Understanding hidden costs is vital when considering a title loan. Fees like processing costs, early repayment penalties, and optional services can significantly add to expenses. Lenders often bury these charges in fine print, so borrowers must carefully review every detail to avoid expensive debt traps. Local Dallas providers offer transparent pricing despite credit challenges.

In the fast-paced world of financial services, understanding every detail is crucial. Title loans, often seen as a quick cash solution, can come with a price tag you might not expect. This article uncovers the fine print red flags for hidden title loan costs. We break down how these loans work and expose the exorbitant fees lurking within their terms. Additionally, we provide strategies to help borrowers spot and avoid these unexpected charges, empowering them to make informed decisions.

- Understanding Hidden Costs in Title Loans

- Decoding Fine Print: Unveiling Exorbitant Fees

- Strategies to Spot and Avoid Hidden Charges

Understanding Hidden Costs in Title Loans

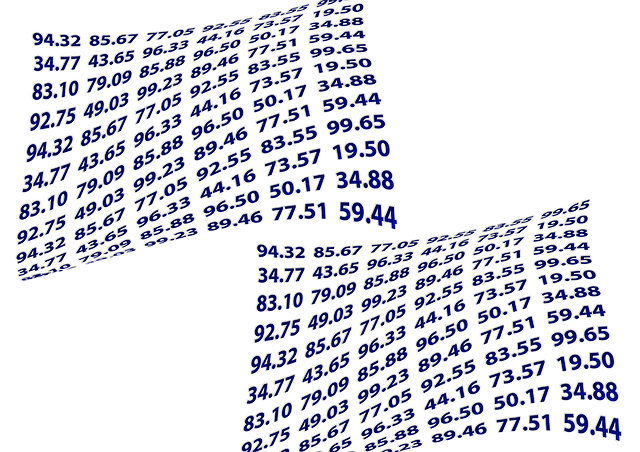

When considering a title loan, it’s crucial to be aware that there are often hidden costs associated with such financial transactions. These fees can significantly impact the overall cost of borrowing and should never be overlooked. Title loans, like any other form of lending, come with various charges beyond the primary interest. In Dallas or for boat-related titles, these hidden charges can include administrative fees, processing costs, and even early repayment penalties.

Lenders may also try to tack on optional services or insurance that are not necessary but add to the overall expense. Interest rates, a key component of any loan, can vary widely between lenders and often depend on factors like the type of title being used (e.g., car, boat) and the borrower’s creditworthiness. Understanding these hidden costs is essential for making an informed decision when taking out a title loan to avoid getting caught off guard by unexpected financial burdens.

Decoding Fine Print: Unveiling Exorbitant Fees

When considering a title loan, the fine print can be a real challenge to decipher—it’s designed to obscure potential hidden charges. Lenders often hide exorbitant fees within the small print, making it easy for borrowers to overlook these additional costs until it’s too late. These sneaky fees can significantly increase the overall cost of the loan, turning what seemed like a quick and easy financial solution into a burdensome debt trap.

One common tactic is to include various processing or administrative fees, which can add up to a substantial portion of the borrowed amount. Another red flag is the absence of transparency regarding interest rates and how they’re calculated. Some lenders might offer seemingly low initial rates but then apply complex formulas that result in sky-high interest charges over time. It’s crucial to read every word carefully, paying special attention to any clauses related to early repayment fees or penalties for missing payments, which could make the loan even more expensive, especially if you’re looking for a fast cash fix.

Strategies to Spot and Avoid Hidden Charges

When considering a title loan, one of the most important steps is to carefully read and understand the fine print. Many lenders hide certain fees and charges within complex terms and conditions, making it easy for borrowers to overlook them. To avoid getting caught off guard by these hidden costs, borrowers should scrutinize every aspect of the loan agreement. Look for clauses related to prepayment penalties, documentation fees, and any additional charges for late payments or extensions. These seemingly small fees can add up significantly over time, increasing the overall cost of your title loan.

In addition to reviewing the fine print, consider seeking out direct deposit options from lenders. Many reputable companies now offer this service, allowing borrowers to have their funds transferred directly into their bank accounts. This simple strategy not only ensures faster access to your money but also helps you keep track of your finances. For those in Dallas looking for title loans, many local providers offer competitive rates and transparent pricing structures. Even if you have bad credit, these loans can provide a quick solution, but understanding the full scope of costs is crucial to making an informed decision.

When considering a title loan, it’s crucial to be vigilant about potential hidden charges. By understanding the fine print and being proactive in your research, you can avoid exorbitant fees that may accompany these loans. Stay informed, compare lenders transparently, and employ strategies to spot red flags. This proactive approach will empower you to make an educated decision, ensuring you’re not caught off guard by unexpected costs associated with title loan services.