Loans

- Payday Loans: A Quick Cash Alternative

- Comparing Loan Terms and Conditions

Understanding Texas Motorcycle Title Loans

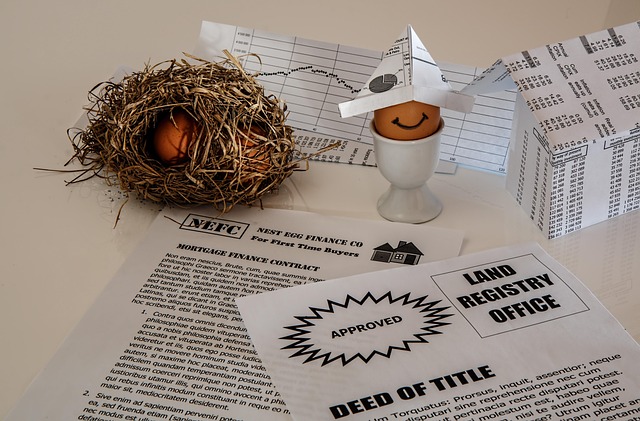

Texas motorcycle title loans are a unique form of secured lending designed for residents of Texas who own motorcycles. In this type of loan, the borrower uses their motorcycle’s title as collateral to secure a cash advance. This alternative financing option is popular among individuals seeking emergency funding or quick access to capital without the stringent requirements often associated with traditional bank loans.

Unlike payday loans that typically require a short repayment term and high-interest rates, Texas motorcycle title loans offer a more flexible repayment schedule. Lenders conduct a vehicle inspection to assess the motorcycle’s value and determine the loan amount. This process allows borrowers to access a substantial sum based on their vehicle’s equity, providing a reliable source of emergency funding. Additionally, unlike truck title loans or other secured loans that may require specific vehicle types, Texas motorcycle title loans are focused solely on motorcycle owners, catering to their unique financial needs.

Payday Loans: A Quick Cash Alternative

Payday loans have gained popularity as a quick cash solution for many individuals. In Texas, with its vibrant motorcycle culture, this alternative financing option has seen increased interest from riders looking to access immediate funds. These short-term loans are designed to provide borrowers with money for urgent expenses or unexpected costs, offering a fast and easy way to bridge financial gaps. When considering a payday loan, lenders typically evaluate an applicant’s income and employment status to determine their ability to repay the loan within the specified timeframe, usually ranging from a few weeks to a month.

Unlike traditional loans, Texas motorcycle title loans offer a unique approach to borrowing. They allow individuals to use their motorcycle as collateral, ensuring faster approval processes and potentially more favorable loan terms. This option is particularly appealing for those seeking debt consolidation or quick cash without the lengthy application procedures often associated with banks. It’s essential to weigh the benefits and consider the potential risks, such as higher interest rates, before choosing a payday loan or exploring alternative financing methods like title loans secured by personal property.

Comparing Loan Terms and Conditions

When comparing Texas motorcycle title loans to other types of financing, like payday loans, it’s crucial to scrutinize the terms and conditions. Motorcycle title loans in Texas often offer more flexible repayment schedules, with options that can extend up to 4 years. This is a significant advantage over payday loans, which typically demand immediate full repayment, leaving borrowers in a cycle of high-interest debt.

Moreover, while both loan types require some form of collateral, the process for securing a Texas motorcycle title loan involves a simple online application and subsequent vehicle inspection. Unlike boat title loans or other asset-based loans that may have stringent requirements, motorcycle title loans often cater to a broader range of borrowers. This accessibility is further enhanced by the option to repay the loan in installments, making it a more sustainable choice for those seeking financial relief.

When considering quick cash options in Texas, understanding the nuances of Texas motorcycle title loans versus payday loans is crucial. Both offer immediate financial relief but differ significantly in terms and conditions. While payday loans provide shorter-term solutions, title loans secured against your motorcycle offer potentially longer repayment periods and lower interest rates. Before deciding, carefully evaluate your financial needs and compare the terms to make an informed choice that aligns with your budget and future financial stability.