Car title loan mileage restrictions, capped at around 120,000-150,000 miles, influence loan eligibility and interest rates. Lower vehicle mileage indicates better condition and value, leading to more favorable loan terms. Understanding these restrictions is crucial for borrowers seeking emergency funding, enabling informed decisions, responsible management, and potentially improved borrowing conditions.

“Explore the intricate world of salvage title loans and uncover how vehicle mileage plays a pivotal role in shaping loan terms. In this comprehensive guide, we delve into the fundamentals of these unique financing options, shedding light on their benefits and potential challenges. From understanding mileage restrictions to navigating their advantages, this article equips readers with valuable insights. Discover how your vehicle’s mileage can influence the conditions of such loans, offering both opportunities and considerations for responsible borrowing.”

- Understanding Salvage Title Loans Basics

- How Vehicle Mileage Affects Loan Terms

- Navigating Mileage Restrictions and Benefits

Understanding Salvage Title Loans Basics

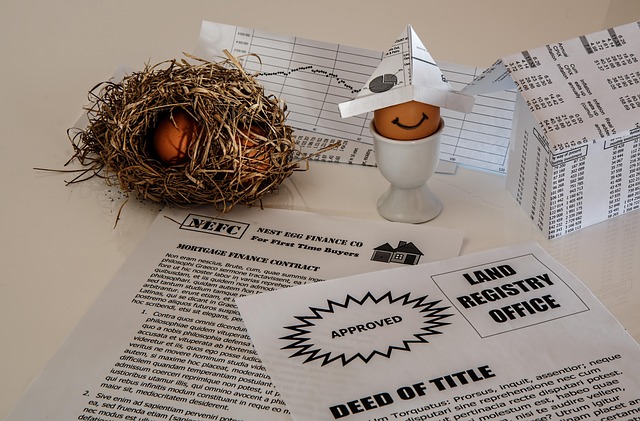

Salvage Title Loans are a type of secured loan where individuals can borrow money using their vehicle’s title as collateral. This option is often considered by those with less-than-perfect credit or limited loan alternatives, providing a quick and accessible way to access capital. The process typically involves assessing the vehicle’s condition, including its mileage, to determine loan eligibility and set interest rates.

Car title loan mileage restrictions play a vital role in this process. Lenders often have specific guidelines regarding the allowed mileage on vehicles used for such loans. These restrictions ensure that the vehicle is in drivable condition and has reasonable wear and tear. For instance, a Fort Worth Loans provider might limit loans to vehicles with under 150,000 miles, ensuring both loan security and customer satisfaction by maintaining vehicle value. Understanding these mileage limits and the eligibility criteria for secured loans can help borrowers make informed decisions when seeking financial support.

How Vehicle Mileage Affects Loan Terms

When applying for a car title loan, one factor that significantly influences the terms of your loan is the vehicle’s mileage. This is because lenders consider a car’s odometer reading as a key indicator of its overall condition and remaining lifespan. The lower the mileage, the more valuable the vehicle is perceived to be, which can lead to more favorable loan conditions such as lower interest rates and longer repayment periods.

For instance, San Antonio loans providers may impose strict car title loan mileage restrictions, typically setting limits around 120,000 miles or less for vehicles to qualify for emergency funding through the title loan process. Vehicles with higher mileage might still be considered for loans, but lenders will often charge premium rates and shorter repayment terms to mitigate the increased risk. Understanding these car title loan mileage restrictions is crucial before you approach a lender for urgent financial needs, ensuring you get the best possible deal based on your vehicle’s current condition.

Navigating Mileage Restrictions and Benefits

Navigating mileage restrictions on car title loans offers both challenges and benefits for borrowers. These limits, usually set by lenders to protect their investments, can significantly impact a borrower’s decision-making process. However, they also serve as a safeguard for the lender, ensuring the vehicle remains in relatively good condition throughout the loan period.

For individuals requiring emergency funds, these restrictions can seem like an added hurdle. But understanding the rationale behind them is key to making informed choices. By keeping your vehicle’s mileage within reasonable bounds, you not only preserve its value but also demonstrate your commitment to managing the loan responsibly. This can lead to more favorable borrowing terms and even the potential for higher future equity when it comes to refinancing or selling the vehicle.

Salvage title loans offer a unique financing option with specific considerations regarding vehicle mileage. Understanding how mileage affects loan terms is crucial for borrowers. While car title loan mileage restrictions may seem limiting, they ultimately foster responsible lending and ensure the longevity of vehicles on the road. By navigating these restrictions, borrowers can access much-needed funds while promoting sustainable automotive practices.