Timely payments in title loan success stories build trust and improve financial health for both borrowers and lenders. Cases like Sarah's and John's demonstrate how flexible repayment options and responsible management can lead to better access to credit, debt reduction, and improved financial stability. Using title loans strategically for emergencies or debt consolidation can empower individuals to achieve long-term financial resilience.

Timely payments are the cornerstone of successful title loan experiences, fostering a symbiotic relationship between lenders and borrowers. This article delves into the profound impact of prompt repayments, examining how they strengthen financial health and create a thriving ecosystem for title loan services. We explore real-life examples of individuals who harnessed the power of timely payments to achieve significant milestones. Additionally, we offer strategic insights to help borrowers navigate the process effectively, ensuring continued success stories in the realm of title loans.

- Understanding the Impact of Timely Payments

- Real-Life Examples: Title Loan Success Stories

- Strategies for Maintaining Prompt Repayment

Understanding the Impact of Timely Payments

Timely payments play a pivotal role in the success of title loan stories, highlighting a powerful cycle that benefits both lenders and borrowers. When individuals make their payments on time, it fosters trust and strengthens the borrower-lender relationship. This punctuality has a ripple effect, enhancing the overall health of the loan portfolio for lenders while ensuring borrowers maintain control over their assets.

For instance, consider Dallas Title Loans, where borrowers leveraging their vehicle equity often opt for flexible repayment options. Timely payments not only help them regain full ownership of their vehicles but also demonstrate their financial responsibility. This positive behavior can lead to improved credit scores and better access to future loans, creating a sustainable cycle that contributes to overall financial well-being.

Real-Life Examples: Title Loan Success Stories

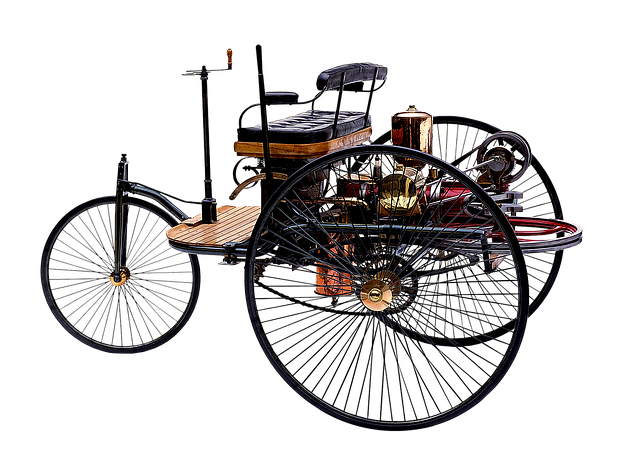

In the realm of alternative financing, title loan success stories are abundant, showcasing how timely payments can lead to financial stability for many. Consider the case of Sarah, a single mother who needed emergency funds to cover unexpected medical expenses. She opted for a title loan secured by her vehicle, ensuring she could keep her car—a practical solution given her reliance on it for daily commuting and transporting her children. Through diligent repayment according to the agreed-upon Title Loan Process, Sarah was able to pay off the loan within the specified timeframe, maintaining ownership of her asset and avoiding any penalties.

Another example highlights John’s experience with a title loan. Struggling to make ends meet, he used his vehicle as collateral to secure a loan that covered immediate debts. By adhering to the terms and keeping up with payments, John successfully improved his financial situation. He was able to pay off higher-interest debt, repair his credit score, and even have some leftover funds for unexpected expenses without sacrificing his trusted transportation, thanks to the flexibility of keeping your vehicle during the Title Loan Process.

Strategies for Maintaining Prompt Repayment

Staying on top of payments is key to any loan success story, especially with title loans. Borrowers who aim for timely repayments often employ strategic financial management techniques. One effective approach is budgeting, where individuals allocate their income to cover essential expenses and debt obligations, ensuring funds are available for loan repayments without delays. Setting up automatic payments or reminders can also help maintain promptness.

Additionally, borrowers might consider using their title loans as a means of emergency funds or debt consolidation. By repaying the loan responsibly, they can access future financial stability, avoiding the need for high-interest credit cards or other costly alternatives. Fort Worth loans, when managed effectively, can thus become powerful tools for personal financial growth and resilience.

Timely payments are the cornerstone of successful title loan experiences, fostering a win-win scenario for both lenders and borrowers. By embracing strategies that encourage prompt repayment, individuals can leverage the benefits of title loans, accessing much-needed funds while building a solid financial reputation. These success stories highlight the transformative power of responsible borrowing, demonstrating that timely payments are key to navigating financial challenges effectively.