Euless auto title loans offer immediate financial support for emergencies using vehicle titles as collateral. With minimal credit checks and transparent terms, these loans provide swift access to capital for various needs, ensuring stability and manageable repayment plans without disrupting daily life or essential expenses. Inclusive eligibility makes them accessible to many seeking alternative financing options during crises.

In unexpected moments, emergency situations can strike anyone in Euless. When faced with unforeseen challenges, understanding accessible financial solutions is crucial. This is where Euless auto title loans step in as a viable option. This article explores how these loans can offer prompt relief during crises, while also emphasizing the importance of repayment plans that lead to long-term financial stability. By delving into these aspects, we aim to illuminate why Euless residents may find this alternative financing method beneficial.

- Understanding Emergency Situations in Euless

- How Auto Title Loans Can Provide Quick Relief

- Ensuring Repayment: A Path to Financial Stability

Understanding Emergency Situations in Euless

In the dynamic and often unpredictable nature of life, Euless residents can find themselves facing unforeseen circumstances that demand immediate attention and financial resources. These emergency situations, whether they involve medical crises, unexpected repairs, or sudden life changes, require swift action and a reliable source of funding. Euless auto title loans emerge as a viable financial solution, offering a fast and accessible way to secure the emergency funding needed without the lengthy processes associated with traditional bank loans.

Understanding the urgency and sensitivity of these situations, reputable lenders provide an expedited application process, minimal credit check requirements, and transparent terms. This ensures that individuals in need can gain access to the capital they require quickly, enabling them to address pressing matters and get back on their feet faster. Euless auto title loans thus serve as a practical and timely emergency funding option for those facing unforeseen challenges, offering a safety net when it’s most needed.

How Auto Title Loans Can Provide Quick Relief

When facing an emergency, time is of the essence, and traditional loan options often come with lengthy processes that can delay much-needed funding. Here’s where Euless auto title loans step in as a swift solution. This type of loan allows individuals to access immediate financial relief by using their vehicle’s title as collateral. The application process for these loans is typically straightforward and efficient, often involving an online application where you provide basic information.

With a focus on urgency, Euless auto title loans offer a convenient way to secure funds without the rigors of traditional bank loans, including credit checks. This makes them accessible to a broader range of individuals, even those with less-than-perfect credit. The loan amount is determined by evaluating your vehicle’s value, ensuring you receive a fair and quick advance on your car’s title.

Ensuring Repayment: A Path to Financial Stability

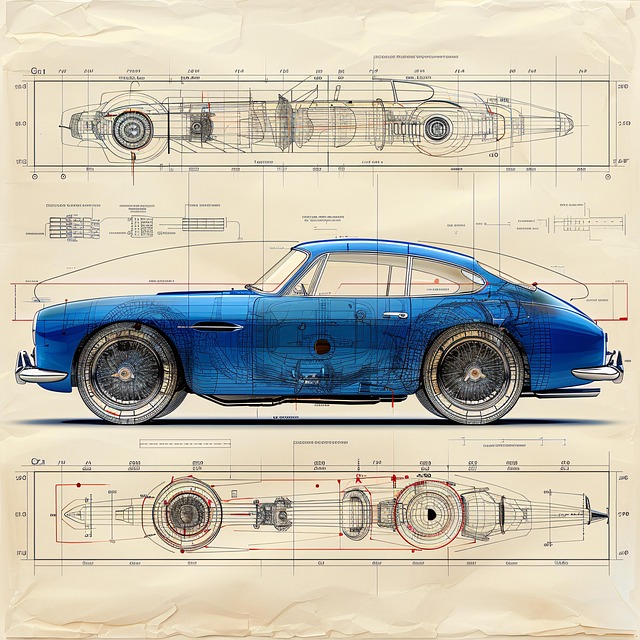

When facing an emergency, whether it’s a medical crisis or unexpected financial burden, Euless auto title loans can offer a lifeline. These loans utilize the vehicle equity as collateral, providing borrowers with access to immediate funds. The beauty of this option lies in its structured repayment plan, designed to help individuals regain financial stability without adding more stress. By converting vehicle ownership into a source of capital, loan holders can focus on meeting their short-term needs while working towards long-term financial health.

Euless auto title loans facilitate debt consolidation, allowing borrowers to combine multiple high-interest debts into a single, more manageable payment. This strategic approach not only simplifies repayment but also helps in building creditworthiness over time. As the loan is secured against the vehicle, lenders offer competitive interest rates and flexible terms, ensuring borrowers can repay without sacrificing their daily commute or other essential expenses. Loan eligibility criteria are designed to be inclusive, making these loans accessible to a wide range of individuals who may not qualify for traditional bank loans.

In times of unforeseen emergencies, Euless auto title loans can offer a swift and reliable solution. By leveraging the equity in your vehicle, these loans provide much-needed cash flow, enabling residents to navigate challenging situations with financial stability. With a structured repayment plan, you can regain control over your finances while still addressing immediate needs. Remember, when unexpected events arise, exploring this option could be the key to managing stress and ensuring a brighter future.